It seems our investing opportunities are running out, dear XXC&CsubXX.

We wanted in on the yacht industry – more QE = more wealth inequality, we argued – and keenly anticipated the initial public offering (IPO) of Italian yacht builder Ferretti.

… But the IPO was pulled due to a lack of demand for the shares.

We were bullish on Saudi Aramco, the giant of the global energy market, as big as “Big Oil” can be.

Reliable dividends are hard enough to find these days, and will be scarcer still in a future of zero interest rates. But surely this titan of Arabia that can pull black gold out of the desert cheaper than anybody else will be able to come up with the goods, we reasoned.

But alas, our dreams of own physical share certificates in one of the world’s most controversial companies is not to be.

Not for the time being, anyhow. From the Financial Times:

Saudi Arabia has abandoned plans to formally market shares in its state-owned oil company outside the kingdom and its Gulf neighbours, in the latest sign of the initial public offering’s shrunken ambitions.

Bankers learnt on Monday that no formal European investor meetings would take place, a day after roadshows in the US and Asia were called off, according to people familiar with the matter. The decision is the latest setback for the kingdom, which will now seek to raise about $25bn through the flotation of Saudi Aramco — just a fraction of the $100bn it once sought. It will do so by relying heavily on local investors and those in the Gulf.

“It’s all local now,” said one person briefed on the process…

Saudi Arabia intends to sell 0.5 per cent of the company to local retail shareholders, luring them with a bonus share scheme as long as they hold the stock for a fixed amount of time.The sweetener comes as authorities have leaned on local banks to make loans available to investors and as some wealthy families have been pressured to invest in the IPO. Saudi Aramco declined to comment.

The remaining 1 per cent of the company being sold is expected to be taken largely by Saudi institutions and funds in the region. Saudi Arabia has also been courting state funds from Russia, China and elsewhere in Asia. These government-level discussions are likely to continue, another person briefed on the matter said.

The dividends paid by the cheapest black gold in the world will be staying in the region. If you want in on the IPO, you need to be a Saudi citizen, a resident, or a national of another Gulf Cooperation Council country.

With no yachts… and now no oil… what is one to invest in?

Looking on the bright side, the lack of an Aramco listing on the London Stock Exchange has a silver lining – preventing the FTSE from being nicknamed “The Oil Index”. BP and Shell already make up almost 20% of the FTSE 100, pushing the index heavily in the direction of the oil price. The further inclusion of trillion-dollar Aramco would turbocharge this effect, making the FTSE even less of a gauge of British… anything.

Though as we’ve covered in the past, there’s already another force that is heavily skewing the returns of investors in the FTSE 100, and confusing those who look to it as a measure of UK prosperity. Thankfully, the FTSE’s lesser-known sister is immune…

Sticking with the Arabian theme, a shopkeeper in Sussex who I discovered had a similar interest in Laurence of Arabia, offered me an antique Janbiya for sale recently. The dagger, the likes of which you’ll likely have seen on the likes of Laurence in his Arab robes, he assured dated back to the First World War.

I was very tempted to purchase it – it would look great by my desk to accompany the kalashnikov hanging above my desk – but it wasn’t cheap, and as I’d no way of checking its providence, I’ve decided against it for the time being. (If you have any experience in the antiques industry, I’d love to know: [email protected].)

To hear the lady at the bank yesterday, the only investment I needed was property – and if she was any guide, I needed as much as I could leverage my net worth to buy. I was only there to pick up some cash and order a new card (I haven’t been using a wallet, and have found the chip is prone to breaking when you carry it loose with keys in your pocket for extended periods), but she was so keen on me buying a house (or two), I felt like I was speaking to an estate agent.

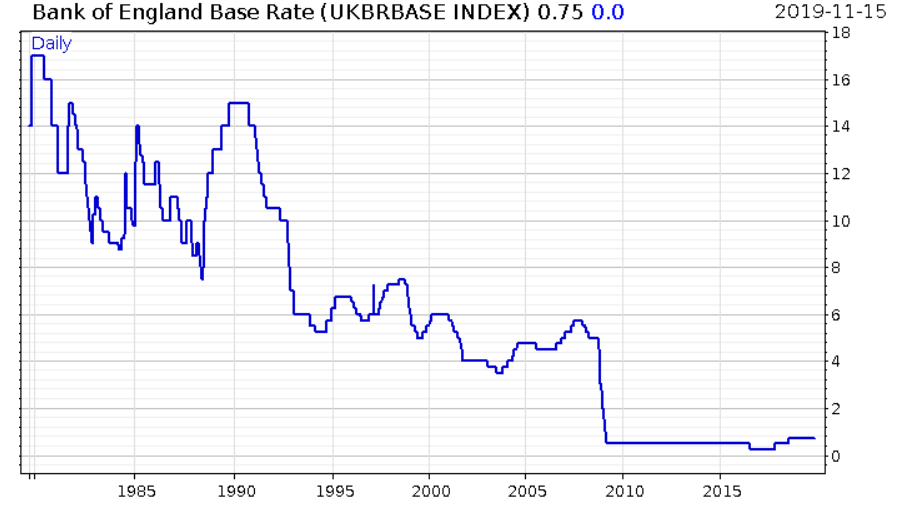

She made sure I knew that interest rates were very low right now, so it was a great time to be getting a mortgage. I wonder when she first started saying that.

For all the practice she must’ve had saying that line through the years, I wasn’t sold by her delivery: could’ve used more Glengarry Glen Ross.

You don’t want a mortgage to buy a house where you live? No, thank you.

How about a mortgage to buy a house somewhere else as an investment? I’m good, thanks.

Maybe I should’ve asked if they provide financing for narrowboat purchases…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates