Sterling is looking strong.

At $1.67 to the pound, it’s touching five-year highs.

Has this rally got legs? Can sterling go higher?

I can’t believe this long-time sterling-loather is saying this: but the answer to those questions – with a couple of ‘ifs’ – could well be ‘Yes’.

Sterling is a play on the financial sector

As a currency, sterling is – to an extent – a play on the strength of the financial sector and the stock market. When both are strong, so is sterling, and vice versa. Such is the way our economy is geared.

During the financial crisis, sterling was one the worst-performing currencies. Falling from a 2007 high of $2.09 to a January 2009 low of $1.37, it lost 33% of its value. For a so-called first-world foreign currency that is an astonishing number.

But in the latter part of 2013 and this year, it rose from a July low of $1.48 to a weekly close last week of $1.67. That’s a 13% gain in the face of capitulating emerging-market currencies elsewhere. Sterling was one of the assets to own.

Its recent strength, by the way, against the Canadian dollar, has been even more pronounced – from a July low of C$1.56 to a high last month of C$1.86.

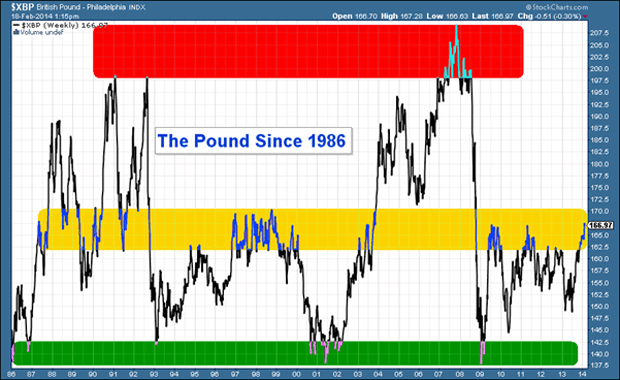

Below is the long-term chart of cable that I like to use. It shows the pound since 1986. (The pound vs US dollar price is known as ‘cable’, because the exchange rate used to be transmitted across the Atlantic by the 1858 transatlantic cable.)

(Source: StockCharts.com)

The simplistic long-term trade is to sell the pound in the red zone – close to $2 – at the top of the range. And to buy the pound in the green zone – around $1.40.

However, it is the intermediate yellow zone – the $1.60-1.70 area – that concerns us today.

Through the mid-‘90s and since 2009, this area has been a barrier of resistance. It has marked highs. But at other times – the early ‘90s and in 2005 – this same resistance has become support.

How Scottish independence could be good for the pound

That is the long-term picture. Let’s now consider the medium term.

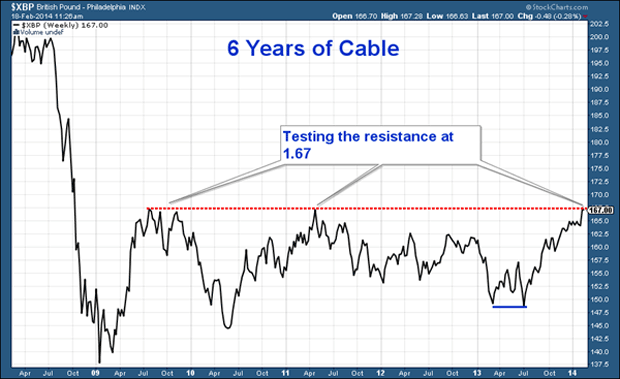

Over the five years since the financial crisis, we see a currency whose trading range has narrowed and narrowed. At points of extremity, we have slipped below $1.50, but, basically, we have gone nowhere. These are the kind of bases on which big moves get built.

In this five-year chart of sterling, we see the narrow range in which it has been trading since 2008.

(Source: StockCharts.com)

I have also drawn a blue line showing a little double-bottom it made last year at $1.49. We can also see that is re-testing that $1.67 mark for the fifth time since 2009. Only this time, the rally to $1.67 has not been a counter-trend bounce as it was in 2009. Rather it is a move off a strong low, with the moving averages (short and long term) all sloping up and providing support. (The moving averages are not pictured here.)

In short, the move has strength. And as I have said before, the more times a price re-tests a level, the more likely it is to get through.

I can easily envisage a move such as we saw in the late ‘90s, where sterling remains in the range shown by the yellow band in the first chart – between $1.60 and $1.70. The fate of the broader financial markets a few months from now will determine which way it breaks out of the yellow band.

But if it can get above $1.67 or $1.70, there really isn’t a great deal to stop it from launching towards the $1.95 area.

In my new-year predictions piece, I suggested a high for the year of $1.70 and a low of $1.53. That reading still looks possible, so I’ll stick with that for now. In the short term, I can see a pullback to $1.62 (the 2012 and 2013 highs), before launching through $1.67 and $1.70. But if it breaks above $1.70 that break could well be worth buying.

One of the factors that I expect to determine the fate of sterling is the way Scotland votes later this year. If Scotland votes to stay in the UK, I imagine sterling will rise – markets like political certainty.

But, bizarrely, I suspect sterling will also rise if Scotland votes out. Thanks to the North Sea, the pound enjoys some ‘petrodollar status’. Presumably, sterling would lose that, which is a negative.

But because of the various social and economic problems that exist in Scotland – unemployment, welfare obligations, and all the rest of it – I also suspect that foreign-exchange markets will perceive a sterling without Scotland as a stronger sterling. And they’ll buy into that.

So perhaps the Scottish vote could be the catalyst that takes the pound towards the two-dollar mark.

What stronger sterling would mean for the UK economy

The implications of stronger sterling are many. It means your summer holiday gets that bit cheaper. But for exporters, it means a struggle to make their products competitive.

The implications for property are also interesting. In 2008-09 London property was pretty much unchanged price-wise in nominal terms. But thanks to sterling’s capitulation, for overseas buyers, prices fell by a third.

A rally in sterling to, say, $2, will mean 20% or more in foreign exchange gains for foreign owners, to add the appreciation their property has already enjoyed. Some of them might be tempted to sell.

Meanwhile, London property will have become that much more expensive to new foreign buyers. Perhaps some will be deterred and that particular flow of capital may dry up a little.

On the other hand, a stronger sterling will mean rising prices in imported goods will not be as strongly felt. This will manifest itself in lower inflation numbers – which means there will be less pressure to raise rates.

Which means all the financial, economic and social pressures created by low rates may well continue to be felt for some time to come.

In any case, watch the $1.70 mark – it could be the key to whether or not we see a $2 sterling again any time soon.

Interested in bitcoin? Back my new book

Finally, I’ve begun work on another book, which tells the amazing story of bitcoin and the cryptocurrencies (and, yes, I’m aware of recent events!).

I am crowd-funding it with Unbound and I’m pleased to say it is already almost funded. But you can still support the project and get your name in the book. If you ‘d like to, I’d be very grateful – just click here.

• Life After The State by Dominic Frisby is available at Amazon. An audiobook version is available here.

• Follow @dominicfrisby on Twitter.

Category: Market updates