How suddenly it seems the nights draw in at this time of year. Like Ernest Hemingway’s description of bankruptcy, the days seem to get shorter gradually, and then all at once.

A few years ago in an interview, the hedge fund manager Hugh Hendry observed that being in a different time zone made him perceive market events differently.

Being in Europe caused him to react differently to US market data than being in the US, and vice versa.

A career observing markets led him to conclude that for him, New York was the best vantage point in time for observing markets globally. California, meanwhile, was the worst.

I wonder how much of that was the amount of sunshine, the degree of light, or just how many hours he had been awake when important markets opened and closed that gave him an edge, or made him feel like he had an edge. Perhaps I’ll write this letter to you from the US sometime, and let you know how it goes.

Whatever works, works, as the saying goes, and for Hendry something definitely worked, timezone or not. One of Glasgow’s finer exports, he no longer abides in New York, California, or Scotland for that matter, having retired to St. Barts in the Caribbean.

I’ll be heading back home to Aberdeen next month – something tells me I’m not going to get a much deeper insight on the US or European markets there. Certainly not from the daylight anyhow – what little Aberdeen sun there is will set roughly 20 minutes before London by then.

But what it will provide is some insight on the oil market. Aberdeen, the “Oil Capital of Europe”, is leveraged to the price of the North Sea’s treasure and the mood of the city is tethered to the profitability of the oil industry.

This can produce some… interesting cultural effects. An old friend of my brother’s, with a decent job at one of the oil majors, used to go out on the town at the weekend wearing his company-issued fleece, to really make sure that the ladies knew he’s B.I.O: “Big in Oil”….

Perhaps my fellow Aberdonians will be bullish on the Saudi Aramco IPO – though I’m not holding my breath. Whatever the case, it appears the Russian and Chinese governments certainly are. From Bloomberg:

Chinese state-owned entities are in talks about investing a combined $5 billion to $10 billion in Aramco’s initial public offering, as Saudi Arabia seeks commitments from friendly governments to shore up the record share sale, people with knowledge of the matter said…

The head of Russia’s sovereign wealth fund said last week that Aramco’s IPO is a “unique opportunity.” Russian investors are “keen to participate” in the deal, Chief Executive Officer Kirill Dmitriev said in a Bloomberg Television interview in Riyadh.

Interestingly, the IPO is causing the broader Saudi stockmarket, the Tadawul, to suffer as shares are being sold in preparation for the big release next month.

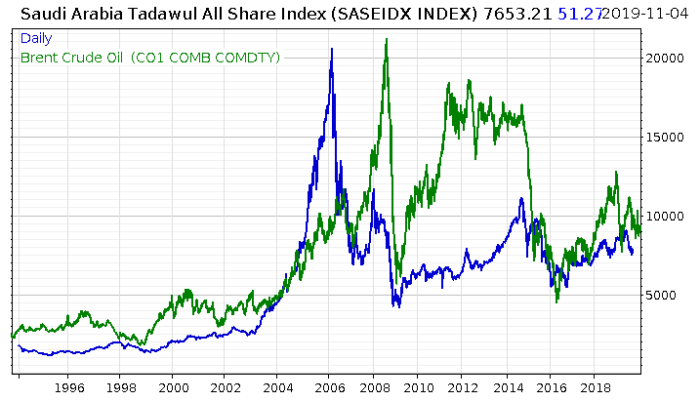

It flies under the radar, but Saudi Arabia was actually the centre of a massive stockmarket bubble between 2003 and 2006, when the Tadawul All-Share Index or TASI went up almost 10x over those three years.

The Saudi riyal is pegged to the US dollar, so Saudi Arabia imports its interest rates from the Federal Reserve (to not do so would break the peg).

Alan Greenspan’s low interest rates, and the rising oil price of the mid 2000s, in a country hyper-levered to oil was an incredibly potent elixir.

The boom was riddled with stock price manipulation and traders buying on margin, without any short-selling allowed to keep prices in check. There was little independent financial research being published but even if there were, the Saudis had little experience with stocks, with most of their investment portfolios filled with gold and real estate.

As you can see, the crash was a brutal one, leading to a brutal trail of trader suicides and dispossession. As you can see, the Tadawul simply hasn’t recovered since, even with the sky-high oil prices that came after:

It’ll be interesting to see how well the Tadawul does once the Aramco shares are listed on it. When you hear how hyped Saudi citizens are for the IPO, a return to euphoria doesn’t seem all that far off.

From Bloomberg again:

It’s the day so many Saudis have eagerly awaited.

The sale of sharesin their national oil giant, Aramco, has been three years in the making and fraught with delays. The buzz in Riyadh is now not if, but when people can own a piece of the most profitable company on the planet. Provided, of course, they have the money.

“We knew it was a matter of time, so all the talk in the office was everybody save up, have some cash ready to go,” said Nosaibah Alrajhi, 30, who founded and runs a financial services company. “I have some cash ready.”

The prospect of the world’s largest initial public offering is a chance for investors to buy into the cash cow that has nourished Saudi Arabia for decades, while for Crown Prince Mohammed bin Salman it underpins his transformation of the kingdom…

Everyone is being encouraged to invest in the kingdom’s most important asset and many Saudis see the IPO as a demonstration of loyalty. Al Shamri said he heard about people who are thinking of selling their houses or borrowing money to buy shares.

I need to ask Charlie Morris over at The Fleet Street Letter what he makes of Saudi Arabian equities at the moment. He’s becoming bullish on emerging markets of late, and had a memorable investor trip to Saudi a while back, which included, but was not limited to, an interview with a robot…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates