The snake which cannot cast its skin has to die.

– Friedrich Nietzsche

The young and old appear to be at an impasse. Divided by wealth, divided by politics. Which rift caused the other?

It’s arguable that the difference in prosperity between generations is what has caused the divide. The anaemic economic growth following the credit crisis stunted millennial employment opportunities, while the post-crisis monetary policies increased the price of assets: assets which only their parents and grandparents owned. As research firm Ipsos Mori puts it:

The economic context in which Western Millennials have matured is characterised by uncertainty and stagnation. The financial strain and employment struggle has created a blockage in the millennial life cycle, an adult purgatory, where key choices associated with moving onto the next phase of adulthood are made later than previous generations.

But it works the other way around as well. The politics of previous generations which led to free higher education and defined benefit pension schemes, both of which were off limits to most UK millennials before they were even born, has bred feelings of unfairness. This is only made worse by the fact that millennials will be subsidising baby boomers’ retirements through the, uh, bankrupt “underfunded” state pension system, on terms that they will never enjoy themselves.

As Tom Selby, a senior analyst at AJ Bell, laid out the cold, hard truth some time ago:

“Unfunded state pension entitlements are worth more than double UK GDP – these are promises that will, ultimately, have to be paid for by future generations either through higher taxes, a lower state pension income or a later retirement age…

“In reality people should brace themselves for a combination of these measures over time, although the pace of change will depend largely on the willingness of politicians to tackle long-term issues that transcend the electoral cycle.”

The millennial/boomer problem has been on the radar of politicos for some time – a cross-party parliamentary committee for the Department for Work and Pensions put the problem pretty bluntly in a 2016 report:

An economy skewed towards baby boomers and against millennials

The UK economy has become skewed. Rapid and sustained rises in house prices have concentrated wealth in the hands of those who own property. Far too many young people cannot afford homeownership and instead have to pay costly private rent. Life expectancy has risen faster than anticipated at a time when the large baby boomer cohort, born between 1945 and 1965, are reaching retirement. As the taxes of working people support the retired, the ageing population places strain on those in work. Pensioners have been protected from public spending cuts that have largely been felt by younger groups. Pensioner poverty has been drastically reduced and average pensioner household incomes now exceed those of non-pensioners after housing costs. The millennial generation, born between 1981 and 2000, faces being the first in modern times to be financially worse off than its predecessors.

And then there’s a report from the European Commission in 2017 which describes the “potential need for… changes in the welfare state which facilitates intergenerational solidarity”.

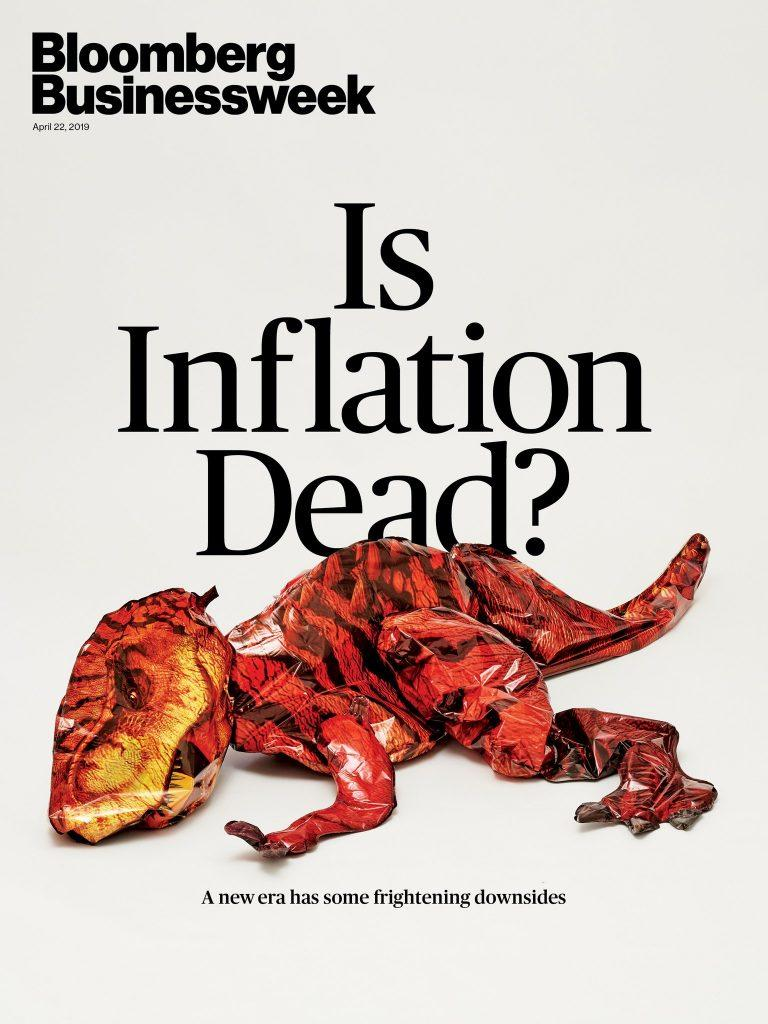

One way or another, we’re going to see somebody seek to redistribute wealth in the name of “intergenerational fairness”. This may be through radical new tax laws that would brutalise asset holders, or it may be through inflation – a beast that today appears so elusive. But with the right stimulus…

One of the main forces that propelled the fortunes of the baby boomer generation in the West was that they entered their prime earning years just as interest rates peaked and began their almost 40-year (and counting) decline. This tailwind has continually boosted the price of their houses and investment portfolios. In this manner, central banks can take credit for much of the boomers’ prosperity.

In a dark rhyme of history, I reckon we’ll see central banks called upon to generate a similar tailwind – but directed at the sails of the millennials… and at the boomers’ expense. All in the interest of establishing “intergenerational fairness”, of course.

More to come tomorrow…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates