Ever heard of Bento Rodrigues?

Probably not.

This sub-district of the Minas Gerais state of Brazil has recently fallen victim to one of the worst environmental disasters in history, one that’s gone woefully unreported here in the UK.

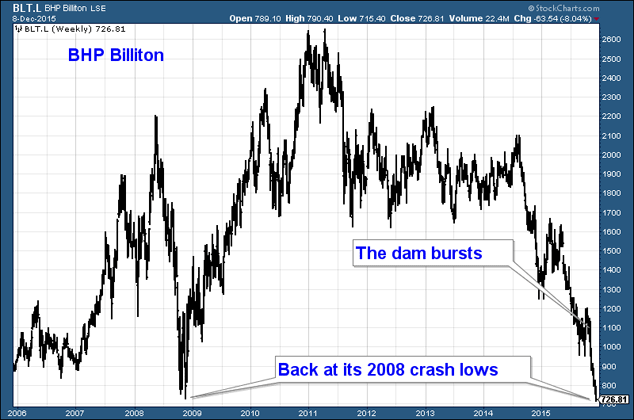

Here we consider the implications for one of the companies involved – BHP Billiton.

Extracting the valuable from the not so valuable

The process of mining involves separating the valuable (V) – metal – from the not valuable (NV) – rock. There’s a lot more NV than there is V. You sell the V, but you’ve got to get rid of the NV – otherwise known as tailings – safely.

We’re talking about vast amounts of crushed rock, now a slurry of fine particles, as well as all the chemicals used in the extraction process – think mercury, think arsenic, think cyanide.

The correct and secure storage of tailings is one of the most important elements to a mine, if not the most important. Failure to do this properly is why the industry is so loathed. The consequences can be devastating.

On 5 November, 2015, a tailings dam from an iron ore mine part-owned by BHP Billiton and part-owned by Vale, burst. The entire subdistrict of Bento Rodrigues was flooded with toxic waste. 13 people have died so far.

The knock-on effects are catastrophic. 60 million cubic metres of iron ore waste soon reached the Rio Doce, which has a drainage area of, according to Wikipedia, 86,715 square kilometres, with 230 municipalities relying on it for subsistence. Flowing down the Doce, 17 days later the poisonous mudflow reached the Atlantic Ocean. Now it is spreading up and down the Espírito Santo coast.

The consequences to the river and its wildlife, not to mention the livelihoods of all those depending on it in some way, are still unknown. One biologist, Andrew Ruschi, has put a timeframe of 100 years for the waste to dilute.

It remains to be seen how negligent BHP and Vale have been. Both companies already have preliminary fines. The figure of $5bn is being bandied about for further down the road.

Phew.

What comes next?

This is a horrific, tragic accident. And the question of whether you want to own BHP or not may boil down to how culpable it was, and how it acts to make this good – two things which we won’t be certain about for quite some time.

But BHP is a staple in many portfolios and this is an investment column. My job now is to discuss the investment implications.

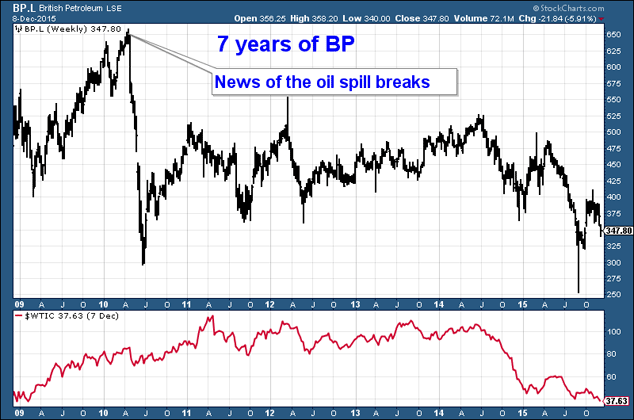

On that note, there is some value to looking at what happened to oil giant BP in the wake of its own environmental disaster – the Deepwater Horizon oil spill. In the three months between April and July 2010 the market cap of the company more than halved, falling from 660p to 300p.

The crude price was weak over that same period – though nothing like as weak as it is now – and it went on to rally over the next year.

From its low, BP rallied to 500p. Over the next four years it ranged in the 375p to 525p range, while crude ranged between $80 and $115 per barrel.

Then when the price of crude collapsed last year, so did BP’s share price. Now it sits at 347p. It never regained its old highs. The fines, the bad publicity, the change in sentiment all put paid to that.

BP is plotted below with, for your reference, the price of crude in red underneath.

I imagine something similar might to happen to BHP. However, there are two key differences.

The big differences between BHP and BP – it’s not just the ‘H’

First, the Bento Rodrigues disaster has not had anything like the publicity the BP oil spill had.

The BP disaster occurred in the US, so it was bound to attract more English-speaking media coverage than Brazil. The Mexican gulf is probably more accessible to cameras than remote rainforest. BP is a more famous company than BHP. The terror attacks in Paris a week later drew just about all media focus away from the BHP disaster.

So while it’s possible that the fallout from this may yet bring BHP unwanted media prominence, it seems it might have escaped this particular punishment lightly.

The other key difference is that commodity prices – be it iron ore, oil, coal, copper – are all falling, whereas in 2010 energy prices were rising.

So where are we now? The crisis is now not much more than a month old. It took BP almost three months to reach its lows.

When the story broke, BHP was at about 1,050p. Yesterday it fell beneath 730p. It’s now sitting at its 2008-crash lows. If it follows the BP route, and we have a three-month correction, 500p is the target.

I wrote a few months back about what a tempting buy BHP was, with its near-8% dividend yield and its strong record of raising that yield. The main risk was the falling price of commodities.

How quickly a situation can change.

Now, the extra problem that BHP has is whether it will be able to pay that yield. Much of that will depend on the fines it receives and the cost of making good the damage done.

But with oil (still BHP’s largest source of revenue, although perhaps no longer, given the fall in its price) hitting a new low yesterday, iron ore doing the same, and commodities everywhere being in such deep trouble, it’s hard to see BHP maintaining that dividend.

The world’s fifth-largest miner, Anglo American, yesterday suspended its dividend. If BHP does that, one good reason to own the company will pass away.

If commodity prices can stabilise, then BHP has a chance. Otherwise, I think we’re headed lower.

Category: Market updates