Have you ever heard of Camel City?

Its official name is Winston-Salem. It’s over the pond in North Carolina, and earned its nickname from being the base of the R. J. Reynolds Tobacco Company – creator of Camel cigarettes.

Nearly 30,000 people in the city worked for the company at one point, churning out trillions of Camel cigarettes.

During its boom, Camel City imported so much French cigarette paper and Turkish tobacco that the US government designated it an official port of entry to the US – despite being 200 miles inland.

I’d like to visit there someday. If only to buy a pack of Camels that actually has the Camel logo on it and not one of these drab khaki packs that looks, to borrow an American term, “wack”.

But I digress. With today being hump day, we’ll be travelling to a different Camel City – on the Silk Road.

Dark deals on the digital desert

“I used to have a drug problem, now I make enough money.”

– David Lee Roth

I’ve no doubt that some readers of this letter will have found the camel symbol gracing the top of today’s letter familiar.

It and its rider once wore the colour green and stood stoically atop the Silk Road, the hidden online marketplace for illegal drugs.

(It also catered to more standard fare, amongst other more legal products, like clothes and cigarettes. It even had a book club where users discussed some great works on Austrian economics.)

Most of the site functioned just like eBay, though with a radically different currency option – one which started with a ₿.

As long-time readers of my scribblings at Southbank Investment Research will know, I first noticed the ₿ currency symbol on a sales listing for heroin on the site when I was a curious schoolboy back in 2011 (something I’m happy to admit to our readership as I wasn’t there to didn’t buy anything, and nor did I).

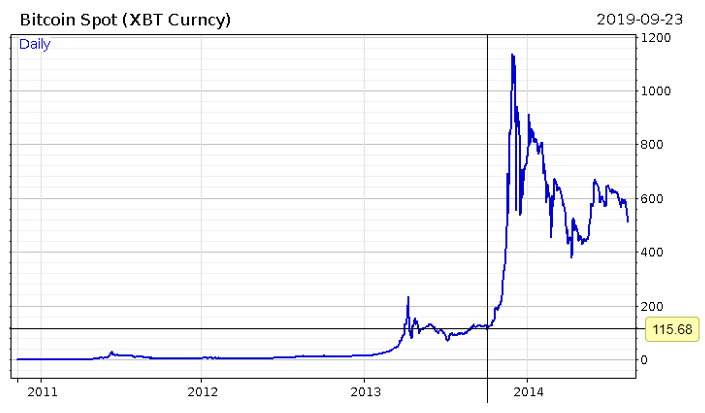

Why I bring up the Silk Road today however, is due to the price action of bitcoin at the time. The Silk Road was launched in February 2011, and lasted over two years until its founder Ross Ulbricht was arrested in 2013.

During that time, BTC was extremely stable relative to its more recent history. But the news of his arrest and word of the Silk Road’s digital currency made the price go parabolic. As you can see below, the BTC price took off like a camel on steroids almost immediately after he was in cuffs:

X marks the day the day Ross Ulbricht was arrested – 2 October 2013

X marks the day the day Ross Ulbricht was arrested – 2 October 2013

(Ulbricht was sentenced to two life sentences and 40 years without parole. He now prays for a presidential pardon and writes Twitter posts by hand from his cell which his mum Tweets for him. His latest musing, from 12 September: “I miss trees.”)

Now before reading on, just take another look at that blue line – look at its shape.

And now take a look at the BTC price since.

That first chart is contained, believe it or not, entirely within that tiny yellow highlighted section.

That first chart is contained, believe it or not, entirely within that tiny yellow highlighted section.

But the shape of the blue line, the price action since then, shares an uncanny likeness to the Silk Road era – just much, much larger. Scroll up, and compare.

It really does seem like the camel of history is re-treading the same path, a “silk road” you could say, just with much more gold in its saddle. And much less drugs, for that matter.

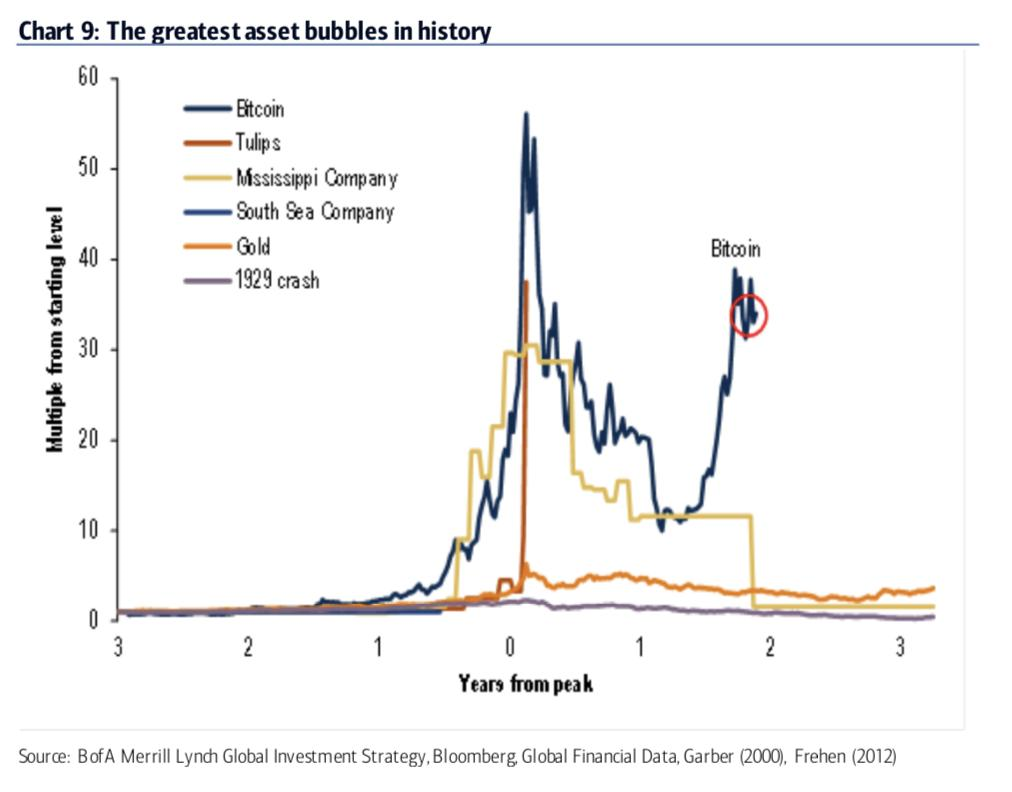

Those who claim this is merely the shape of a “classic bubble” (there is no shortage of Financial Times readers who will automatically and unceasingly grunt the word “tulips” on every FT article which references BTC), should take a look at this great comparison of the classic bubbles.

Notice how in none of them, in the years after the bubble burst, did the asset in question recover in the way bitcoin has this year:

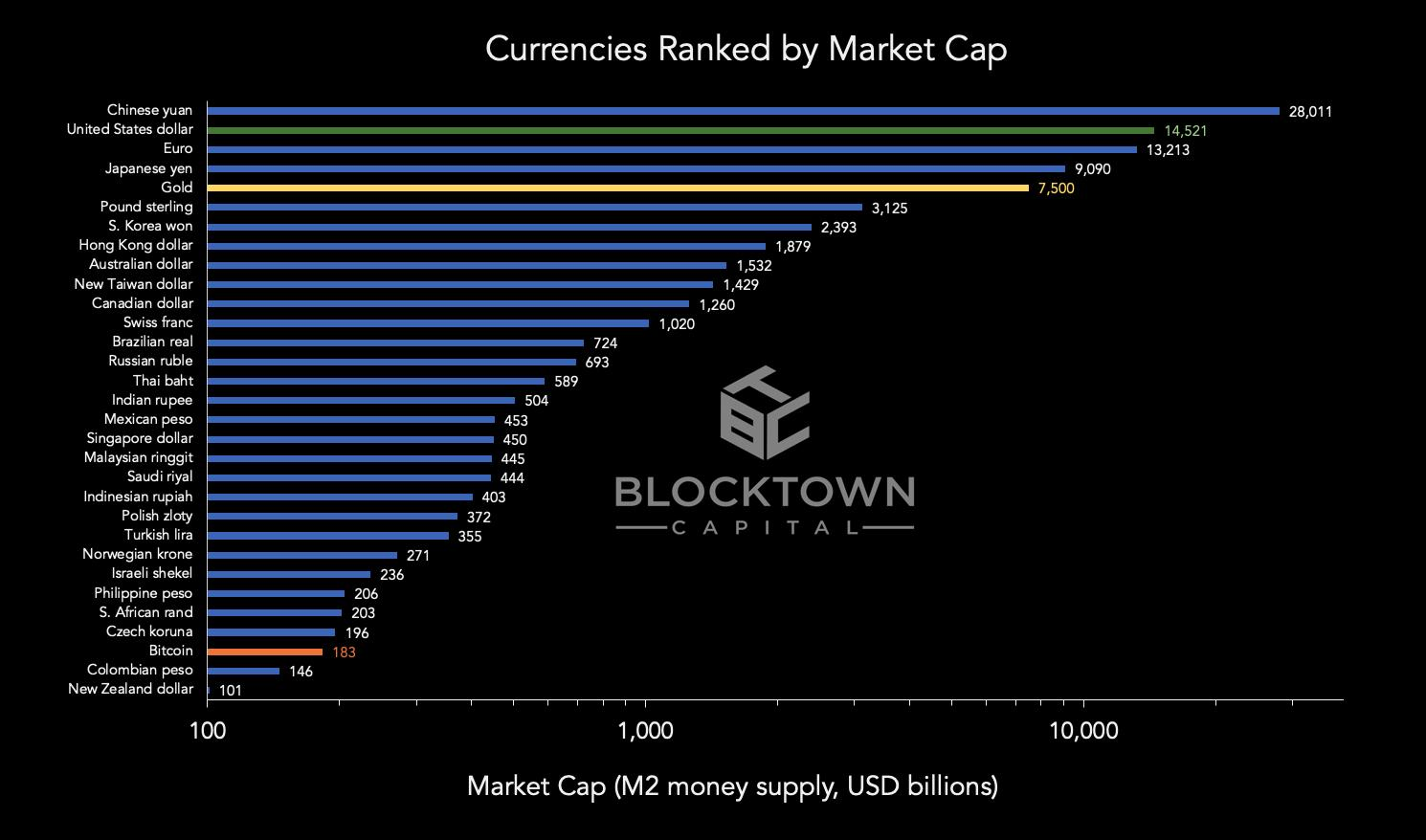

The market cap of BTC was about $1.5 billion when Ulbricht got arrested. It’s more than ten times that today, breaking into the world’s top 30 currencies, as this fine table from Blocktown Capital illustrates. This camel has overtaken the Kiwis and the Columbians (New Zealand dollar and Columbian peso):

Click to enlarge. Image courtesy of blocktown.capital

Click to enlarge. Image courtesy of blocktown.capital

I think the yell of “hut-hut” that will spur it on will come from central banks (though wealthy Chinese have yelled it plenty this year). When the next wave of interest rate cuts and quantitative easing comes around, and investors are forced to become ever more aggressive in finding returns… I reckon you’ll wanna be in Camel City.

One thing’s for sure: bitcoin used to have a drug problem. Now it makes enough money.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates