Yesterday we took a look at bitcoin’s abrupt spike upwards over the weekend. Today, let’s investigate what has so suddenly woken the crypto market.

This is not the product of retail investor exuberance which characterised the grand bull run of 2017. To my eyes, the recent moves upward have been caused by large amounts of money, concentrated in the command of a few players, entering the crypto market.

BTC is up over 55% in the last three months at the time of writing, and yet global Google searches for the word “bitcoin” remain subdued:

Regions in which bitcoin has become a popular Google search term in recent days (as a fraction of total Google searches within the area) are a curious bunch.

These include tax havens such as St Helena, Anguilla, Liechtenstein and the Seychelles, which would support the idea that a few wealthy fellas decided to throw some capital at the big ₿ over the weekend.

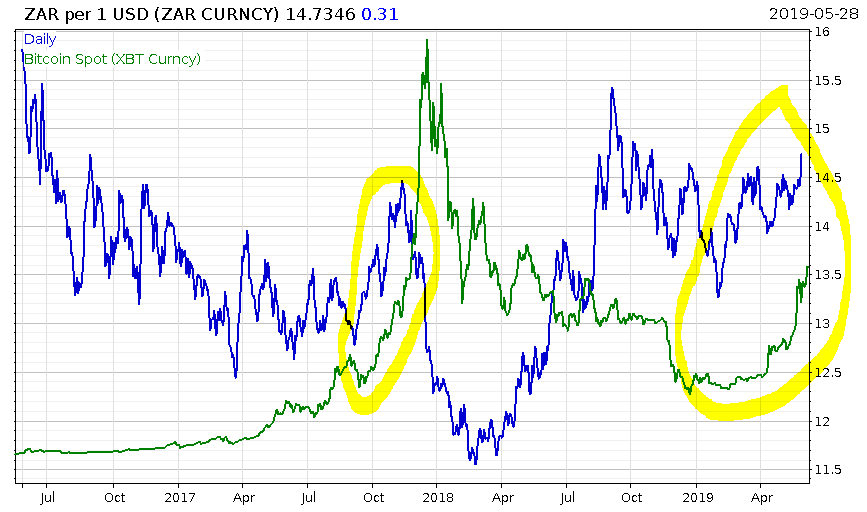

However, it’s also become a popular Google search in South Africa, Lesotho, and Swaziland. All three countries use the South African Rand (ZAR), which began steeply falling in value around the same time bitcoin began rising.

Bitcoin in green. Ascending blue line represents the depreciation of the rand.

Bitcoin in green. Ascending blue line represents the depreciation of the rand.

Interestingly, this correlation has played out before, during bitcoin’s grand bull run in 2017 (though not nearly so much during April and October last year). Could wealthy South Africans be buying BTC to hedge against the decline of their currency?

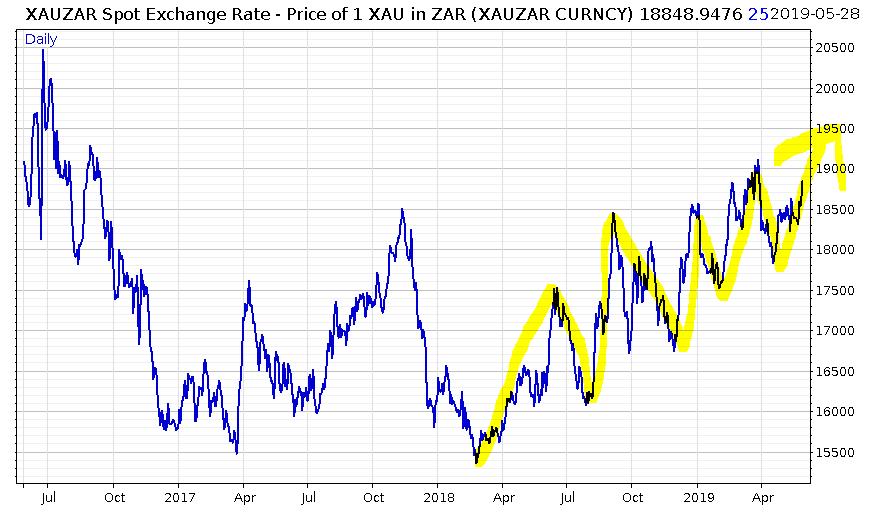

Well, the traditional asset for protecting purchasing power is gold, and they’ve certainly been buying that in spades since their currency started falling:

(1 XAU = 1 troy ounce of gold. XAU is gold’s currency code.)

(1 XAU = 1 troy ounce of gold. XAU is gold’s currency code.)

However, on the topic of currency devaluation leading to a bitcoin boom, there’s a giant panda elephant in the room: China. As you likely already know, you can’t use Google in the Middle Kingdom (or Twitter, or Facebook, or Netflix, or Wikipedia…), so we can’t pore over its internet search statistics for sudden crypto craving.

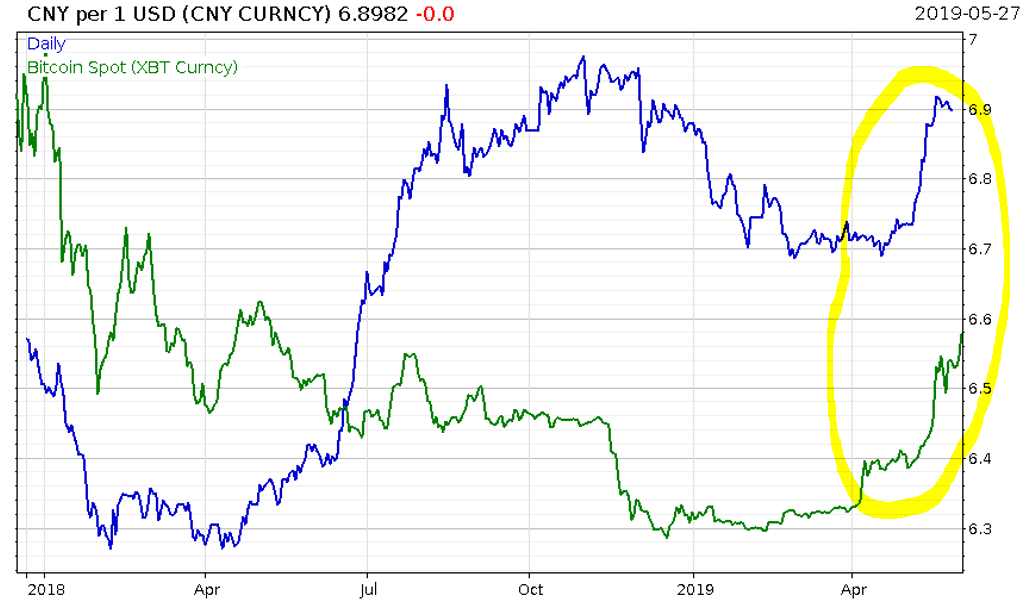

But, prior to the bitcoin boom of 2017, 95% of bitcoin settlement was in renminbi. The Chinese are very familiar with bitcoin as a method for getting capital out of the country, and getting capital out of the country is the name of the game for wealthy Chinese afraid of a currency devaluation.

The tariff battle between the US and China (one of the visible peaks of the Cold War II iceberg) has increased the threat of the Chinese Communist Party (CCP) devaluing the renminbi to stay competitive. The currency market has significantly devalued it already, and while the CCP slammed the door on the bitcoin escape route at the beginning of 2017, it’s likely that insiders within the CCP and the very rich Chinese (often the same thing, funnily enough) have found a way to open this escape hatch once again:

Bitcoin in green again. Rising blue line representing a fall in value of the renminbi.

Bitcoin in green again. Rising blue line representing a fall in value of the renminbi.

The correlation is again strong, and the sheer scale of wealth that is within China and dying to get out makes the Chinese capital flight a stronger candidate than South Africa for the recent boom.

So there you have it, a little “rogues gallery” as to who might be responsible for the bright green candles we’ve been seeing in the bitcoin market.

Tomorrow, we’ll zoom out a little to see how accommodating the broader macro landscape will be for higher crypto prices. Don’t go away!

Until then,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates