In yesterday’s note, I made the case that the crypto boom of 2017 was the product of post-crisis monetary policy. Investors, forced to take more risk due to the low returns found in traditional assets, reached for yield in the alternative investments scene, and eventually grasped an asset born in the crisis itself: bitcoin.

But by the time investors had seized upon crypto, the Federal Reserve had begun hiking interest rates, injecting marginal amounts of “risk-free” returns back into the system. The more the Fed hiked, the less cash investors threw at the lunatic fringe of the market in search of yield, and the cash flow inflating the bubbling crypto boom was staunched. Bitcoin, leader of the market, was decapitated at $20k, and the crypto regime collapsed.

Bitcoin has recently been revived by wealthy Chinese using it as a pipeline to smuggle capital out of the country, but I think the story won’t end there. Once the Fed starts cutting rates and expanding its balance sheet again (in an attempt to either deal with a recession or prevent one), the crypto space will once again fill with yield-starved investors.

And importantly, institutional investors will be able to participate this time around, giving a new boom and bubble even grander scale.

Before, the road to crypto was taken only by a few retail investors and some hedge funds as safe passage was not available for larger players. Even if they had wanted to, institutional investors could not access the crypto market as to do so would violate their fiduciary duties.

There were a couple of ways around this, like the Grayscale Bitcoin Investment Trust in the US and the Bitcoin Tracker One exchange-traded note in Stockholm, but by and large the appropriate custody solutions for crypto had not been created yet. They have now.

While Coinbase launched an institutional custody service last year, interestingly old-school financial firm Fidelity will soon be offering Bitcoin to institutions hungry for a piece of pie they could only look at until now. From Bloomberg:

The Boston-based firm, one of the largest asset managers in the world, created Fidelity Digital Assets in October in a bet that Wall Street’s nascent appetite for trading and safeguarding digital currencies will grow. It also puts Fidelity a step ahead of its top competitors that have mostly stayed on the sidelines so far. The firm said in October that it would offer over-the-counter trade execution and order routing for Bitcoin early this year.

Fidelity would join brokerages E*Trade Financial Corp. and Robinhood in offering cryptocurrency trading to clients, though Fidelity is only targeting institutional customers and not retail investors like E*trade and Robinhood, said the person, who asked not to be named discussing private matters. A study released by Fidelity on May 2 found that 47 percent of institutional investors think digital assets are worth investing in.

While Fidelity will only be providing safe passage to BTC, A higher BTC price leads to an inflation of all cryptos, often in dramatic fashion.

I reckon another boom and bubble in the crypto market is on the way, especially when the Fed stops hiking rates and flips to an easing cycle. That’s my thesis, anyway.

Time will tell if I’m wrong, but I’ve been increasing my holdings of BTC and buying some altcoins just in the case that I’m right, as the wealth that can be harvested from a crypto boom can be life changing.

I’ve had a fondness for BTC since I first bought it in 2014, but let me be clear – the main reason I’m buying altcoins now is purely because they represent an opportunity to front-run a giant wall of money that may or may not show up; it is not based on their fundamentals. This is pure speculation, and I’m prepared to watch all the capital I’ve thrown into the market fall to zero.

Anybody even remotely interested in buying crypto should be similarly prepared. As I once heard my colleague Eoin Treacy say, “If you’re worrying about a [trading] position, it’s too big.”

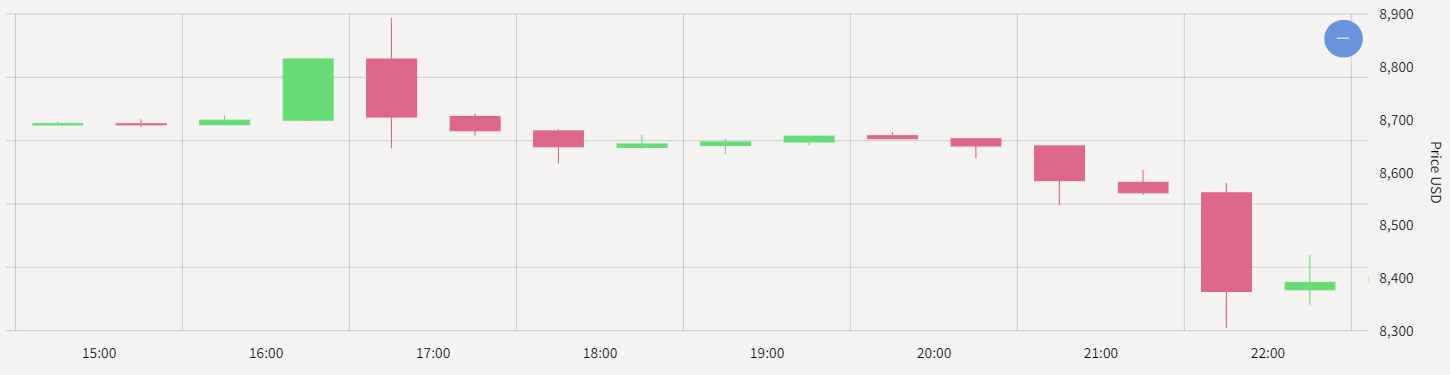

The road to crypto profits is a savage one. Just yesterday after 5pm, BTC, which had been climbing toward the $9k mark, plummeted $800 in just five hours.

Most of the selling occurred in two half-hour waves, with the most brutal occurring just after 10pm, and was most likely a speculator scalping some of their recent gains:

At the time of writing, BTC is lingering around the $8.4k handle. It’ll be interesting to see how it performs over the weekend. I’m thinking it’ll go higher, but I’ve found that crypto has a knack for surprising everybody, especially when they feel comfortable with its price action.

But that’s all from me for this week. I wish you a great weekend!

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates