Today, I want to look at natural gas.

Why?

I think there’s a pretty good seasonal trading opportunity to take advantage of – right here and now…

A good time of year to buy natural gas

Natural gas reminds me of silver. It’s a commodity with enormous and varied potential, yet, in price terms at least, one that has an annoying tendency to frustrate.

However, it has a remarkably consistent tendency to move higher over September and October.

The obvious reason behind this is an increase in buying ahead of winter, following a drop in buying at the end of summer. (Natural gas is used extensively in air conditioning.)

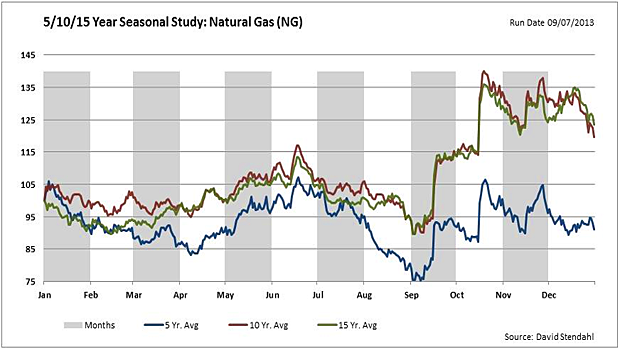

First, let’s look at a chart from David Stendahl of the Signal Financial Group in Ohio. It shows the seasonal tendencies – how the price has moved – of natural gas over the average of the last five years (in blue), the last ten years (in maroon) and the last 15 years (in green).

It’s remarkably consistent. Gas regularly puts in a low in early September. It then spikes up, consolidates, and enjoys a second spike in October.

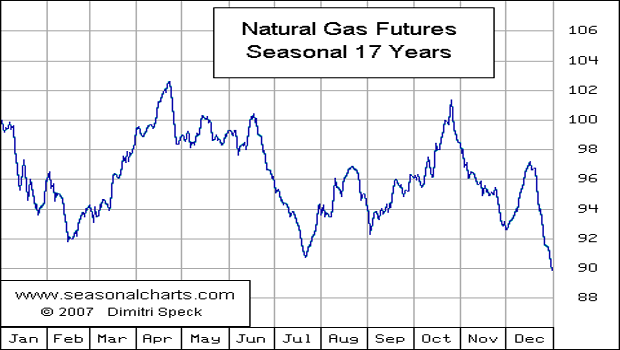

This pattern is backed up by Dimitri Speck’s seasonal chart of natural gas over the last 17 years, directly below – not quite as defined, but clear nonetheless.

Source: www.seasonalcharts.com

Source: www.seasonalcharts.com

Looking more specifically at the last three years, the trade worked out in 2012. Natural gas started September at $2.80 per million British thermal units (Btu) and hit a high of $3.80 in October.

In 2011 it didn’t work so well. It began September at $3.90, fell through the month, then rose through October back to $3.90. Nor did it work in 2010, falling from $3.90 through September and October before rebounding at the end of the month at just above $4.

One in three isn’t great. But at least the trade didn’t lose money. The longer-term record is more persuasive.

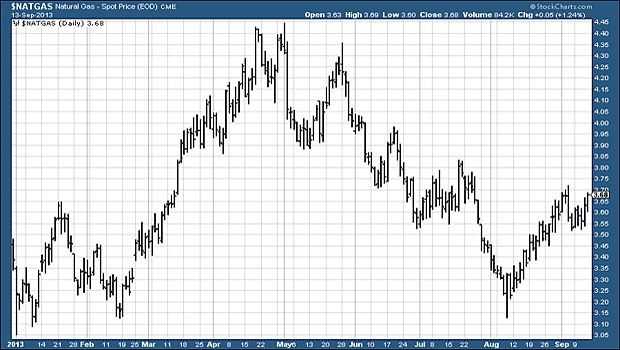

So will it work this year? Let’s take a look at the action over 2013 so far.

Source: stockcharts.com

Source: stockcharts.com

You can see that so far natural gas has mirrored Speck’s seasonal patterns of the last 17 years pretty well. Falls in January, a rally from February through till April, then declines into July and an August rally.

The difference has been that this year has not seen the typical late August capitulation. That’s largely, I understand, due to unusual weather patterns.

This may change – about 50% of analysts surveyed by Bloomberg reckon that gas prices will fall between now and the end of this week. But for now natural gas has some support at just above $3.50. That might be a possible entry point. It is currently trending higher and sitting above both its 21, 55 and 255 day moving averages. The trend is in gas’s favour – and you know what I think about trends.

Given this, $3.90 looks a given to me and there might be some resistance there. But it could easily go well above $4 if this trend runs into late October. However, part of me is concerned that those 50% of analysts will be right, and we’ll see lower prices first. So we need to be careful.

The way to play this, I suggest, is to buy the trend now (somewhere in the $3.60 area ideally) with a very tight stop-loss, perhaps just below the 55 day moving average at $3.50. If that stop doesn’t get hit, then great – enjoy the ride.

If it does, then look for some declines – perhaps with an entry point in the $3.00 to $3.30 area and buy them with a view to exiting the trade towards the end of October. Also, keep an eye on how the market reacts to the ‘taper’ news due from the Federal Reserve tomorrow evening – depending on what happens, that could provide an entry point.

This isn’t a long-term buy and hold, nor is it an investment in some long-term growth story. It’s a simple seasonal flip trade and – should the market come to my target entry prices – I’ll be out of it by the end of October, sooner if my targets are hit.

The simplest way to play the natural gas price in the UK is via a spread bet or a contract for difference (CFD). Do remember that such levered products are dangerous things (you can lose far more than your initial stake), so manage your risk carefully. For more on spreadbetting techniques, sign up for my colleague John C Burford’s free email, MoneyWeek Trader.

Alternatively, there are exchange-traded funds (ETFs) you can use to play natural gas. Again, these are not buy-and-hold investments, but for short-term trades such as this they should work pretty well. Do be aware that for a sterling buyer, there will be foreign exchange risk, as the ETFs are priced in dollars.

Category: Market updates