2013 has been a grim year for the pound.

It began the year worth US$1.63. Now it’s $1.51.

It’s had a similar fall against the euro. On 1 January it was €1.24. Now it’s €1.16.

Its waterfall decline accelerated after ratings agency Moody’s downgraded Britain last Friday. But this downgrading came as no surprise, so I suspect it was already priced in.

‘Buy the rumour, sell the news’, runs the saying – though in this case the reverse applies.

The rumour got sold. So is it time to ‘buy the news’? In other words, is it time to be long the pound?

Sterling could be headed for the $1.40 level

I’d like to start with a chart of sterling over the last three years.

(Click on the chart for a larger version)

You can see that for the last two and a half years it has traded in a range against the US dollar, capped at around $1.63 – $1.64 (apart from brief sorties above in mid-2011). This cap is shown by the red band.

At the other end of the range, the $1.53 area, as shown by the amber band, has been strong support. Six times that level was been tested and six times it held.

On the seventh re-test, however, sterling ran out of buyers. The range has broken to the down side. That does not bode well.

(Incidentally, that chart of sterling looks remarkably similar to gold’s chart over the same period, which I posted last week. The difference is that gold has held – for now at least – while sterling has broken down. For all gold’s failings this year, it is actually up a couple of percent against sterling, such has been the pound’s weakness).

Coming back to the pound against the dollar, sterling has left a gap between $1.53 and $1.54. I have circled this gap in red on the chart above. Gaps have a tendency to be filled, which suggests a relief rally of sorts will come. The velocity and violence of sterling’s recent descent, coupled with strong anti-pound sentiment, are all additional arguments suggesting a bounce is likely.

But any such bounce wouldn’t go much above $1.57, I wouldn’t have thought – unless America suddenly takes a turn for the worse (possible). Perhaps it’ll only make it to $1.54-$1.55.

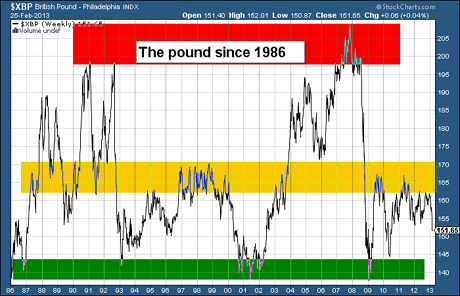

Longer term, I would suggest the pound is now destined for the $1.38-$1.43 zone – the green area on the chart below, a long-term chart you will have seen me post before. If $1.50 is broken, this area will act like a magnet.

(Click on the chart for a larger version)

Should we get back to that green zone, the question then will be, ‘Will that hold?’

The probability, based on the evidence of the last 25 years or so, is that it will. But that’s by no means certain. Our economy is built on finance, house prices and government spending.

So the combination of a weak government, too much debt and a central bank bent on engineering a boom in time for the next election, suggests that the pound will come under severe pressure in the coming months and years.

For example, there was talk of negative interest rates yesterday from Paul Tucker, deputy governor of the Bank of England. In such a situation a central bank would charge banks to hold their money, rather than pay them interest, in order to ‘encourage’ them to lend out more. Such a policy, were it be implemented, is unlikely to be bullish for the pound.

(I thought the credit crisis was caused by too much irresponsible lending, by the way. It makes you wonder why they are trying to force more).

We’ll review the situation if and when we get to the $1.38–$1.43 zone.

Will the pound hit parity with the euro?

When we went below that green zone in the dark days of the miners’ strike in 1984-5, we almost reached parity with the dollar. It would take a crisis of similar magnitude – cuts could potentially bring it on – to take us below $1.38 once again.

Parity against the euro, however, is rather more achievable. We only have another 16c to fall to win that particular battle in the currency wars. The euro is that much harder to debase.

Here we see the long-term chart of the pound versus the euro (the 1990s numbers are based on a composite of European currencies).

(Click on the chart for a larger version)

At €1.16 we are already below sterling’s dark days of the early 90s. However, there is quite a strong uptrend that has developed over the four years since the 2008-9 lows. You can see that the pound has been making sequentially higher highs and lows. If this current low holds, and the pattern continues, that gives a target of about €1.32. That does not marry with my bearish sterling views, but who knows what the next phase of the euro crisis will be and what effect it will have on its currency.

Shorter term some kind of relief rally now seems to be happening thanks to the fall-out from the Italian election – we have gone from €1.14 to €1.16 in the last day or two. I’d bet that on a move to the €1.20 area. But then that this uptrend breaks and we test €1.10.

If that all sounds a bit confusing, I apologise. Pound vs dollar I’ve always found easy to read clearly. Pound-euro less so.

If you ignore the politics, Italy leaving the euro would probably be good news for the currency. Italy’s track record with government money, as anyone who has looked at the history of the lira will tell you, is not great. It would mean the loss to the eurozone of a large economy, yes, but it would also mean the loss of an economy with serious problems.

However, such an exit would be a political disaster for the European project. It would suggest the euro’s days were numbered, which, as my colleague John Stepek noted yesterday, makes it unlikely to happen. More likely is some bureaucratic compromise in the form of European Central Bank money-printing.

Until it gets to that, there will be the usual to-ing and fro-ing and grandstanding. That suggests we can expect to see a lot more volatility from the single currency in the months ahead.

If you fancy betting against the pound, I think shorting it against the dollar will give you a less hairy ride than the euro. But wait for some kind of rally before you place your bet. If you’re just worried about when you should change currency for your summer holiday on the continent, give it a few weeks.

Category: Market updates