“I know this defies the law of gravity, but I never studied law!”

– Bugs Bunny in High Diving Hare (1945)

You might think that when a company starts exploring the possibility of declaring bankruptcy, that its share price would be in for a rough time.

You might think a company’s stock price would go down when, struggling to earn money, it begins defaulting on its debts.

Indeed, you might think that when a company outright declares bankruptcy, that its shareholders would get destroyed…

… but you’d be wrong.

I certainly was. I must confess – I thought that when a company goes bust and publicly declares it, that this was generally a bad thing for people who owned a stake in the business. But clearly, I was deluded.

For 75 years later, the wisdom of Bugs is ringing true in the stockmarket.

Valaris ($VAL), the largest offshore oil drilling company in the world…

Whiting Petroleum Corporation ($WLL), the “fundamentally better” oil explorer…

Chesapeake Energy ($CHK) the fracking titan of Texas…

Extraction Oil & Gas ($XOG), another oil explorer…

And Hertz ($HTZ), the US car rental firm with over ten thousand outlets…

Have all either openly flirted with bankruptcy, declared bankruptcy, or defaulted on their debts in recent weeks.

And all rallied over 100% during this week. Some, much more than that – extraction made it over 200% at the time of writing.

As my colleague Sam Volkering said to me yesterday:

Crypto was crazy they said. Too risky they said. Way too volatile they said.

Gimme a break. This market sh*t is WAY wilder than crypto ever was/is.

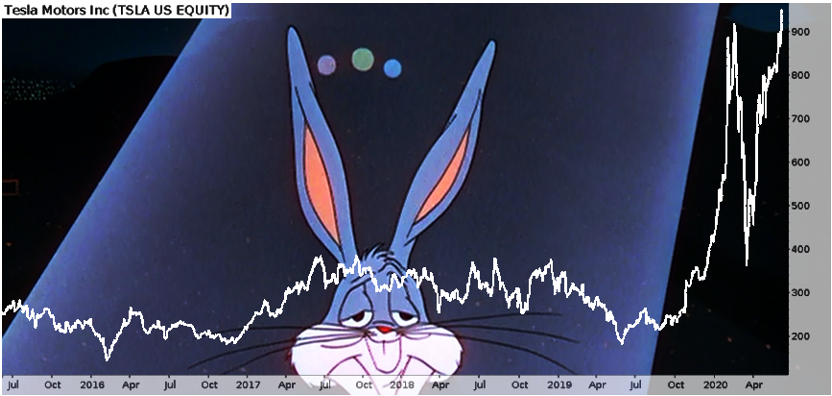

It’s turning into an episode of Looney Tunes out there. Of particular note is Tesla Motors ($TSLA), Elon Musk’s venture in electric vehicles, which has simply gone nuts in recent months.

Source: me, on Twitter

Source: me, on Twitter

$TSLA quadrupled and then some from midway through last year going into 2020. Then it was cut in half and then some when the March crisis hit. And then it managed to more than double, and has reached all-time highs!

Bugs is a better commentator than I for this scenario. Is Musk’s firm really in a better position now than before the WuFlu hit? I don’t think so. But that’s clearly not what matters right now to the people buying these stocks.

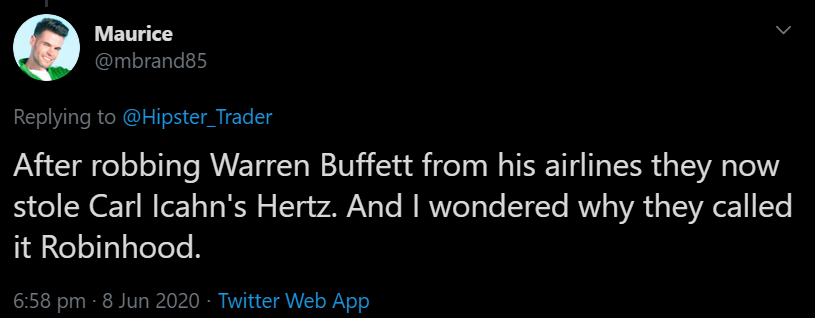

A lot of the action is being attributed to millennial investors using Robinhood, the commission-free trading app that is very popular over the pond, though has plans to launch in Britain.

Millennials were raised during the global financial crisis and now faces a similarly brutal recession now due to the WuFlu. But unlike other generations, the opportunity to purchase stocks at deep discount prices has not been afforded to them due to the swift actions of central banks to inflate asset prices following each crisis. Investors all over the world have been conditioned to “buy the dip” at every opportunity for the last decade – the opportunity granted in March appears to have been seized with both hands by the new generation.

We explored this a little yesterday with the $JETS airline ETF being bought in size by millennials after Warren Buffett sold his airlines, leading to large profits for those involved. There’s a similar story in play where Carl Icahn, the billionaire hedge funder who owned a large stake in Hertz ($HTZ), sold it all in May at a significant loss, only for the Robinhood crowd to buy it up and now sit on triple-digit gains. I found this remark from a trader on the transfer of wealth from the billionaires to the younger generation interesting:

Source: @mbrand85, Twitter

Source: @mbrand85, Twitter

While there’s a sense of balance in the idea that youngsters are beating old investors at their own game, buying shares in bankrupt companies is not going to solve the generational wealth gap. These blisteringly bullish returns – especially from functionally insolvent firms – can neither continue nor create lasting wealth for the folks buying them. Just since I began writing this note, Chesapeake ($CHK) has fallen over 60%. That’s the same company that rallied well over 100% on Tuesday by the way.

This feels like a righteous sugar rush, and it’ll wear off – the question is how soon. The good news is, a publication of ours here at Southbank Investment Research has been rinsing this rally for everything that it’s worth: absorbing the vast flow of speculative capital that has been unleashed into the market following the corona crash, and locking in the gains. More on that tomorrow…

“That’s all folks!”

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Market updates