A friend of mine just put her (nice) two-bed flat in Kingston on the market for a price she thought was silly.

It was first shown on a Saturday. Over 70 people came to view it.

The following Monday, she had 18 offers at or above the asking price.

Great for owners and sellers, depressing for buyers, these kinds of stories are all too common. The question we have to ask is: when will the madness end?

Nobody knows the answer to that, but I have a tiny carrot to dangle in today’s Money Morning, which might bring a little solace to buyers.

The housing market is rigged in favour of owners

There is probably no greater manifestation of the wealth divide in the UK than the housing market.

In fact, it’s more bizarrely specific than that. There are those that own a house in London and those that don’t.

Ignoring how things have gone at work or with their other investments, those that own a decent pad in London have more than doubled their wealth over the last three years without having had to make a single improvement to the property. They could have scrawled all over the walls and worse. It wouldn’t have made any difference.

An ordinary terraced house, for example, that was half a million in 2010 is now not far off a million. What was a million is close to two. Add in the leverage of a mortgage and most people have doubled their wealth or more.

This wealth divide will remain for as long as interest rates are suppressed, inflation is not measured properly and planning laws remain as they are. In fact, thanks to Help To Buy and other schemes by which the housing market has been propped up, the government now almost has a responsibility to maintain high house prices in the future.

So things looked pretty rigged in favour of owners.

Housebuilders are warning of a potential peak in house prices

That said, I like to watch the house builders. By that I mean the likes of Barratt (LSE: BDEV), Persimmon (LSE: PSN) and Taylor Wimpey (LSE: TW). They have, over the years proven to be reliable indicators as to the future direction of house prices.

And here’s the thing – their share prices have turned down. In fact, the whole household goods and home construction sector has turned down.

It might not mean much. It’s early days. But there’s a small chance it could be the start of something bigger.

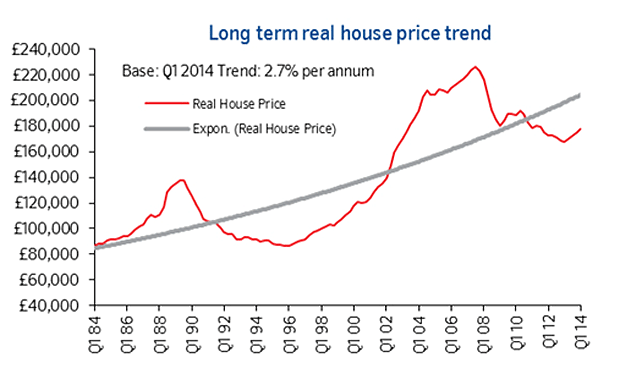

Here’s a chart of UK house prices since the mid-1980s from Nationwide.

You can see the boom of the 1980s, followed by the bust of 1989-94. Then we had the ‘saucer’ bottom of the mid-‘90s. This was followed by a multi-year bull market, which got started in about 1996-97 and peaked in 2007-8.

As we all know, London fell by much less than the rest of the UK post-2008. It also made its post-crash low sooner and began its subsequent rise faster. In the first quarter of 2014 alone, London saw annual house price inflation of 18%.

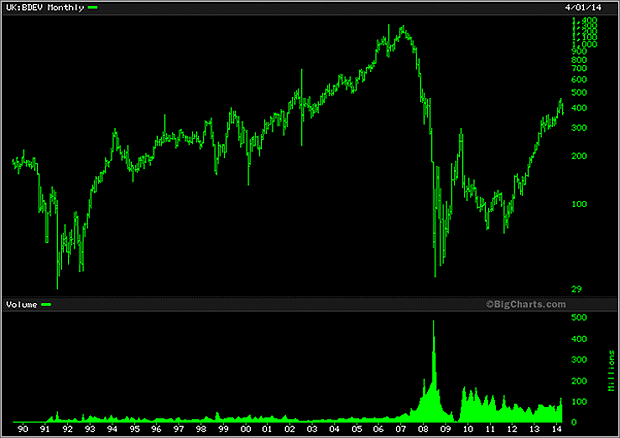

Now let’s look at a log chart of Barratt, the UK’s largest homebuilder, since 1989 (a log chart shows the magnitude of change – so on the y-axis, the distance between 100p and 200p is the same as the distance between 200p and 400p). If you compare the two, it’s house prices on steroids.

First, note the crash of 1989-94. You can see Barratt made its crash low in 1991, and re-tested it in 1992. That was two years or more before house prices actually bottomed. Between 1991 and late 1993, the share price appreciated by ten times (from 29p to 300p).

Through the rest of the ‘90s, Barratt traded in a range between about 150p and 375p. It made panicky spike downs in 1998 and 1999-2000 (both of which proved to be bear traps) before setting off on another run that would see it appreciate by another ten times by 2007, when it touched 1,300p.

There were slight wobbles in the housing market after 2000 and again in 2004-6. Barratt anticipated both of these, as well as the crazy rise to an eventual peak in late 2007 – early 2008.

Then we got the bust of 2008, the bounce, the re-tests in 2010 and 2011 – and the surge we have just seen. (The guy who bought in 2008 and sold in January this year made ten times his money again.)

In each move, Barratt has been ahead of the housing market. Intraday, Barratt actually peaked in 2006 and retested that peak in February 2007, while house prices themselves peaked in late 2007.

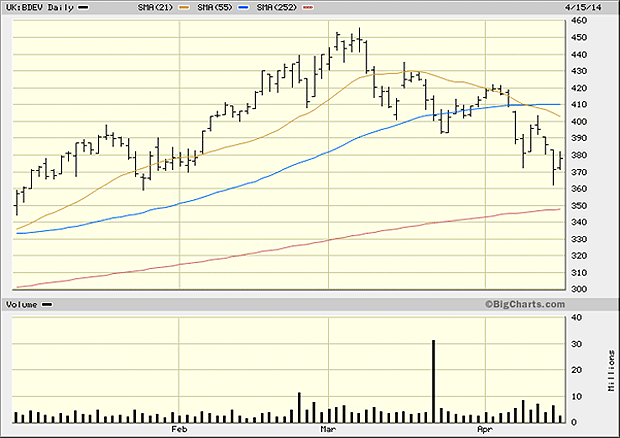

So, to 2014. Having been as high as 450p in early March, Barratt touched 360p on Monday. That’s a fall of more than 20%. In other words, it’s bear market territory.

The shorter-term moving averages have turned down (the blue and yellow lines in the chart below) and Barratt’s price is below them. It is heading down towards its one-year moving average (the red line).

One reading of this is that a trend is forming – and it is pointing lower.

And as I already noted, the household goods and homebuilding sector is also pointing lower, as we can see below. This sector actually peaked in late February.

The big surge in London prices could be over

I’m not predicting that this is the start of a housing bust. There is too much vested interest propping it up, not least from the army of buy-to-letters in the House of Commons. And neither Barratt nor the house-building sector are even at 2014 lows yet.

But, as I often say, trends are remarkable things. They can go on for a long time – and there are early signs that one is forming. The way the prices of Barratt and its fellow homebuilders go in the coming months will tell us a great deal about where housing is heading.

Given that every other article you read in the papers is about high house prices, I’m inclined to think we have a hit a peak in hype. I doubt we crash from here. But I do think things could settle and that we head into a period of sideways action, rather as we saw in the mid ‘90s, over the next year or three.

If London prices instead continue to appreciate at the rate they’ve done over the past two years, then serious social problems lie ahead for the capital.

For those of you that are interested in how yours truly has played the housing market over the past couple of years, I joined the river folk and lived on a barge in Canary Wharf, which I rather enjoyed. Very glamorous indeed, it was. Just last week, I moved back onto dry land – for reasons I shall tell you about another time.

• Dominic Frisby is crowd-funding his latest book, Bitcoin – the Future of Money. His first book, Life After The State, is available at Amazon. An audiobook version is available here.

• Follow @dominicfrisby on Twitter.

Category: Market updates