Were you taught about this at school?

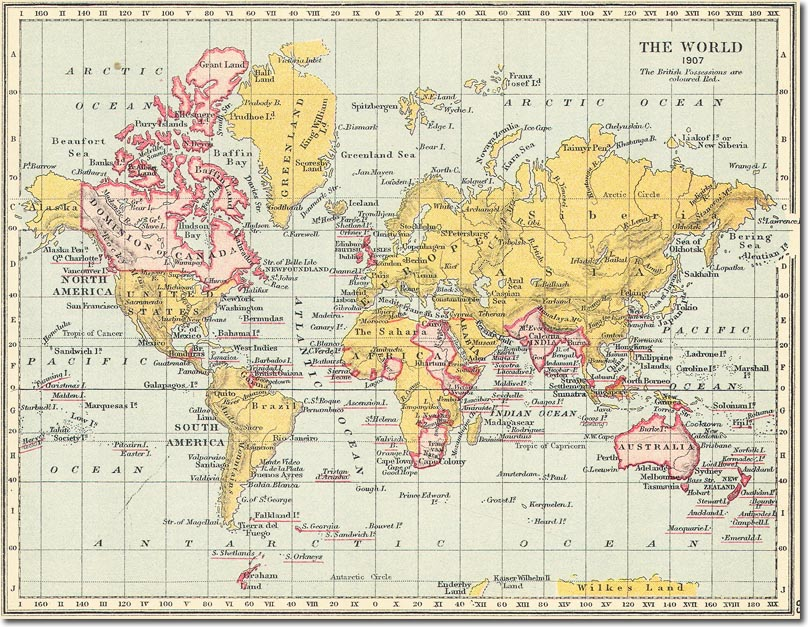

This likely reveals a lot about my age, but I only discovered that maps of the British Empire were illustrated in pink relatively recently.

For those as uninformed as myself, this was because colouring the territories in red would obscure their names, and so the lighter pink was used to highlight them as possessions of the Crown.

Of those I’ve met that’re familiar with “The Pink Map”, most are baby boomers, taught about it long ago.

In recent months, I’ve seen plenty of noise in the news on how the history of the British Empire should be taught at schools, with the likes of Jeremy Corbyn declaring that the “injustices” perpetrated within it should be vividly illustrated within the curriculum from the ground up.

Some have gone so far as to claim the British Empire is still glorified in UK schools. That certainly wasn’t my experience, but then again, most of my schooling took place in the Scottish state system…

Empires just ain’t popular these days – certainly not the British one anyhow. You’re more likely to hear praise of Genghis Khan or Karl Marx by the commentariat than you are Benjamin Disraeli or Queen Victoria.

Today’s letter is not to debate the merits of the British Empire however. Last week, we pondered might transform the UK and its global influence.

Eoin Treacy’s prediction of had me thinking of its “first” coming. And how what remains of it is now under attack…

The Imperial $ceptre

The US-led “new world order” after WWII effectively forbade empires and colonies – something the UK learned the hard way in its multiple scuffles with the US during its Empire’s final decades.

This is somewhat ironic as the US in many ways behaves like an empire and uses many of the same tools an empire would to pacify the rest of the world and subsume it into its own architecture of control.

However, though the UK has nothing like its former status as a physical empire… that says nothing of its status as a financial empire.

The City of London’s position as the heart of the global financial system did not come about by accident. This is not a title that can be lost over something as minor as leaving the European Union, though you wouldn’t hear that from the mainstream press (over a thousand European financial frims intend to open an office in the City for the first time following Brexit, in case you’re not convinced).

While the British Empire was collapsing, plenty of efforts were made to preserve London’s centre as a global financial hub. The post-war shift to a US dollar standard backed by gold was facilitated by the London bullion market, but London’s role expanded massively when Richard Nixon closed the gold window entirely in 1971.

The world was still on a US dollar standard, but even less was required to back it.

Ever since the end of the war and Europe’s reconstruction began, US banks have found great utility in being based outside the US. Specifically, they aren’t beholden to regulations set by the Federal Reserve, as they were outside US territory. This has allowed them to lend far more money than they would have within the US, to a war-torn region hungry for loans to build itself back to health.

As the issuance of a loan creates currency, this massive creation of dollars in Europe, unbacked by gold, is partly responsible for why Nixon closed the gold window.

But after ‘71, with gold no longer required whatsoever, this system of creating unbacked dollars kicked into overdrive. And the skeleton of the British Empire was where the banks made their home.

If you scroll back up to take another look back at that pink map, you may notice the very large number of islands under imperial control, with their names underlined in pink.

Many of these remain to this day as UK-owned territories. While they may not hold much in the way of natural resources or manufacturing, or even much of a population, they are significant nodes in the global financial system.

You’ll likely have heard of the Cayman Islands and Bermuda in the context of tax havens. While this is true and is key to their appeal for financial institutions, these offshore financial centers have very loose banking regulation, which allows their issuance of US dollar loans – their ability to create and multiply dollars – to be extreme. Much of this offshore dollar creation is administered from the City, utilising these former imperial outposts remotely and shovelling the new credit elsewhere in the globe.

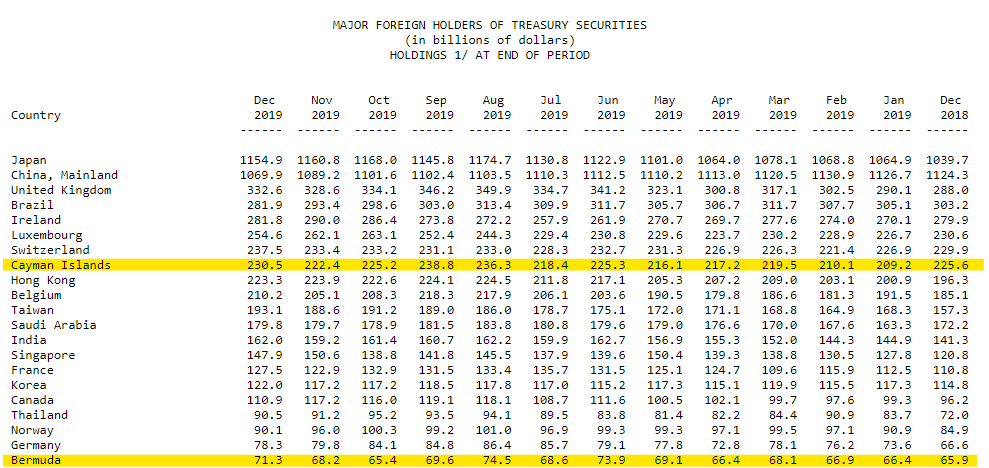

That’s why you can find tiny crown dependencies, islands with very little in the way of domestic economies, beating major G6 countries in their holdings of US Treasury bonds:

Click to enlarge

Click to enlarge

Source: Department of the Treasury/Federal Reserve Board

18 February 2020

These bonds form the base of the global financial system, from which vast amounts of credit flowing through it are created. You should note that the vast majority of bonds registered to the UK will be from within the City.

As it’s dollars that are being created, this helps the US in a way as it makes more companies and countries around the world dependent upon the US Treasury and the Federal Reserve. And so Britain’s once mighty Empire, still lives in the shadow of the US: what I call “The Imperial $ceptre”.

Now that we’ve left the EU however, Brussels has launched an attack on Britain’s “Second” Empire. A couple of weeks ago, the EU formally blacklisted the Cayman Islands as a tax haven.

From the Financial Times, earlier this month:

EU27 ambassadors on Wednesday took a decision to place the Cayman Islands on a nine-strong list of overseas tax territories that do not effectively co-operate with the EU, according to diplomats. The move comes less than a month after the UK’s exit from the EU. European finance ministers are set to confirm the move when they meet in Brussels next week.

The statuses of the Cayman Islands and the British Virgin Islands — both overseas British territories — were up for review by the EU this month. Both were placed on a “grey list” that gives authorities time to introduce legislation to address tax deficiencies identified by Brussels.

Officials said the Cayman Islands did not pass legislation that adequately addressed concerns about companies who claim tax advantages but do not have a sufficient economic presence on the island…

Blacklisted countries face difficulties accessing EU funding programmes and European companies doing business in those jurisdictions have to take additional compliance measures.

The designation has stoked diplomatic tensions between the US and EU after three overseas US territories were added. Brussels claims that the exercise has led to tax reform and greater transparency in more than 20 countries.

Luxembourg does just the same thing as the Caymans of course (a tax haven with significant dollar holdings – you can see it on that Treasury document, above Switzerland), but you won’t see it being added to the blacklist. After all, it’s an EU country, and the EU doesn’t exactly have a habit of keeping its financial system in check.

It’ll be interesting to watch how this assault on Britain’s “Second” Empire goes – as Europe requires dollar funding the same way the rest of the world does: the European Central Bank begged for dollar-swaps from the Fed in the sovereign debt crisis as European banks were loaded with dollar debt.

Be careful what you wish for…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates