I first visited New York City a couple of years ago. I was there to attend my brother’s wedding, but it was scheduled close to my birthday, so I took a few extra days off to see more of what so many people won’t shut up about.

After a while of staying there however I realised, like the governments of Thailand and Russia in the late 90s and European banks in 2011, that I didn’t have enough US dollars in my wallet.

My greenback shortage came to a head, somewhat ironically, when I was about to purchase a pair of boots of the same shade.

Pastel green and with gold details, they were just like greenbacks used to be before Nixon came around. I’d discovered them through an American Twitter user who’d made the same comparison, and thought while I was in the states I’d get a pair.

But I digress – they cost 225 bucks which I didn’t have. What I did have however, was Bitcoin and a brother with a US bank account.

He bought me the boots, and I reimbursed him with the equivalent in Bitcoin. Bitcoin was around a thousand dollars at the time, so I paid him almost a quarter of 1 BTC: around ₿0.225.

Not my best trade, I’ll admit. I mean, I like those boots, but I probably would have foregone buying them had I realised I was about to spend what would be worth almost $5000 by the end of the year.

When I got back to Scotland, I held off on replenishing my store of BTC as its price had gone up by a hundred bucks or so, and I thought I may as well wait for it to retrace back to $1k.

It never did.

Again, not one of my finest investing decisions, but a learning experience nonetheless.

There will only ever be 21 million Bitcoin out there, and each one is unique. Mark Cuban, the billionaire investor likens them to works of art. I think of them more as properties in Monopoly. Once they’re bought, that’s them off the table. They’re rarely sold, except under stressed conditions – or for a significantly higher price.

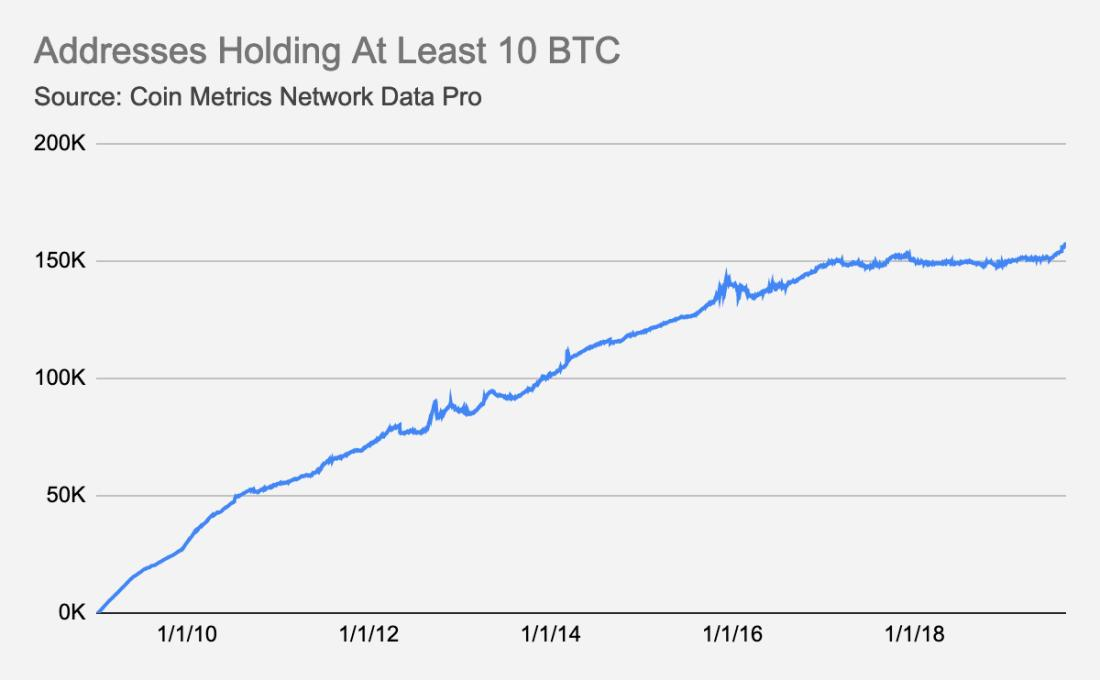

As anyone who’s played the game knows, the longer you play, the less properties there are, and the more expensive it becomes to keep playing. It becomes a game of who can accumulate the most, and monopolise the board. The very same thing is happening in Bitcoin today, where bitcoin wallets or ‘accounts’ holding 10 Bitcoin or over have reached an all-time high:

Institutional investors want their share of what’s left on the board too. Coinbase custody, the Bitcoin custody service for institutional investors we mentioned on Monday has been hoovering BTC up very aggressively in recent months, with assets more than doubling in a space of weeks:

The game of Bitcoin monopoly has been on the go for a while now (though admittedly the institutions are only now wading in).

But most of those 21 million have already been ‘landed on’ – they’ve already been mined and are already in private hands. And some of those will never be sold ever again…

Almost 18 million of the 21 million have been mined since the protocol went live a decade ago. However, blockchain analysis firm Chainalyisis reckoned last year that the private keys for up to almost four million BTC have been lost, and as a result can never be recovered. On top of that, almost a million BTC were mined by Bitcoin’s creator, the pseudonymous Satoshi Nakamoto at the beginning of the project which have sat idle for years and have never been spent (though things will get very interesting if they do).

So while those who own at least ₿1 may think of themselves as members of the 21 million club…

In reality, that club may be a lot smaller. I’ve written in this letter before that it’s unlikely I’ll reduce my BTC holdings to less than ₿1 anytime in the near future for just this reason.

That’s the thing with BTC. There’s only so much of it out there. And there’s no limit to the amount of monopoly money that can chase it. To continue the metaphor, the number of properties left on the board is a lot smaller than many realise. Mayfair has already been bought – it’s the hotels we’re waiting on now. But once they’ve been built… any player wanting to visit is gonna get milked.

Charlie Morris, fund manager and exceptional crypto analyst reckons a minor storm is ahead and puts the fair value of BTC currently at $8k, two grand below its price at the time of writing. If he’s right, such a storm will be a great buying opportunity however – for his 2022 price target is an incredible $40k+.

I’m wearing those greenback boots as I write this – I assure you, they’re less outlandish than they sound. I’m heading off to the countryside for a few days this evening, and my regular soft sneakers aren’t gonna cut it out there.

But have no fear – in the meantime, you’ll be hearing from crypto-nut Sam Volkering and analyst Kit Winder in the meantime.

Until next week,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates