Earlier this week, I asked your thoughts on what the future holds for Saudi Arabia, oil, and energy in general.

Thank you to all who wrote in, it’s been great to hear your predictions and stories on the topic.

On Monday I wrote about the “$10,000.00” question – a wager between two men on the future price of oil which fundamentally was a question of whether Saudi Arabia would be able to keep supplying the world with enough of it.

One reader had an interesting tale to share:

I lived and worked in Riyadh between 1976 and 1982.

One weekend I and a few friends were camping in the south on the edge of the Empty Quarter – a long way from the Eastern Province oil field.

Imagine our surprise when three (I think from memory) tracked vehicles came over a sand dune. They were an Aramco exploration team and when asked if there was oil this far from the established fields they said “we wouldn’t be here if there wasn’t.”

If this was true it suggests that the Saudi oil reserves are indeed massive.

Another reader was very assured of the ability of the Saudis to supply the world with oil:

Of course it will remain a mainstay of oil production over the next 10 years. What a daft question. Along with the USA and numerous others all able to produce serious surplus quantities to keep oil below $80/barrel – unless there is a serious war. Apart from oil for chemicals – 40% of the barrel – and other miscellaneous uses, oil is essentially finished now! And China and India will have to come off oil otherwise there will be a worldwide environmental panic with many deaths. So march on renewable.

To clarify, my initial question was whether Saudi Arabia will continue to function as the world’s oil pump, and remain a keystone of the global economy for the next decade. If oil is “essentially finished” now, then so “essentially” is Saudi Arabia…

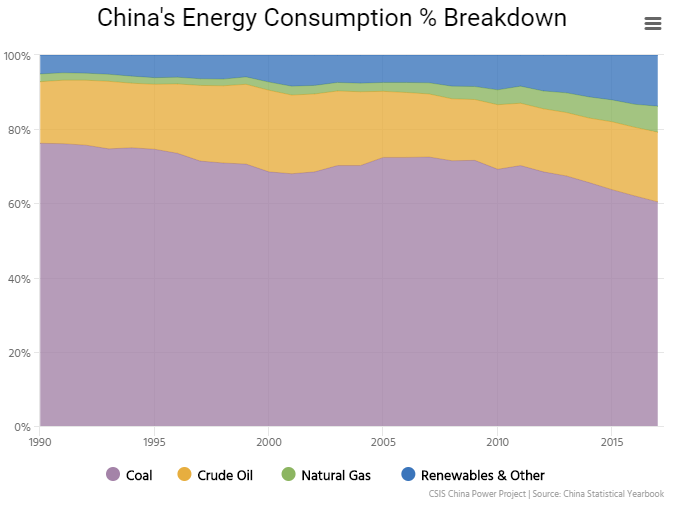

As for China coming off oil in order to reduce environmental damage, I think it’ll need to come off coal first:

Source: CSIS (click to enlarge)

Source: CSIS (click to enlarge)

Bear in mind that that the Chinese government is currently considering a proposal from its largest energy producers that could allow them to build a new coal power station every fortnight until 2030.

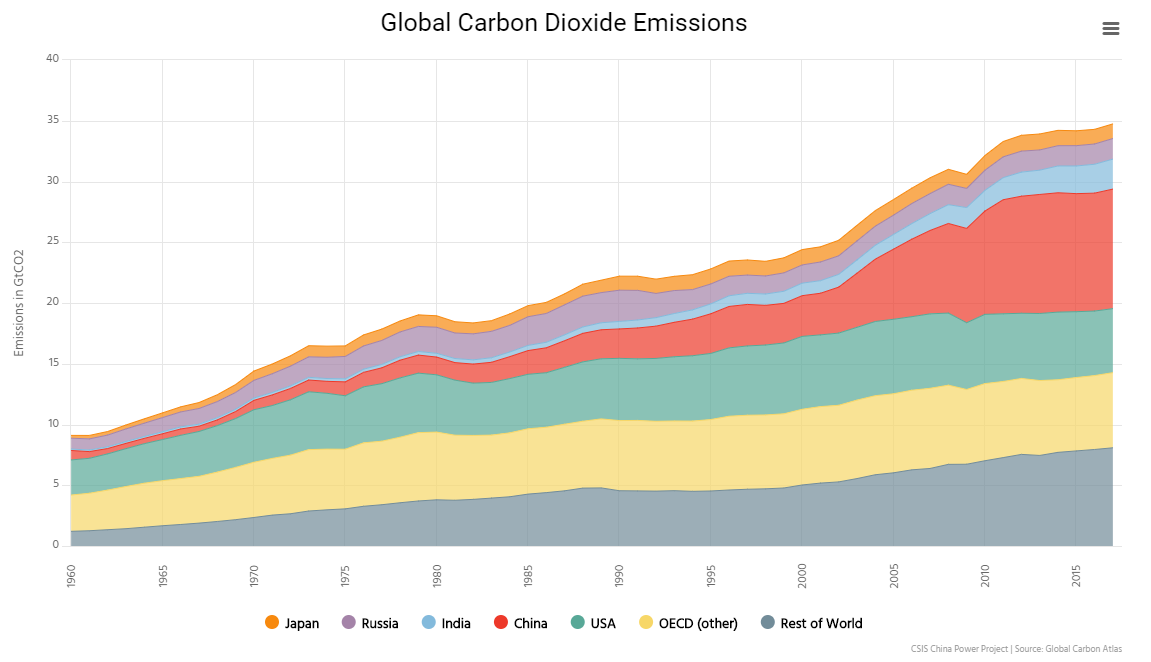

Source: CSIS (click to enlarge)

Source: CSIS (click to enlarge)

Climate change activists would do well to unglue themselves from London Underground trains and turn their attention to the Chinese Communist Party instead – for all the change they’ll be able to effect there.

Coming from Aberdeen as I do, you will know the production cost is critical in terms of oil production. What price is the Permian viable at which would determine whether or not the 4.1 million bpd would ever materialise?

A fair question. How high must the price of oil be for the US to actually be able to rely on its fracking fields for energy? Well, the ingenuity of the frackers has managed to bring production costs down from $100 to below $40, but ExxonMobil recently claimed that some of its newer, larger operations in the Permian will have production costs as low as 15 bucks a barrel.

An incredible claim, which if true and can be sustained across the Permian will further erode US dependence on foreign oil production – and the governments which control that production.

But the rise of renewable energy poses another, quite different threat to Saudi Arabia – something several readers were acutely aware of:

… why should [Saudi Aramco] have disputed the perception of what their oil field will be able to provide so upsetting wealth projections? However, the question is will Saudi remain the ‘oil pump’, which is a hypothetical question with the ongoing major discoveries in Russia, Guyana, USA and even Bahrain, with many more predicted, according to Rystad Energy. That Saudi will remain a major source of oil for the next decade is in all probability highly likely, but nothing is a certainty.

The second question is of greater interest in my view, with nuclear fusion being the next major source of clean energy. Should the developments go anywhere near to plan then it could be during the thirties when commercial production begins to manifest itself. However, how long it will take to become the ultimate source of energy is another matter but as things stand it must be near enough a certainty.

Another reader was more radical:

Unless you are a climate change sceptic – and I suspect a few exist at Southbank – energy must change beyond recognition in the next 10 years.

Throughout the world governments of all types – from brutal dictatorships to functional democracies – are initiating policies that will reduce dependence on hydrocarbons. They are not yet doing enough – but the consequences of failure are now generally recognised as unacceptable.

Currently the world has enough capacity to meet oil demand even if the entire Saudi production is removed from the market. Prices would rise to mobilise alternative supply but the capacity is there.

Demand for oil as fuel will fall dramatically as the world shifts to non-hydrocarbon sources and Saudi Arabia’s role as an energy supplier will be greatly diminished.

This is in the same vein as some research Eoin Treacy has been working on recently. He thinks that once renewables reach a certain “critical mass”, that we’ll see domestic unrest unfold in a big way across the Arabian Peninsula; that a trend in the energy market… will start a riot in Riyadh.

More on that tomorrow.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates