I only found out how the scoring worked in cricket about a month ago.

Cricket isn’t taught much in Scotland for reasons which may have something to do with the weather. I think the only time I was ever taught anything about it in school was in a gym class when I was nine, and that was purely because a South African teacher was visiting.

Suffice to say, rugby was more my thing, and the Ashes and Cricket World Cup routinely passed me by. But Kit Winder, research analyst and resident cricket nut (one of several in this office), thought it was time to give me a crash course over beers after work one Friday.

Now I’ve finally been introduced to “the game of empire”. And what a great game it is, with all the nuances and tactics you could ever hope for as an observer. Not to mention terms like “Yorker”, “full toss”, and the suggestively visceral “bodyline” (a ruthless cricketing strategy invented by a Scotsman, funnily enough).

You’re probably wondering (quite rightly) where today’s letter is going. Kit made a parallel between cricket and investing in this letter a while back when I was away (Two types of cuts – 19 July). But in light of recent events, I’d like to make a more overt comparison.

The dollar’s dismissal

Jerome Powell of the Federal Reserve (left) and Mark Carney of the Bank of England (right) at Jackson Hole

Jerome Powell of the Federal Reserve (left) and Mark Carney of the Bank of England (right) at Jackson Hole

Though the pound fell from grace as the world’s reserve currency many decades ago, the City of London remains the world’s favourite financial cricket ground, where every major bank on the planet goes to play. And while those banks can play a lot dirtier in the City than in their home countries, with far fewer rules and regulations… they still fall under the Bank of England’s domain.

In this way, Mark Carney, governor of the Bank of England, is in some respects an umpire of the entire global financial system.

When a cricket umpire raises his index finger to a batsman, it’s time for him to leave the field. The opposing team may have outfoxed him, or maybe he made an error. Whatever the case, it’s time for him to withdraw: he has been dismissed.

Last week at Jackson Hole, Mark Carney called upon the world to dismiss the US dollar. A bold move, almost perfectly reflected in the image above, taken there as he addressed Jerome Powell, the man batting for the US and the USD at the Federal Reserve.

“In the new world order, a reliance on keeping one’s house in order is no longer sufficient. The neighbourhood too must change,” Carney declared in his speech. Umpire indeed.

Creating a “Synthetic Hegemonic Currency”

Carney’s speech, imaginatively titled “The Growing Challenges for Monetary Policy in the current International Monetary and Financial System”, calls upon the financial policymakers elite to not only drastically reduce their use of the dollar, but to replace it with a global digital currency, which he likens to Facebook’s new Libra project.

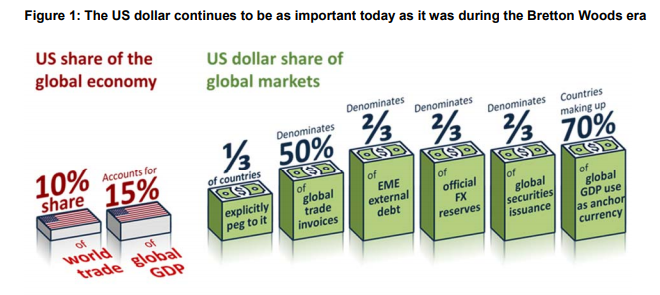

His case against the US dollar is relatively simple, in that the US’s currency is much larger than the US’s economy, and as a result, problems in the US which should be small on a global scale, end up having massive global impact, especially in emerging markets, where it is much easier to borrow in dollars.

John Connally, US Treasury secretary during the Nixon era (trivia: he was also in the car with JFK when he was assassinated), famously declared that the USD was “our currency, but your problem” to his foreign counterparts at a G10 meeting after the US went off the gold standard.

To Carney’s eyes, the growth in dollar usage around the world has now broadened this dynamic to the point that Connally today would say “any of our problems is your problem”. The negative impact on foreign economies when the US has raised interest rates is now twice what it was during the 1990-2004 era, despite the US’s share of the global economy shrinking heavily since then.

From his speech, emphasis mine:

The US dollar’s widespread use in trade invoicing and its increasing prominence in global banking and finance are mutually reinforcing. With large volumes of trade being invoiced and paid for in dollars, it makes sense to hold dollar-denominated assets. Increased demand for dollar assets lowers their return, creating an incentive for firms to borrow in dollars. The liquidity and safety properties encourage this further.

In turn, companies with dollar-denominated liabilities have an incentive to invoice in dollars, to reduce the currency mismatch between their revenues and liabilities. More dollar issuance by non-financial companies and more dollar funding for local banks makes it wise for central banks to accumulate some dollar reserves. Given the widespread dominance of the dollar in cross border claims, it is not surprising that developments in the US economy, by affecting the dollar exchange rate, can have large spillover effects to the rest of the world via asset markets.

As Hélène Rey has put it, and as Arvind Krisnamurthy and Hanno Lustig echo in their paper for this symposium, the global financial cycle is a dollar cycle. In part, that arises because movements in the US dollar significantly affect the real burden of debt for those companies (especially in Emerging Market Economies) that have borrowed unhedged in dollars, and tend to reduce the dollar value of companies’ collateral. Both result in tighter credit conditions and, in the extreme, defaults.

Emerging markets borrowing and saving in dollars has led to dollar interest rates being low in general. But if the global reserve currency pays low interest rates, the world is effectively placed in a low interest rate regime. And low interest rates, says the umpire, who’s inflicted plenty of them himself in the UK, are actually not a very good thing. Who knew?

The International Monetary and Financial System is not only making it harder to achieve price and financial stability but it is also encouraging protectionist and populist policies which are exacerbating the situation. This combination reduces the rate of global potential growth, increases its downside skew, and bolsters the likelihood of an extreme downside event (a fatter left tail). As my colleague on the MPC Jan Vlieghe has illustrated, such a change in the distribution of economic outcomes reduces the global equilibrium rate of interest.

Past instances of very low rates have tended to coincide with high risk events such as wars, financial crises, and breaks in the monetary regime. Whether the last happens is still within our control, but for now the lower global equilibrium interest rate is reducing monetary policy makers’ scope to cut policy rates in response to adverse shocks to demand, and increasing the risk of a global liquidity trap. And left unattended, these vulnerabilities are only likely to intensify.

Noting that “history teaches that the transition to a new global reserve currency may not proceed smoothly”, Carney proposes that after the dollar has left the wicket, that a digital “Synthetic Hegemonic Currency” should step up to the crease. And though the umpire has made it very clear in the past that Facebook’s Libra ain’t welcome on the grounds, that doesn’t mean it shouldn’t be ripped off in pursuit of this goal:

Technology has the potential to disrupt the network externalities that prevent the incumbent global reserve currency from being displaced. Retail transactions are taking place increasingly online rather than on the high street, and through electronic payments over cash. And the relatively high costs of domestic and cross border electronic payments are encouraging innovation, with new entrants applying new technologies to offer lower cost, more convenient retail payment services.

The most high profile of these has been Libra – a new payments infrastructure based on an international stablecoin fully backed by reserve assets in a basket of currencies including the US dollar, the euro, and sterling. It could be exchanged between users on messaging platforms and with participating retailers.

There are a host of fundamental issues that Libra must address, ranging from privacy to [Anti Money Laundering/Countering Financing of Terrorism] and operational resilience. In addition, depending on its design, it could have substantial implications for both monetary and financial stability. The Bank of England and other regulators have been clear that unlike in social media, for which standards and regulations are only now being developed after the technologies have been adopted by billions of users, the terms of engagement for any new systemic private payments system must be in force well in advance of any launch.

As a consequence, it is an open question whether such a new Synthetic Hegemonic Currency (SHC) would be best provided by the public sector, perhaps through a network of central bank digital currencies…

An SHC could dampen the domineering influence of the US dollar on global trade. If the share of trade invoiced in SHC were to rise, shocks in the US would have less potent spillovers through exchange rates, and trade would become less synchronised across countries.

By the same token, global trade would become more sensitive to changes in conditions in the countries of the other currencies in the basket backing the SHC. The dollar’s influence on global financial conditions could similarly decline if a financial architecture developed around the new SHC and it displaced the dollar’s dominance in credit markets.

It’ll be interesting to see if this particular batsman respects the umpire’s wishes. After all, from the US government’s perspective, the world’s dependence on the dollar is not a bug in the monetary system, but a feature. However, there was something else in his speech that caught my eye:

… ultimately a multi-polar global economy requires a new IMFS to realise its full potential.

That won’t be easy.

Transitions between global reserve currencies are rare events given the strong complementarities between the international functions of money, which serve to reinforce the position of the dominant currency. And the most likely candidate for true reserve currency status, the Renminbi (RMB), has a long way to go before it is ready to assume the mantle.

The initial building blocks are there. Already, China is the world’s leading trading nation, overtaking the US at the start of this decade. And the Renminbi is now more common than sterling in oil future benchmarks, despite having no share in the market prior to 2018. The greater use of the Renminbi in international trade is also leading to its growing use in international finance. This has been enabled by reforms to China’s monetary, foreign exchange, and financial systems that have liberalised and improved its financial market infrastructure, making the Renminbi a more reliable store of value.

Oil future benchmarks in renminbi. Laughed at to begin with, now growing hugely. Now who was it that was telling me about the massive significance of those earlier this year..? The one who said a new multi-polar global economy, just as Carney describes, is heading our way, whether Carney likes it or not? And that it all has something to do with a heavy yellow metal? Oh yes – Luke Gromen.

While the rest of the financial commentariat has been taken aback by Carney’s dismissal of the dollar, Luke hasn’t been surprised at all. In fact, as it turns out, he’s been expecting it.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates