“How did he die?”

“Your contact?” Mr Market?”

*nods*

“Not well.”

– Casino Royale, opening scene (mildly edited)

It’s “No Time to Die”… or to risk losing Chinese box office revenue. I may well be proven wrong on this, but I reckon the postponement of the latest 007 film will be looked back on as “peak” coronavirus hysteria.

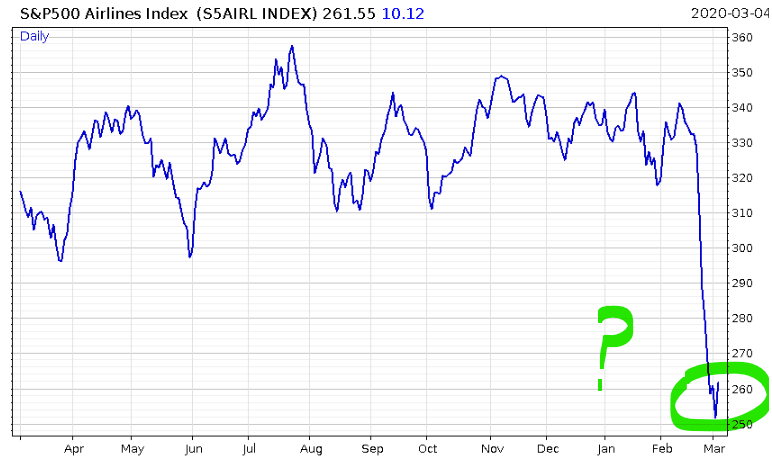

No time to fly either. I showed you a chart of the S&P 500 Airlines index a couple days ago. The tiniest of green shoots has arrived for the index…

… but the music has finally stopped for Flybe. No bailout, no business:

While I think the coronavirus hysteria has peaked however, it’s not my opinion that matters – it’s that of the market.

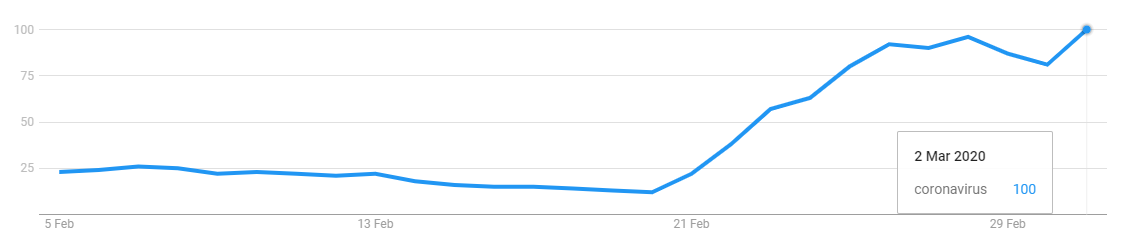

It looked like Google searches for the coronavirus had peaked over the weekend, but no dice:

Charlie Morris over at The Fleet Street Letter Wealth Builder has just sent over an urgent message to his subscribers on changes he’s making to the Whisky and Soda portfolios. All the central bank intervention we’ve seen will aid the growth stocks and the digital economy he argues – but that won’t help those invested in the real economy:

The virus is harming the real economy. The authorities have responded with rate cuts and spending pledges. The good news is that has buoyed markets, but the bad news is that it is only boosting growth of the “new economy”. Real economy stocks remain under severe pressure and I can only see this getting worse… The market bounce has been disappointing, and at this point, the priority is to live to fight another day.

Hysteria in the press or not, the coronavirus will have some impact on the economy. Whether or not that’s the external force that will finally crack this bull market is the trillion-dollar question – and it deserves to be asked considering the wild moves we saw last week. When the worm finally turns, you need to be prepared – coronavirus caused or not.

Our publisher Nick O’Connor sent myself and the other Southbank Investment Research editors a note effectively asking that question. He’s said he’s happy for me to share it with you, so here it is below:

So is this it… the end of the bull market?

If you’re like me you’ve probably had friends and family asking you that over the past few days. Last week was brutal – the biggest sell-off since the financial crisis.

So is this when it all unravels?

I can give you my best guess. I don’t think so… not yet. I think we’ll hear the printing pressed fired up before long. Now if the markets keep falling in the face of that… well, it could be time. Things could get really messy, really quickly.

But as I said, that’s just a guess. I don’t know. All I know is the bull market will end eventually. What goes up must come down.

And that’s why next Wednesday’s event is shaping up to be the most important in the history of our business. Remember our mission: to help every one of our readers prepare themselves for the end of the bull market – to create a sensible exit plan without just cashing out and walking away (and potentially leaving future gains on the table).

It’s a big challenge. And it’s bigger than any one stock, or stock-picking strategy. Remember, we want to give people the tools to make more money in rising markets and lose less when the bull market ends – no matter what stocks they hold.

So please – invite as many of your readers to join us on Wednesday 11 March as possible. It’s free. And just attending will help them get valuable insights on how they can make more money from the markets, whether this current “downdraught” is the “the end” or not.

Whatever happens to push this market over, you need a plan for what your strategy will be – and you need to make it ahead of time, so your emotions don’t cloud your judgement. When “Mr Market” does die – he won’t die well.

My apologies for saying in yesterday’s note that Nick would be chairing an event on Friday about the critical indicators you should monitor for surviving the next bear market. I got my dates mixed up – it’ll be on Wednesday.

The VIX index: immortal Bond villain

Funnily enough, I was actually making a James Bond market metaphor this week prior to the announcement of the latest film’s postponement.

During the first scene of Casino Royale, Bond is seen fighting an unnamed antagonist, pushing him through the cubicle walls of a public toilet. He then resorts to drowning the man in a sink, who then falls limp, but pulls a gun when Bond turns to leave.

That scene has been occurring on a loop in the volatility market for years, with the VIX index playing the unnamed antagonist, and James Bond the market.

The VIX index is a measure of how cheap or expensive insurance is against sudden moves up or down in the US stockmarket. And it has been relentlessly suppressed by investors who have turned into insurance salesmen to make an income.

Market participants are constantly drowning the VIX index by endlessly selling stockmarket insurance as a substitute for the lack of interest you can earn at the bank.

The VIX, forced lower and lower, then plays dead, until suddenly pulling a gun on market participants when stocks eventually do make a sudden move up or down.

As you can see, after long periods of being held down, the VIX makes massive spikes upward:

But just like in the film, Bond then whips around and shoots the antagonist dead. In the film this leads to the opening credits scene, but in the market this just repeats, and the VIX is getting its head pushed into the sink in no time.

You can see the spike attributed to the coronavirus on the right there. The longer it stays up, the more the market feels the pain, as it needs to cover all those insurance claims.

There are hundreds of billions of dollars of capital invested in strategies which assume that the scene will play out as it has previously, and the VIX will be pushed back down beneath the water. But if the coronavirus really is the threat everybody fears, the VIX will be able to resist being pushed down again, and best “James Bond”.

I don’t reckon the VIX villain will be able to best Bond this time around. But one day it will – and when it does, you need to be prepared…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates