Today I want to look at an incredibly broad theme: demographics.

I’ve heard a few people lately comparing our current situation in the West with Japan in the 1990s.

Japan experienced a huge boom and bust, and deflation plagued it for a couple of decades afterward.

One of the key problems facing Japan is its aging population. It is very well publicised, and Prime Minister Shinzo Abe’s push for increased gender equality in the workplace is hoping that women might fill the gap. Its problem: the post-war baby boomer generation is reaching retirement, and the birth rate has failed to keep up.

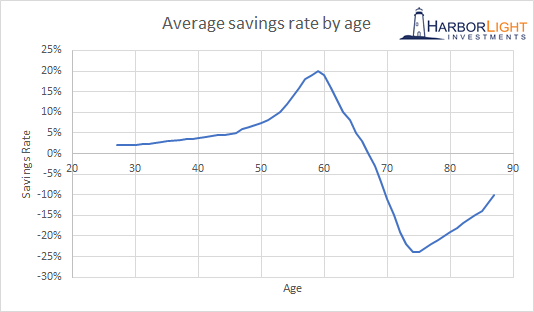

When you retire, you stop producing, and start consuming. You no longer work, and start drawing out from your pension to fund your life.

A balanced demographic would see as many young people joining the workforce as are leaving it. Preferably more, actually, because as life expectancy increases (in Japan it’s now 84), so does the burden on the state to pay for their longer pensions and bigger medical bills (where there is free healthcare, at least).

All over the world, demographics are changing.

In Russia, for example, the population is shrinking rapidly. In a speech to parliament in May 2006, Vladimir Putin called it the most acute threat in contemporary Russia.

Former finance minister Aleksei Kudrin has forecast a decline of 10 million people of working age in Russia by the 2030s.

The problem is rooted in the fall of communism. After the wall fell, the citizens of Russia enjoyed the benefits that came following Soviet rule. As a result, they were in no hurry to have children.

In 1990, 1.9 million babies were born in Russia, in 1997 it was only 1.2 million. 25 years on, the number of women of child-bearing age is now falling as a result.

Additionally, immigration into Russia is very low, as with Japan. Many in Britain may see immigration as a scourge, but it is in fact an infinitely old, necessary and beneficial part of existence. These major countries need it now, more than ever.

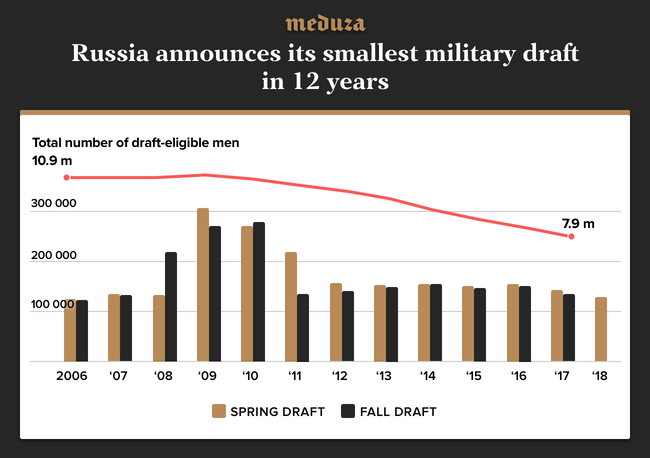

One area where Russia is particularly sensitive is the military.

Draft sizes are decreasing, and many of the men conscripted in the last decades of the Soviet Union are now at or reaching retirement age.

2018 saw Russia announce its smallest military draft in a decade. The total number of eligible men for the draft has fallen from 11 million in 2006 to only 8 million men now.

This kind of change will have an effect on Russian foreign policy, and power.

Its failure to keep up with Western military power was a key reason for the failure of the communist project. What will happen this time, I wonder?

Pension pots

Since the 1980s, stockmarkets have done extraordinarily well. That has coincided with the arrival of the baby boomer generation into their late 30s to early 50s. This is the period of maximum accumulation of financial assets – stocks and bonds.

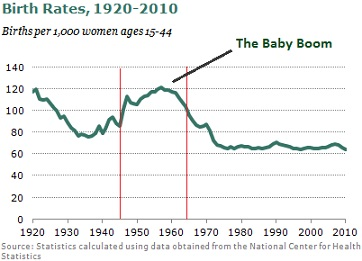

The baby boomer generation is the group of people born in the 18 years after the end of the Second World War.

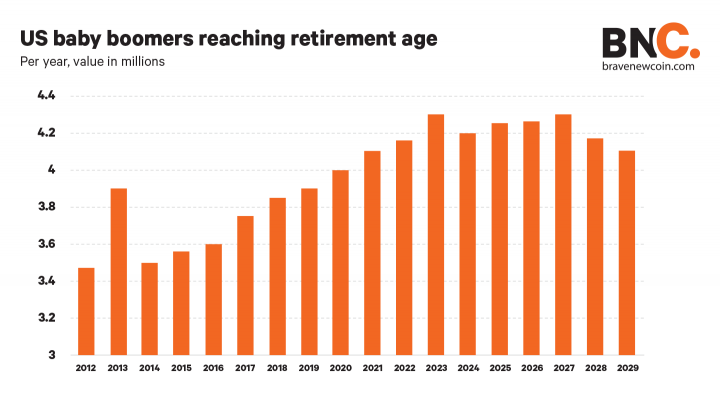

That means they are now in their late 50s, 60s, and early 70s. As a result, the largest slice of the demographic pie in the Allied Western nations is about to go from working, to retirement.

This is concerning, because having spent the last few decades building up their pensions by buying stocks and bonds, this great swathe of people will soon start selling those stocks and bonds in order to fund their retirement plans. En masse.

If they were partly responsible for an amazing few decades of record stockmarket returns, will the reverse be true in the next couple of decades?

When the number of sellers in a market increases, the prices tend to go down. So a vast number of people switching from buying to selling is pretty concerning for investors.

In 1996, Zheng Liu and Mark Spiegel wrote the original study on this, called “Boomer Retirement: Headwinds for U.S. Equity Markets”.

They concluded,

Despite theoretical ambiguities, U.S. equity values have been closely related to demographic trends in the past half century. There has been a tight correlation between population ratios, and the P/E ratio of the U.S. stock market. In the context of the impending retirement of baby boomers over the next two decades, this correlation portends poorly for equity values.

This suggests that market participants may anticipate that equities will perform poorly in the future, an expectation that can potentially depress future stock prices.

Japan

Japan has suffered from deflation since the infamous asset bubble burst in the early 1990s, right around the time the working-age population peaked and started dropped off into mass retirement. For close to 25 years, Japan’s working-age population has been declining on average 1% per while its elderly population has been growing.

Since its 1990 peak, Japan’s Nikkei stockmarket was in a downtrend virtually until 2009/2010, and even after the bull run since 2012 it has only recently retraced to a level last seen in 1997, a value just over half of its all-time peak.

This is the problem potentially facing the US and the rest of the Western economies.

Comparing the current S&P 500 index (candle sticks) to the Nikkei of the 90s (red line) we can see an uncanny resemblance in trajectory. Only since April have we seen a real divergence in the two indices.

Scary stuff.

There are some factors which could mitigate this threat. An increase in foreign investment, for example, or immigration. But with the political climate as it stands, with Brexit and Donald Trump, encouraging immigration hardly seems like it’s going to be a major global policy.

Demographic changes are very slow moving, and therefore quite hard to see happening. That’s why it’s probably not at the forefront of most investors’ minds. It’s also unlikely to provoke any dramatic movements in the markets, like a flash crash or a bubble.

Nonetheless, it’s worth being aware of. If the theory is correct, and the Japan analogy holds up, investors could have to reduce their expectations of returns in the next cycle or two.

All the best,

Kit Winder

Investment Research Analyst, Southbank Investment Research

Category: Market updates