Too much oil is one thing… but no beer production is something else entirely.

Some of the largest breweries in the world are facing a shortage of one crucial element required to brew their nectar. If left unchecked, a beer drought beckons…

Both negative oil prices and a beer-free future are the product of the WuFlu lockdown, but they’re even more closely related than that – it comes back to energy.

We’ve written a lot in the last few days about the strange situation that is transpiring in the oil market, where we’ve seen negative prices arrive for West Texas Intermediate. But we haven’t paid so much attention to petrol, crude oil’s refined and presentable offspring.

The production of petrol also drives the production of ethanol, a form of alcohol derived from corn or sugar. The ethanol is then blended with the petrol to create a cleaner form of fuel.

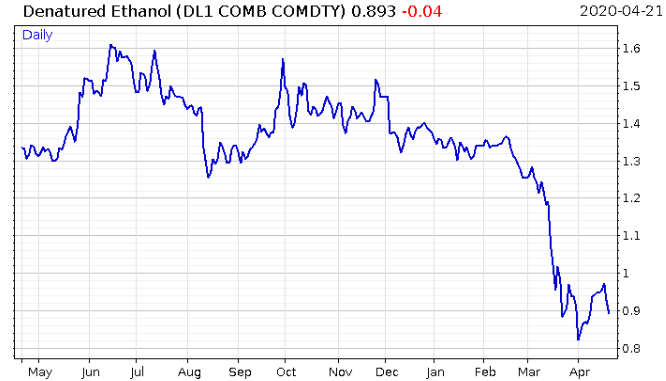

With nobody driving around right now, the wholesale price of petrol has got whacked, though we’re (somewhat sadly) not anywhere near a scenario where we’ll get paid to fill up jerry cans at the pump. This lack of demand for fuel has accordingly led to the price of ethanol getting whacked too.

The problem is, the production of ethanol creates a very important byproduct for the beer industry – carbon dioxide. The ethanol industry is relied upon by some of the largest brewers in the world to sell them their CO2 which they use to make their beer fizz.

As the primary market for ethanol (car fuel) has got whacked, the ethanol producers have cut back their production steeply – at a time when their other customers, the brewers, are facing an increase in demand. This continues, and the brewers will only be able to make flat booze…

Luckily, so far, this would appear to be a problem limited to the Americans. From Reuters:

… ethanol, which is blended into the nation’s gasoline supply, has seen production fall sharply due to the drop in gasoline demand as a result of the COVID-19 pandemic. Gasoline demand is down by more than 30% in the United States.

The lack of ethanol output is disrupting this highly specialized corner of the food industry, as 34 of the 45 U.S. ethanol plants that sell CO2 have idled or cut production, said Renewable Fuels Association Chief Executive Geoff Cooper.

CO2 suppliers to beer brewers have increased prices by about 25% due to reduced supply, said Bob Pease, chief executive officer of the Brewers Association. The trade group represents small and independent U.S. craft brewers, who get about 45% of their CO2 from ethanol producers.

“The problem is accelerating. Every day we’re hearing from more of our members about this,” said Pease, who expects some brewers to start cutting production in two to three weeks…

With all the climate change activism we’ve seen recently, it’s somewhat ironic that demand for carbon dioxide is on the up. Indeed, investors that pride themselves on their environmental, social and governance (ESG) credentials are dying to see pollution out of China that precipitates a return to “normal”.

But this link between ethanol and petrol is an interesting one – I certainly wasn’t aware of the beer industry’s dependence upon it. Goes to show just how pervasive the energy market is, and how entwined all the things in our lives are around fuel.

Will the demand for booze end up resuscitating the ethanol price despite the lack of demand for its use in fuel? Or, shall the breweries pass the higher cost of CO2 on to consumers through higher beer prices? That feels like a risky bet right now…

It should be noted that it’s only breweries who rely on externally sourcing CO2 that have this problem of course. As a brewing friend informs me, adding priming sugar to the brew pre-bottling and adding yeast in the bottle itself will ensure the beer is carbonated (he said the yeast should amp up the strength somewhat, but I’ve never found that to be a problem).

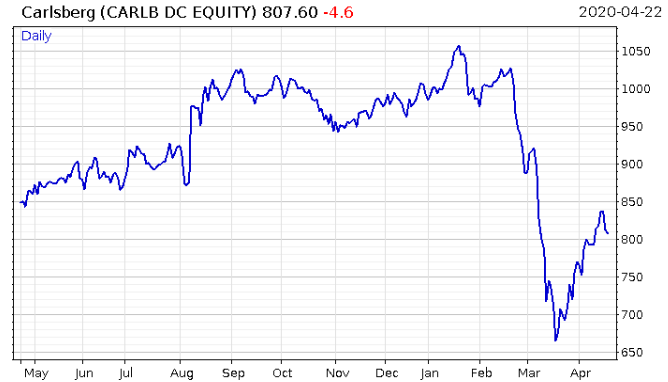

Good news if you’re a Carlsberg ($CARLB) fan: it’s assured everybody that it’s carbon independent, requiring no such external supply of the gas. It’ll be interesting to see how this stock performs in the coming months – will businesses who’re making money hand over fist in this environment see their shares perform well when the broader market is getting its ass handed to it?

The share has bounced from the March lows, but ticked down again in recent days:

However, this isn’t the only issue facing the beer industry now – moving to Germany, where Oktoberfest has just been cancelled, another crucial beer ingredient is facing a shortage: hops. This problem is of a different variety however – the hops are all there, but with the WuFlu about, there’s not nearly enough folks to harvest them.

From Raw Story:

Adolf Schapfl, 58, owns a farm of about 80 hectares in Hallertau, the small Bavarian region where 90 percent of Germany’s hops are grown…

Mid-April is usually the time when the plants would be tied to splints, he explained, so they grow to several metres tall by August harvest time.

“This year, I don’t have the manpower for it,” he said.

More than a thousand hop growers in Hallertau are still waiting for seasonal workers to arrive from Poland and Romania.

With European borders closed to limit the spread of the coronavirus, many of the workers are stuck at home.

Schapfl, who is also president of the Association of German Hop Growers, would normally have around 20 Polish workers on his farm at this time of year. Right now, there are four.

The region as a whole needs about 10,000.

“I don’t want to be dramatic, but without a harvest, the risk for us is bankruptcy, and for Germany, a beer shortage next year,” Schapfl said.

A beer shortage feels like the very last thing the world needs right now – it’s certainly the last thing I do. Having had a fresh batch in on Friday, I’m already needing to replenish The Strategic Alcohol Reserve…

I hope you’re fully stocked in these trying times. Several readers wrote in after I published an email from a reader who cited Woodforde’s Wherry as their tipple of choice. One in particular stood out:

Couldn’t help but respond to one of your subscriber letters regards Woodforde’s Wherry. An excellent beverage. As a Norfolk boy I would be remiss if I didn’t point you in the direction of some of the delights to be found in the south of the county though.

Grain Brewery 316 is a particular favourite of mine as well as Wolf Golden Jackal – my wife’s favourite.

Of particular interest to you may be Ampersand Brewery since I see you seem to favour the stronger ales. Set up recently by close friends of mine, they are producing outstanding ales across the board and are doing mail order. I only live 6 miles away and get free delivery. BAB is awesome and if you like a challenge on the palette then I really like the raspberry parfait- just treat it more like an alcopop! Once this is all over I strongly recommend a trip to one of their ‘evenings at Camphill’ for the proper Norfolk experience! Maybe catch you there one day.

I hope this little drop of Norfolk sunshine helps oil the wheels of industry for you. Keep up the good work.

Funnily enough, I’ve actually had several beers from Ampersand before, and all very pleasant indeed. Grain Brewery is a new one on me however, as is Wolf – I shall need to give them a look…

I’m a slave to novelty, and – for my sins – drink hundreds of different beers a year. I’m constantly trying to find the best beer out there, but then once I think I’ve found it… I’m trying to find the next one.

Reader recommendations are always welcome – perhaps I shall compile the Capital & Conflict beer list… [email protected].

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Market updates