Monday again, and we’re back in business. A new week beckons – and if it’s even a quarter as dramatic as last week, we’re in for a hell of a ride.

While the crazy action of last week was contained mostly to the energy market, this week more pressure is on the stockmarket in anticipation of a “rogue wave”…

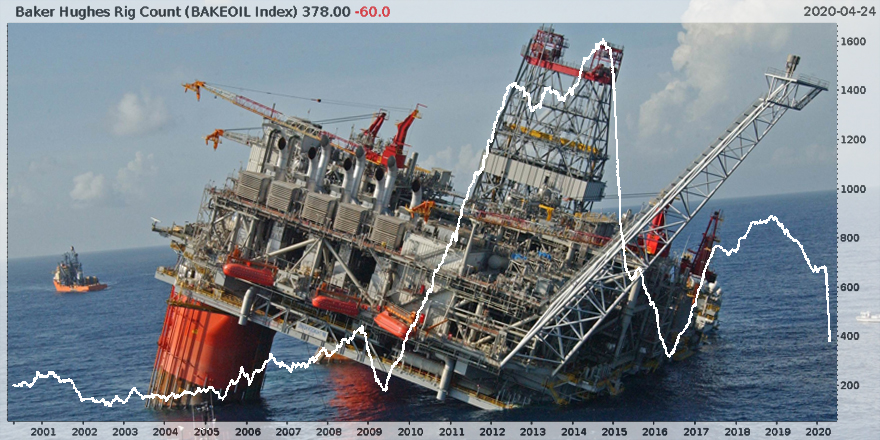

But more on that in a second – let’s stick with energy for a moment. Sixty oil rigs were shut last week as the oil price in the US went negative for the first time ever, a previously inconceivable situation. We may not have hit the lows of 2009 or 2016 yet in terms of rig count, but that chart is decidedly heading in one direction at the moment:

Source: Me, on Twitter

Source: Me, on Twitter

While negative oil prices were contained to the Americas last week, the Brent crude price still got hammered. It’s not looking good for my friends in the oil industry back in Aberdeen – but it ain’t as bad for them as it is the fellas working the oil sands in Canada, the frackers in Texas, and the poor blighters working the oil fields in Venezuela…

Earnings chaos

This week, Monday to Friday, some of the largest companies in the world are going to report the earnings for the first quarter of the year – earnings which will no doubt have been affected in some way by the WuFlu lockdown.

Take a gander:

Source: Earnings Whispers, on Twitter

Source: Earnings Whispers, on Twitter

Plenty of big names on here. 3M ($MMM), the global conglomerate receiving plenty of press due its vast safety mask production… $BP and Exxon ($XOM), bound to be bleeding heavily due to the oil price collapse… and then there are the internet giants. Are Alphabet ($GOOG), Amazon ($AMZN) and Twitter ($TWTR) flourishing as you might expect now that we’re stapled to our devices even more than usual? Are folks turning to music streaming services like Spotify ($SPOT) to calm their nerves in these trying times? And now we’re avoiding physical cash more than ever, is Visa ($V) picking up the slack?

Plenty of questions, and they’re gonna get answered this week in the language of cold hard cash. How much do people really value the goods and services of companies like these when they’ve been locked down? We’ll find out soon enough. Tobacco megacorp Altria ($MO) reports results on Thursday – it has to be making money if the number of folks I see puffing away by their front door is any guide…

One I’m looking out for is Tesla ($TSLA) and its results on Wednesday. The highly indebted darling of the tech sector and millennial investors is utterly riddled with scandal, and I’ve always felt that its charismatic CEO Elon Musk is only able to keep the company afloat by generating himself and the company endless press. He constantly impresses or astounds the press with crazy announcements, which may or may not come true in future – when they don’t, he has another crazy announcement specially prepared.

But these magic skills that make Tesla owners feel like they own a piece of the future must hit a limit when nobody can or will buy a car. If anything is going to push Musk from his perch, it’s the WuFlu. WIll this be when $TSLA drives straight into a wall? I think it might be – Musk will need something really distracting to get out of this mess…

That’s all from me for today – I’m just about to get back at the helm of our daily market broadcasts. I hope you were informed and entertained by Kit Winder in my absence last week – now I’m back as host and I’ll be kicking this week off with a regular favourite of listeners: Tim Price over at The Price Report. I’m keen to see what he makes of negative oil prices, and the wild week of earnings announcements we have ahead of us…

Thank you for your suggested additions to the formal Capital & Conflict beer list. I have received many interesting suggestions of “investment grade” beers to be added to the list, though of course I shall have to conduct the relevant “due diligence” and try them myself before they’re formally added. No “high yield” junk allowed! If you have any favoured brews you’d like added, just send ‘em here: [email protected].

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Market updates