As the US’s fresh batch of hypersonic weapons approaches the flight-testing phase…

As a nuclear-powered missile test in Russia goes horribly awry…

And as an Australian MP compares his country’s obliviousness to the threat of China as the French were to the rise of Nazi Germany…

We sit back and wonder just how wild this Cold War needs to get before mainstream investors realise it’s going on…

Dangerous

In 1958, the US developed a plan to detonate a thermonuclear device on the moon: Project A119.

The top-secret project was developed after the Soviets launched Sputnik, to boost the US’s street cred after it’d lost the race to space. In a game of one-upmanship, the US would show the Soviets who was boss by lighting up the moon above Moscow.

Interestingly, nobody actually knows why the project was cancelled. Vince Houghton, the historian that brought the project to light, doesn’t believe it was to preserve the moon’s beauty:

The mission was scrapped seemingly out of a worry that the best- laid PR plans of the Air Force would be thwarted when the public saw this as an abhorrent defacement of the moon’s beauty instead of a demonstration of American scientific prowess. Maybe we realized landing a man on the moon was possible, and more impressive?

… Are you convinced the US Air Force, at the height of the Cold War, in the wake of the shocking launch of Sputnik and the fear left in its wake, scrapped A119 because it might muss up the moon a little bit?

Neither am I.

Included in the planning was, believe it or not, a young Carl Sagan, who would go on to break the rules and put his involvement in the project on his CV. Sagan would go on to happily take credit for writing such papers as Radiological Contamination of the Moon by Nuclear Weapons Detonations and Possible Contribution of Lunar Weapons Detonations to the Solution of Some Problems in Planetary Astronomy when applying for a scholarship at the University of California in 1959 (as great excuses go, “solving some problems in planetary astronomy” has to be up there).

The fact that such an idea was kicked around for eight months by the US military establishment is indicative of the time. This was a period of all-out competition between the two powers; a period totally opposite to the global order we’ve experienced since the Berlin Wall fell… but one to which we are rapidly returning to as the US recognises China as a great power competitor.

Project A119 was spurred on in part because the US thought the Soviets would nuke the moon too. But of course, back then American investors had zero capital in Chinese markets. Nor did the Soviet Union have a currency that was pegged to the USD, as China effectively has today.

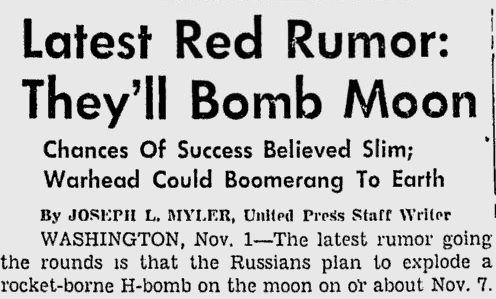

Imagine how the stock, bond and FX markets would react today if this headline made it to print. Swap out “Russians” for “Chinese Communist Party”:

This was printed on Friday 1 November 1957 in the Pittsburgh Press. 7 November was supposedly the date at which the Soviets would nuke the moon to celebrate the fortieth anniversary of the Bolshevik Revolution.

This rumour was completely unfounded, though incidentally the Soviets would develop such a plan soon afterwards. They cancelled their programme as they were afraid the missile wouldn’t launch correctly, and fall back to earth, nuking either themselves or a foreign country. The Soviets concluded in a gloriously understated fashion, that this would create “a highly undesirable international incident”.

Such schemes appear ludicrous now, but I strongly suspect the great power competition of the Second Cold War will produce some equally mad and dangerous ideas. But this time around, Western investors will feel the impact of them in their portfolios – passive investors especially.

By the end of this year, MSCI (which creates indices or stocks and other assets) will have quadrupled the weighting of mainland Chinese stocks in its global indices (a significant increase happens just this month, with another boost in November). Investment managers which offer passive products – like Blackrock or Vanguard offering low-cost ETFs – use those MSCI indices as a guide to where that money should be invested.

The greater inclusion of China in the indices will direct billions of dollars from pension funds and passive investors into Chinese companies… right as Cold War II ramps up, and geopolitical risk returns to markets in ways we haven’t seen in decades.

The inclusion of China in such benchmarks has made MSCI a geopolitical actor. I anticipate it shan’t be long before the US administration begins to target such inclusions (and starve China of dollars), just as the US has begun to crack down on Chinese investment in the US.

Not all fund managers are oblivious to what’s going on of course. I spoke to an investment manager recently on the subject, who describes the gradual disintegration of US/China relations similarly – as a “New World Disorder”. He views the deterioration of post-Berlin Wall order as a “Black Swan Factory” (I wish I’d thought of that line), which he’s been developing some strategies to defend against, and profit from.

While Nick Hubble and I have outlined a few ways to play the Second Cold War in , my colleague James Allen has identified another, playing on Russia’s role in all this. He’ll be publishing his research on the matter shortly – keep an eye out.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates