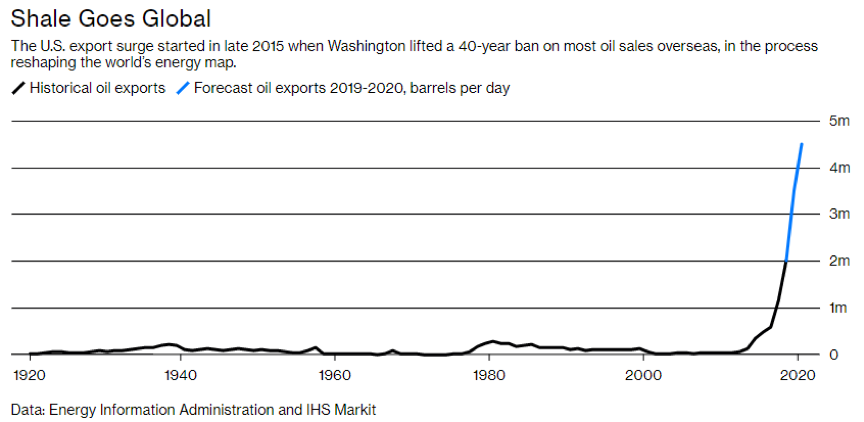

US oil exports are a success story of the past decade. They are a function of new drilling technology, record average annual oil prices post-2008, cheap capital post-2008, and one last (but greatly-underappreciated) factor: The US government sanctioning cheaper oil out of the market in order to provide a vacuum that US shale is able to fill.

– Luke Gromen, Forest For The Trees

Any country still buying oil from Iran by 2 May is in trouble. US Secretary of State Mike Pompeo announced over the Easter weekend that any country importing Iranian oil will be targeted with US sanctions – with no exemptions.

From Pompeo’s press briefing:

Our oil sanctions have taken approximately 1.5 million barrels of Iranian oil exports off the market since May of 2018. This has denied the regime access to well over $10 billion in revenue. That is a loss of at least $30 million a day, and this is only with respect to the oil. Iran would otherwise use this money to support its destructive and destabilizing activities. Because of our efforts, the regime now has less money to spend on its support of terrorism, missile proliferation, and on its long list of proxies.

In November, we granted eight waivers, oil waivers to avoid a spike in the price of oil. I can confirm today that three of those importers are now at zero. That brings us to a total of 23 importers that once were purchasers of Iranian crude that are now at zero. With oil prices actually lower than they were when we announced our sanctions, and global [oil] production stable, we are on the fast track to zeroing out all purchases of Iranian crude.

If the US is successful in “zeroing out” Iranian oil production completely, who will plug the gap in oil supply? Well, as Luke Gromen alludes to, it’s likely that the US government is expecting “the boys down in Texas” to pick up the slack.

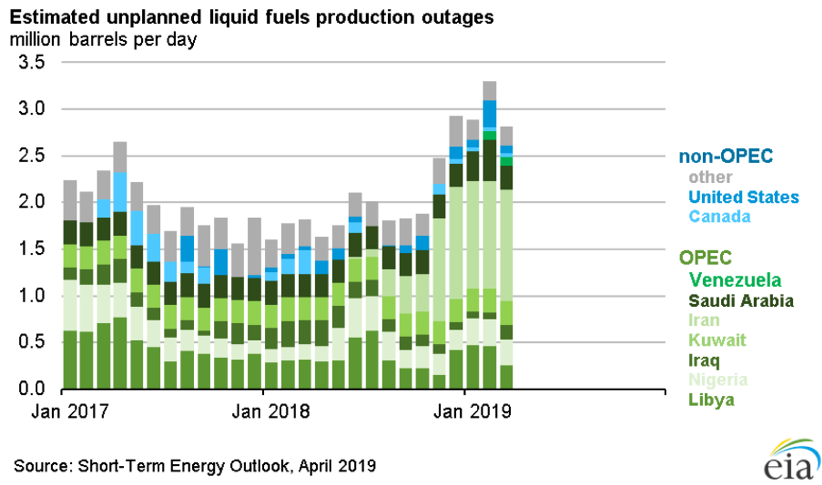

US sanctions on oil-producing countries have been great for the frackers in Texas. For as oil from countries like Iran has been prevented from being brought to market (note bars on the right)…

… frackers have been able to fill the void, sending US oil exports booming like never before:

Source: Bloomberg

But as James Allen explained in our two-part video series, this has come at a cost. The huge increases in oil production from the shale drillers has not brought with it any profit – just a boatload of debt. Debt which is coming due, at higher interest rates…

The “zeroing out” of Iranian oil could act as a further accelerant for the oil price, on top of the credit crunch in US “subprime oil” that James predicts. Perhaps it’ll get into the triple-digit territory once more, and the nightlife in Aberdeen will recover…

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates