We wrote yesterday how mainstream investors have grown complacent to geopolitical issues thanks to decades of US dominance. They meet the rapidly developing Cold War between the US and China with a shrug.

What better way to wake ‘em up than with a good old-fashioned missile crisis?

The release date for this particular show is to be confirmed – but the new suit at the Pentagon wants to get this baby on the road “sooner rather than later”.

Got investments in Asia? You might wanna pay attention.

The withdrawal of the US from the Intermediate-Range Nuclear Forces Treaty was a risk we first highlighted in November last year in Zero Hour Alert. The official withdrawal of the US from the treaty on Friday formalises a new arms race.

A brief recap:

The INF treaty was signed by the US and the USSR at the tail end of the last Cold War. Under the agreement, neither side would deploy missiles with an “intermediate range”: between 310 and 3,410 miles. Despite the “nuclear” in the title, the treaty bans the deployment of any missile, ballistic or cruise that has that range, be its warhead nuclear or conventional.

Most importantly: China didn’t sign it. It was a shadow of its current self in the 80s, and didn’t need to be brought into the arrangement to end the first Cold War. As a result, the People’s Liberation Army of China has been free to invest heavily in developing some top-notch intermediate range missiles, and now wield a stockpile of around 2,000 of them, while its rivals have none (or close to it – the US claims Russia sneaked in a dozen).

Of particular note are the Dongfeng-26’s, China’s “carrier killer” missiles, which the PLA claims can destroy an aircraft carrier in one, and is hard to intercept.

Russia, being right next door to China’s development of the new weapons, was quite aware of this imbalance, and proposed an end to the treaty in 2007 – the US refused.

But now the US military has recognised China as a great power rival, and wants to counter the PLA’s power in Asia, particularly the South China Sea. And not only will the US develop its own such missiles, but crucially it will plant them amongst its allies in the region. Potential recipients for such “gifts” include Japan, Vietnam, Malaysia, the Philippines, Australia and more.

The US defence secretary Mike Esper has said that “we would like to deploy a capability [to the Pacific] sooner rather than later.” On deploying them to Australia “I would prefer months. I just don’t have the latest state of play on timelines.”

All these countries will have a decision to make when the US asks if they’ll have the missiles on their shores, pointed at China: say no, and get sanctioned by the US… or say yes, and get sanctioned by China.

All of Asia has been powered by the engine of Chinese growth. To take the missiles will mean being locked out of Chinese trade – taking a brutal hit to their own economies. To reject the missiles will mean being targeted with US sanctions – tariffs, embargoes, being banned from the SWIFT system, accounts held in US banks being frozen, etc.

And most importantly for investors there is the risk that countries which refuse the missiles will be locked out of foreign investment flows.

There are trillions of pounds’ worth of assets in Asia that are owned by foreign investors. Much of this is owned by pension funds, insurance companies and the like. Imagine what will happen if they can no longer invest in the area, or more importantly, sell what they’ve previously bought.

If “investing in emerging markets” begins to take on the same meaning as “investing in Iran/Venezuela”, (ie, good joke, pal), you’d better hope you got your money out of there first.

The latest issue of Zero Hour Alert features an Asian country that will likely be free from the US’s financial hammer, and stands to make certain investors very rich with its own wave of defence spending – but I can’t reveal too much.

However, there’s another asset that’ll ride high if we encounter such a scenario – which if you’ve been reading this letter for a while now, you’ll know a fair bit about already…

Meanwhile, in goldville…

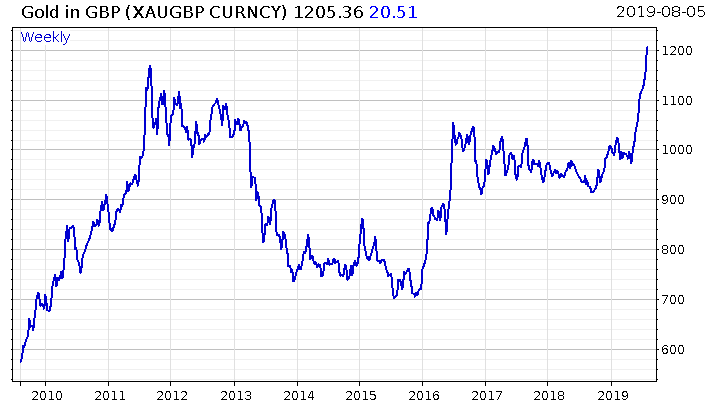

£1,200 per troy ounce. Damn, is it a good day to be a British gold bug.

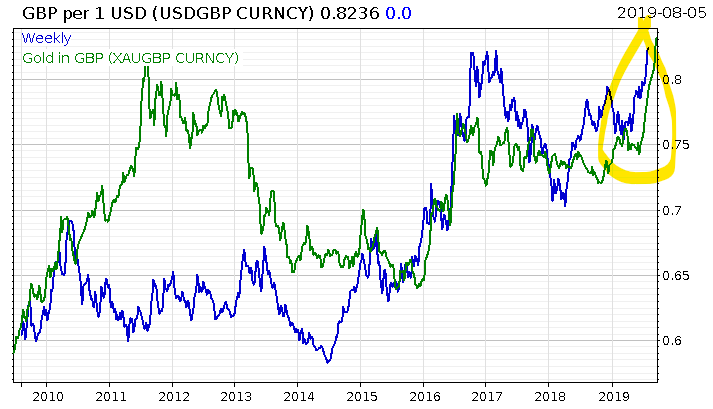

The joy for the British gold bug is bittersweet, as the recent all-time highs have been heavily helped by the fall of the pound. Tightly accompanying the rise of gold in sterling is the dollar:

The price of gold (green) and the price of the dollar (blue) in pounds

The price of gold (green) and the price of the dollar (blue) in pounds

Still, look on the bright side. The UK is now the envy of every developed government on the planet – through Brexit, we’ve actually managed to make our currency weaker!

For all the efforts by central banks to devalue their currencies to ease the weight of their nation’s debt burdens and spur inflation, nobody’s really managed it. Except us. (By mistake).

Not that that’s gonna stop them trying. With the POTUS and Mario Draghi hungry for weaker respective currencies, the UK is leading the way. As Grant Williams wrote in a recent issue of Things That Make You Go Hmmm…

It seems as though the ‘every man for himself’ phase of whatever the hell it is that we find ourselves in has begun.

Ironically, all the world’s central banks are facing the same problems and so their actions may well seem coordinated going forward, but make no mistake about it, this is going to be a competitive situation.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates