What will a cocktail of market forces and climate change taste like, when they’re shaken together by a politico with a righteous twist of regulation?

While this drink has yet to reach the global market, it is possible to get a sip of it – or at least something close to it – if you know where to go.

But I warn you, it’s hellishly expensive. And as you’ll discover, the flavour leaves a lot to be desired: it tastes like balsa wood, and it smells like burnt gold.

Last week, we explored the commodities space, an asset class anchored in the real world but shunned by investors in favour of companies that don’t make money but can tell a good story.

While “softs” – perishable commodities – have been left in the dirt, there’s been a noticeable trend upward in the “hards” – in the metals especially.

And in some parts of the metals space, the market is going absolutely bonkers. Prices are rising so fast, that people are selling below the market without realising it…

Ballerina brokers behind schedule

Back in the late 1980s the Soviet Union, in the twilight of its existence, was running broke. One way to alleviate its problems was to trade 17 submarines, plus a cruiser, a frigate, and a destroyer in exchange for $3 billion worth of Pepsi. (Pepsi supposedly became the world’s 6th largest military power briefly before it scrapped the fleet.)

Another way of easing its financial woes was to get into the bullion business, and start selling Russia’s rich sources of precious metals to investors. Most notable of this effort were the production of palladium coins known as “Ballerinas”.

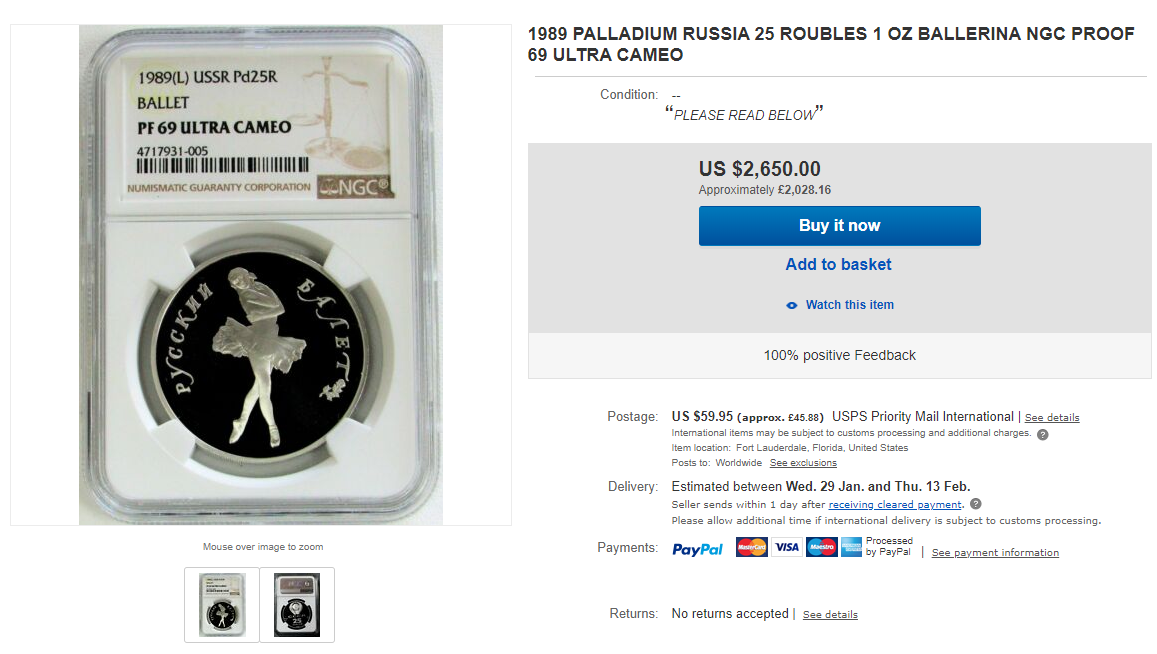

Containing one troy ounce of palladium, these celebrated the Bolshoi Ballet with an image of ballerina as Odette in Swan Lake on the front. Beginning in 1989, the ballerinas were in production for seven years, and despite the collapse of the Soviet Union during this period, they all have the USSR emblem on the back.

Their origin and relative rarity mean they generally command a large premium, selling significantly above the palladium price.

But such is the rapid increase in palladium prices (at the time of writing, around £1,900/$2,500), that vendors without their eye on the ball have Ballerinas still up for sale with only a 6% premium.

Even more telling, I found one chap selling another palladium coin (a Canadian Maple, not a Ballerina) at less than market prices.

This is an arbitrage opportunity waiting to happen – provided the coin isn’t a fake (something you really need to watch out for on eBay).

But what’s causing it? If I’m right, I think this is a taste of the climate change cocktail I alluded to earlier: governments creating regulation in the name of saving the planet, which then creates demand shocks and squeezes. What’s happened to palladium is a flavour of what is to come once the climate change agenda really catches up.

Palladium demand has effectively been ordered to go up by governments around the world who have decreed there must be less automobile emissions, one way or another. Palladium, the vital ingredient in catalytic converters in petrol cars, has been bid up massively, thanks to a series and worldwide increase in environmental regulation.

Here are just a few drivers that have slowly pushed it upward until it’s bolted upwards like a cork out a champagne bottle.

In September 2018, the EU banned the sale of new vehicles that were not compliant with the Worldwide Harmonised Light Vehicles Test Procedure (WLPT), and emitted more CO2 than on average than a target they came up with. In October of that year, Berlin was ordered to ban EU-5 and older (cheaper) diesel fuels. In London last year, there was the implementation of the Ultra Low Emission Zone (ULEZ) which punishes users of EU-6 and older diesels.

These either pushed diesel users to consider opting for a petrol car, or increased the amount of palladium required within the converters. And that’s just Europe. The US has been tightening its emissions standards too, while India is implementing the Bharat Stage 6 and China the China 6 pieces of legislation, which mandate significantly higher quantities of precious metals within catalytic converters. In China’s case, this means 30% more palladium is required to make a converter.

Platinum has begun to break higher in price too in recent days, though it’s got a long way to go before catching up with its siblings. Between 2003 and 2008, platinum was roughly 40% more expensive than gold, and it got to the point where car manufacturers were designing catalytic converters that would use gold instead. This would be one of the rare uses of gold that would actually consume the metal, effectively destroying it and decreasing the quantity of “above ground gold” in existence.

I think what’s happening with palladium in miniature is something we’ll see a lot more of as more environmental/anti-climate change is rolled out. I wrote a little about this last year, with the International Maritime Organisation 2020 rules coming into force which ban the use of bunker fuel in powering oil tankers and transport vessels. I argued that this effectively puts a floor on the price of global maritime trade unless fuel efficiency is greatly increased.

Whatever plans are rolled out to constrain emissions, the consequences will never be fully known ahead of time. This is a risk, but it is also an opportunity for those with an eye on the fringes – like those who saw wind turbines creating a supply squeeze in balsa wood…

From the Financial Times:

2019 was a dismal year for model aeroplane enthusiasts, who bore the brunt of fierce competition to secure their favoured lightweight material — balsa wood — from the grips of green energy. But it was stellar for balsa bulls.

The wood is used as a core material in wind turbine blades, and the rapid rollout of clean power this year left turbine makers scrambling to secure it. The price for block-like planks of balsa has doubled to about $800 per cubic metre, and the shortage is now so severe that it could delay the deployment of new wind turbines.

“Balsa supply can’t follow the increase in demand,” said Rudolf Hadorn, chief executive of Gurit, a supplier of wind turbine blades.

The rally looks unstoppable. Wind turbine manufacturers are gearing up for a surge in new wind power capacity installations. [In 2020], 75 gigawatts of wind power capacity will be added globally, up 12 per cent from 2019.

As demand rises, Chinese intermediaries are going directly to producers with higher offers for the wood. Ecuadorean producers and traders say prices are going up weekly and likely to keep rising.

Plastic materials threaten to displace balsa but the wood remains the best performing material for structural sections of turbine blades. Supply will eventually catch up to demand but balsa trees take at least four years to grow until harvesting.

While at the centre things may seem quite still, at the fringes things are getting pretty wild. And what happens at the fringes, is a signal of what to expect of the centre in the future…

The World Economic Forum, the annual gathering of various elites in business, academia, finance, politics and media, often referred to as “Davos”, where it is held, begins tomorrow.

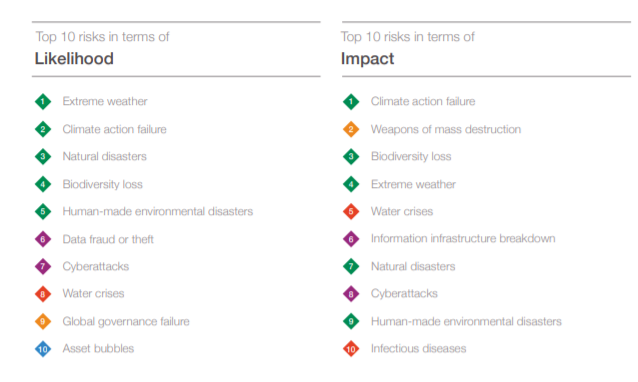

One look at its summary of risks for the world will give you a pretty clear idea of what’s on the agenda. Greta Thunberg, who will be attending, is gonna have a field day:

While the cocktail I alluded to at the beginning of today’s letter has yet to hit the global market in size, it’s coming soon to a bar market near you – and everybody’s gonna have to drink it.

More to come…

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates