The London Metal Exchange is toughening its stance on alcohol consumption with new rules that will prohibit floor traders from drinking during the workday, according to people familiar with the matter.

– Bloomberg

The change in rules comes at a bad time for the metals traders. The prospect of the US invading a major iron ore exporter (Iran) would have me dying for a drink.

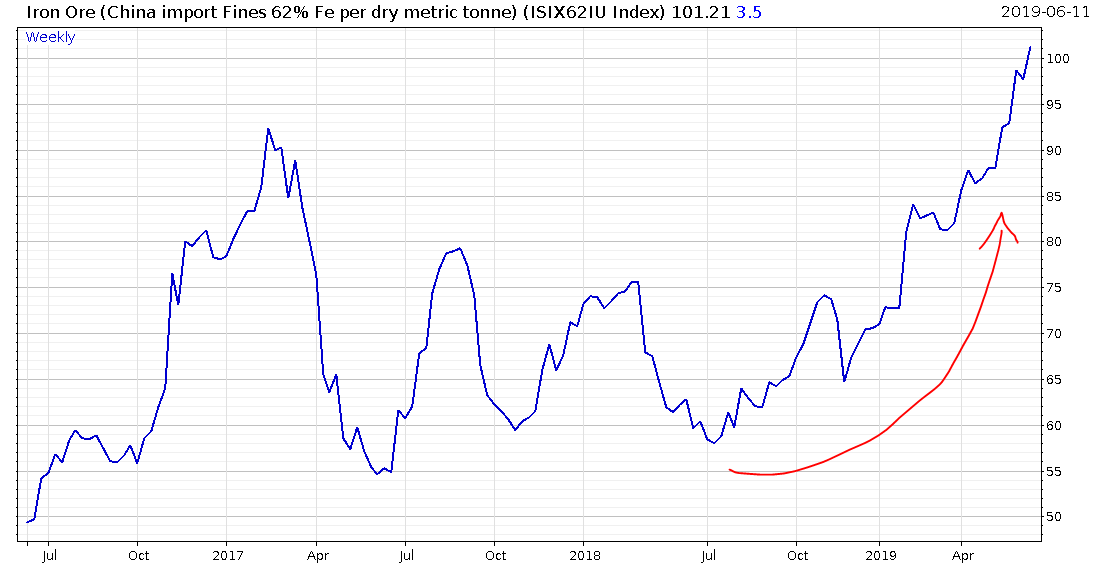

Iron ore has been climbing giddily for a year, aided by US sanctions on the country’s iron producers.

Iranian iron production contributed only 1% of total seaborne ore supply in 2018. But prices are set at the margin, and US sanctions on Iran, on top of the world’s largest iron ore producer restricting supply ($VALE, after a dam collapse) have thrown iron skyward.

We’re still a way off the sunlit 2011 uplands:

But further restriction of Iranian iron supply seem inevitable after the attacks in the Gulf yesterday.

It’s unsurprisingly oil that’s taken centre stage in the drama, which surged after two oil tankers were attacked with explosives, following a similar incident a month ago. The primary culprit in both cases is Iran, who could be trying to control the flow of oil through the Strait of Hormuz (critical for global energy supply) in order to push back against US sanctions.

US Secretary of State Mike Pompeo certainly thinks they have their man, saying that “It is the assessment of the United States government that the Islamic Republic of Iran is responsible for the attacks”.

The Iranians blowing up a Japanese oil tanker when the Japanese prime minister was in town to ease tensions has raised a few eyebrows however, with some suspecting this was a false flag operation by the US or Israel to justify a US invasion of Iran, or by Saudi Arabia to accomplish the former and boost the oil price, which has fallen steeply since April.

Whoever the perpetrator may be, I highly doubt Donald Trump will invade Iran, especially so close to the 2020 elections. He may have plenty of hawks in his administration, but he’s resisted their efforts for overt invasions of Syria and Venezuela – after all, anti-foreign intervention was a key pillar of his 2016 campaign. He knows the US public is wary and weary of more war, something illustrated graphically by the replies to this terribly misjudged tweet from the US army.

If regime change in Iran is pursued militarily, it won’t be by sending in the infantry – further sanctions and the use of proxy forces will come next, though I’m prepared to be totally wrong on this.

I’ll need to speak to James Allen to see what he thinks the consequences will be for the energy market – the booms in the Gulf have been boons for his recommendations in Power & Profits. His thesis for a higher oil price was the collapse of the shale oil sector, led by the highly indebted frackers in Texas. These guys are drilling for red ink, not just shale – 170 companies in the sector have gone bankrupt since 2015, with eight so far just this year…

His Imperial Majesty, “The Zuck”

Meanwhile, bitcoin has continued its ascent.

It had a steep sell-off at midnight last night, but is now poking above $8,250. Retail investors have more time at the weekend, so it’ll be interesting to see how this turns – I’m guessing we’ll enter the next week on a higher footing, but let’s watch. If you’re new to the crypto space and want a full, top-down briefing on what bitcoin and cryptocurrencies mean for the world, my colleague Sam Volkering has something for you – click here to find out more.

Facebook is after a piece of the action now, with its own cryptocurrency – more on that next week. But before I leave you for the weekend, I was quite struck by an image the Financial Times used in its coverage of the project:

Seemed awfully familiar…

Have a great weekend!

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates