A reader responds to our letter on Friday…

Highly prophetic that you should write “guard your car” – someone has just had the catalytic converter off my mother’s car as it sat outside her house in West London.

You guys get it right way too often!

If precious metals keep going up at this rate, the streets will empty of SUVs, and we’ll all be going around in motorbikes with sidecars.

The treasure inside catalytic converters may just become too expensive. Motorbikes aren’t emissions tested in their MOTs, so many folks get away without having one, despite it being against the law.

I’m probably taking a little too much artistic licence with that prediction – but when platinum group metals are behaving like cryptocurrencies, you can forgive a man for dreaming.

The cost of borrowing palladium is into credit card territory. The one-month lease rate for the metal from a bullion bank, a service used by speculators and other market participants bullion bank in London, hit 36.65% yesterday.

To illustrate just how fast the supply of this metal is drying up, how tight the market is becoming, that one-month lease rate was 27.67% on Friday. And it was 21.67% the day before that. There’s a serious shortage of this stuff, brought about by car manufacturers stuffing more of it into that bulbous thing attached to your exhaust. They’ve no choice to buy it, no matter the cost – emissions standards are emissions standards, and you don’t want to end up looking like Volkswagen.

Palladium has slowly been drained from investors for several years now, but it’s only been in the past few months that the shortage has really started to bite.

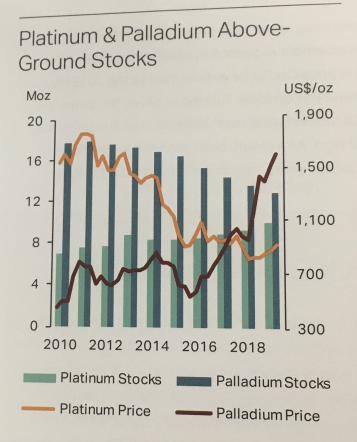

Palladium is something of an “honest” market – it’s relatively small and doesn’t have a gigantic paper derivative market that influences it like other commodities. As a result, it’s very susceptible to simple changes in supply and demand. Look how the brown line (palladium price) moves conversely to the dark blue bars (palladium stocks):

Also note how platinum has behaved oppositely

Also note how platinum has behaved oppositely

Source: Metals Focus

Palladium supply has been lower than demand for some time now, and the deficit has been covered by melting down investors’ bullion to put into cars.

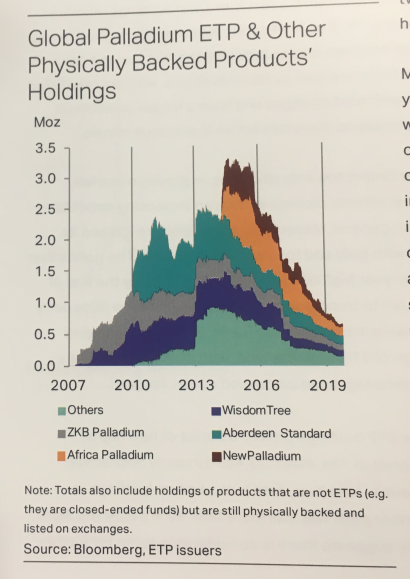

Holdings of palladium by exchange-traded funds (bought and held by investors wanting exposure to the palladium price) peaked in 2014. Since then, palladium has been steadily drained by traders pulling the palladium out and selling it to the car manufacturers:

Of course, the high prices of palladium create an incentive for car manufacturers to use a different metal. However, creating and implementing new catalytric converters is not easily done – the industry standard would be 12-18 months, while I’ve read reports from General Motors that gives such a process a three to four years. Hell, the reason palladium is so involved in converters now is because when the current designs were developed, palladium significantly cheaper than platinum (the total opposite of the current market situation).

So far as I can see, relief will not be coming to the London bullion borrowers anytime soon, and the blood-rush higher will continue. If you own a car, the aforementioned reader has some valuable advice for you:

The local garage gave my mum a good bit of advice – on her car the Cat is on the driver’s side, so they recommend parking driver’s side against the kerb. If you’ve ever been in the habit of repairing your own car, it’s impossible to get underneath it on the side parked by a kerb. You can also get a Cat guard fitted which will deter thieves – they’re in and out so quickly they don’t want to wrestle with obstacles.

If platinum group metals soar high enough, we may see road and motorway sweeping take up as a pastime. Metal dust from catalytic converters in cars escapes from the exhaust all the time, leaving granules of platinum, palladium, and rhodium finely sprinkled across roads all over the country.

By some estimates, the quantity of precious metal in road dust is in the same concentrations as ore from precious metal mines, making recycling a profitable endeavour. A bit like the metropolitan equivalent of being a detectorist.

It’s strange to think that the roads are “paved” with rare metals, but it’s true – if you’re curious as to what mining a road for platinum looks like, this chap shows you the full process.

It’s also strange to think that oil just hit $100 a barrel. Well, kind of.

It’s another case of emissions standards causing sudden increases in prices. We argued that the IMO 2020 regulations, which demanded cleaner fuel of maritime vessels, would markedly increase fuel costs for global shipping, and thus increase the costs of global trade. We alluded to this yesterday, and low and behold, the effects are beginning to cut though admittedly only in niche fuels at the moment. From the Financial Times:

The era of $100-a-barrel crude oil might feel like a very long time ago for an energy industry that has weathered five years of lower prices. But changes to shipping fuel rules mean that a few select grades of crude have risen back towards that level, even as the majority of barrels still change hands far closer to $65.

Pyrenees, an Australian crude produced by BHP Group, last week shocked traders by selling for almost $95 a barrel, with refiners coveting its rare profile of being a heavy thick oil that is also low in sulphur. Refiners are willing to pay massive premiums to secure the rare grade — production is only about 15,000 barrels a day — as its low sulphur content and heavy weight make it ideal for blending into shipping fuel, which from January 1 has been restricted globally to much lower sulphur content.

I remember the market historian Russell Napier once saying that while central banks struggle by themselves to create inflation for the everyman (and not just financial asset prices), there is no such difficulty for governments, as they can arbitrarily raise the prices of things by fiat.

With enough environmental regulation increasing the prices of basic inputs to the economy, inflation seems inevitable. These moves in niche oil and metals markets are at the fringe for the moment – but I think they’re forward indicators for what the developed world and the everyman will encounter when the next big wave of green regulation takes off.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

PS On a separate note, keep an eye on the news out of China about the coronavirus. The SARS outbreak and subsequent fear of economic damage caused a stockmarket sell-off back in 2002. Sadly, there are plenty of rumours that the Chinese Communist Party is covering up the number of folks affected, just as they did back then. Hopefully we will not see a repeat of such a tragedy, but you should keep it on your radar just in case.

Category: Market updates