Is this a dagger deal I see before me, the handle toward my hand..?

Tomorrow we’ll see if BoJo can clutch it, or if it’s really a “false creation” of multiple “heat-oppressed brains”…

All joking aside, the Brexit drama has proved to be worth paying attention to from a global investment perspective, not just from us here in the UK. As we covered in the Daily Blitz yesterday, Brexit rhetoric alone has been able to create incredible market moves, enriching some traders and wrecking others.

Kit Winder, our resident analyst and cricketer, was quick to come up with an analogy from his favourite game, with Jean-Claude Juncker appearing to be as umpire declaring the UK “out” of the EU.

Charlie Morris made an interesting observation on BoJo’s breakthrough yesterday. We’d met at a favourite Belgian beer establishment of mine for lunch to discuss gold, bitcoin, and The Fleet Street Letter, but the news of the negotiations was not to be ignored.

Charlie speculated that the pro-EU MPs who vote against BoJo’s deal will face a similar response to what the Extinction Rebellion crowd got that morning. Opting to protest climate change by halting electric trains, does not, oh so surprisingly, win you any friends. MPs that are pro-EU and yet vote against its wishes (and that of BoJo) will have a very hard time getting popular in a general election.

Whatever you make of Charlie’s views on politics, you’d do well to take his advice on markets. Charlie began loading up on certain UK stocks in September, and the results have been incredible – the majority are up over 10% since, with a couple over 20%.

And these aren’t uber-risky plays either. Some of these stocks are as blue chip as it gets. But the Brexit noise was enough to throw other investors seriously off track – and opening a window for those who know better to make off like bandits.

It’s a tricky time for investors who want to own British stocks, as the value of the pound has become a decisive factor for the FTSE 100. As the index is dominated by multinationals who make profits overseas in dollars, those profits soared after the referendum, and the index did well, despite all the doom and gloom the journos plastered everywhere.

A strong British economy post Brexit will likely mean a stronger pound, which would, somewhat ironically, reverse such gains. The key to making hay from the British markets in a post-Brexit boom is to avoid being “pillaged by the pound”, and go for more domestically based stocks, of the kind you can find in the FTSE 250.

What a positive Brexit would do for broader financial markets is less spoken about, but just as interesting.

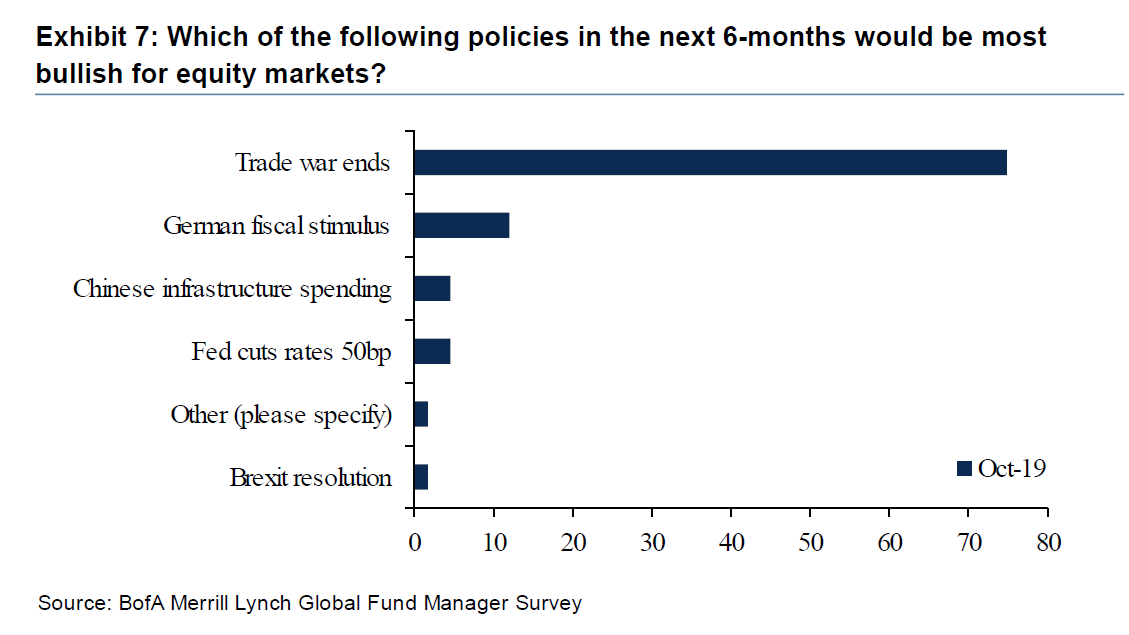

The investment bank Merrill Lynch routinely conducts surveys to gauge the sentiment of fund managers on market conditions. In their most recent take, they asked what event would make them most bullish over the next six months.

An end to US/China trade disintegration came up first by a large margin. Up second was Germany finally spending some of its massive budget surpluses it’s been rolling in since the euro gave Germany a massive trade advantage (what such spending would be directed at was unspecified – simply spending it somehow would be bullish).

Up next was the Chinese building yet more infrastructure – 50 million vacant apartments just isn’t enough it seems. (Similarly, the type of infrastructure was unspecified. Military infrastructure to drive the US out of the South China Sea? Bullish.)

Next on the list was lower interest rates in the US. President Donald Trump may not have been surveyed, but strongly agrees.

And after “other”, coming in last, was a Brexit resolution.

As you can see, Brexit ranks pretty low as a bullish development amongst fund managers.

But prices are made on the margin. And small nudges from the UK into the broader global stockmarket could cause large ripples.

As those who’ve been reading this letter for a while will know, the recent overwhelming bearishness from the financial media and the asset management industry has made me bullish, as the crowd is rarely right when it comes to making investments. Perhaps light at the end of the Brexit tunnel will be enough to swing their mood back to the sunny side – a political Prozac to keep them buying stocks.

We’ll have to wait and see – tomorrow’s Parliament action will make for an interesting watch. MPs working on a Saturday? We really are living in strange times…

Have a great weekend!

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates