Did you know that over the last two months your net worth has probably fallen by about 6%?

That’s assuming your money and assets are based in the UK.

From a mid-July high just high of $1.72, sterling slipped below $1.61 yesterday morning.

So even if your sterling-denominated assets – your house, your savings, your stocks – haven’t changed in price, they’ve changed in value.

In today’s Money Morning we look at the amazing fall in the pound against the dollar, we study the charts and, with the Scottish referendum approaching, we ask, ‘What’s next?’

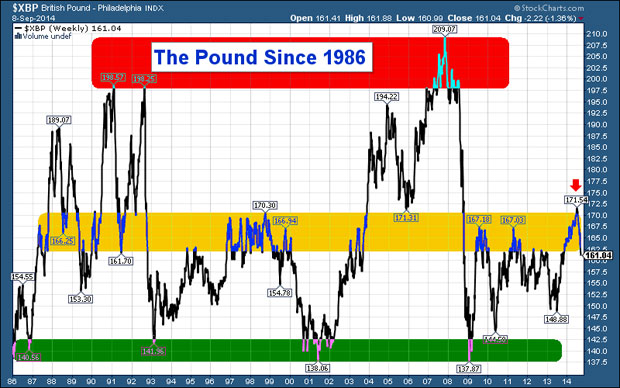

I like to start any piece on the dollar versus the pound, or ‘cable’ (thus called because of transatlantic cable by which the dollar/pound exchange rate used to be transmitted) with this long-term chart, which goes back to 1986.

You can see the green area around $1.40, which has consistently been support – the long-term buy zone. There’s the red area around $2 which has been resistance – the sell zone. ‘Nobody got poor selling the pound at two dollars’ runs the old saying.

And there’s that central amber zone between $1.60 and $1.70 – resistance during times of pound weakness (the 1990s, for example) and support during times of pounds strength (the late 1980s and early 2000s).

It’s actually a pretty rhythmical chart, at least in the long-term. And, for all the noise about the pound’s recent falls – and for all the intensity of the forex markets – at $1.61 we’re kind of in the middle of the range.

The rapid reversal that shows why you should always have a plan B

‘From false moves come fast moves’ runs the saying and the pound has given us a great example of this in recent months.

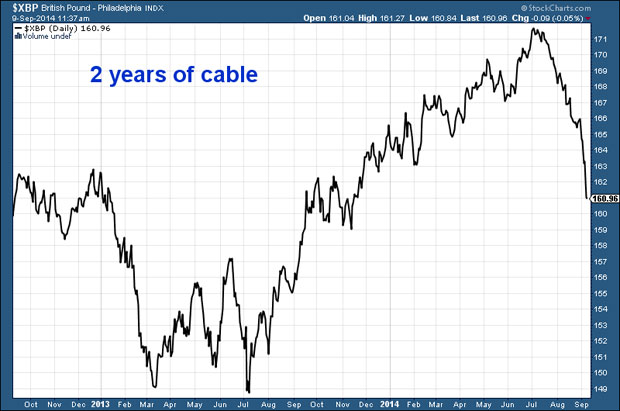

Sterling moved above $1.70 a couple of months ago. I got very excited because it was breaking out of that amber zone. Here’s the chart I posted.

I recommended buying the break-out with a stop ‘just below the blue line’, perhaps at $1.67. I thought it could go as high as $2 – though it might take a year to get there.

Here is a perfect example of why it is so important to manage risk, why I am forever harping on about it. I couldn’t have been more wrong with the call. Sterling reversed dramatically, just as the dollar gained strength. That stop prevented a small loss becoming a nasty one.

Technical analysts would call that move above $1.70 a ‘false break-out’ – and, following that false move, we got the fast move to where we are today at $1.61. Over a year’s worth of gains given back in two short months.

So what now?

So many questions, so few answers

It should be stressed that until last weekend, the pound’s falls were as much about US dollar strength as anything. Compared to the euro (and of course the euro has its own problems), the pound, at €1.25 is trading higher than it was three months ago. In fact, last week, the pound actually reached a two-year high against the euro.

It’s only with the shock poll last weekend suggesting Scottish nationalists had a slight majority that the pound really got ‘all shook up’.

Currency markets, as a rule, prefer political stability to political uncertainty. Suddenly, we all seem to be waking up to the fact that, whichever way this vote goes, there is going to be upheaval. There are so many unanswered questions.

Who’s going to win? What happens if the nationalists win? Will the Scots carry on with the pound? Will they have any influence on monetary policy? Will Scotland default on its debt? What effect will all this have on interest rates? Will there be a run on Scottish banks? What kind of taxes and capital controls are likely to follow?

And what happens if there is a ‘no’ vote? How much power is going to be ceded to the Scots? What will the fallout be – both up north and down south? The Conservatives and Labour are going to come out of this with their reputations badly muddied, what will the political consequences be? Plus there’s the Carswell defection and the unsettling of the Tory right – where’s that going to end?

And, as seems increasingly likely, what happens if it’s 50:50?

These are the kind of questions we are all wondering about. Nobody knows the answers because nobody knows quite what is going to happen. The uncertainty is creating huge amounts of volatility.

Some professional Forex traders are going to make fortunes out of this. Others will get battered.

The manic swings we can expect until 18 September

But I expect the volatility is going to swing with the polls right up to the referendum vote. We will probably get some kind of bounce in the next few days as Clegg, Cameron and Miliband go campaigning. This will be followed by further falls as it emerges their campaign didn’t have that much effect and Salmond retaliates.

I don’t see the volatility ending until the referendum is over, the results accepted and plans settled. And if I were to speculate, I’d bet on a very narrow ‘no’ vote.

Polls are not always accurate, the ‘nos’ tend to be less vocal and all the excitement over the weekend had the feeling of a stock peaking. It’s the time when you might be considering selling out and looking to go short.

This superficial call is based on nothing but instinct, however.

Numbers-wise, it really wouldn’t surprise me to see $1.53 before all this is over, though $1.57 will probably be the low. A possible target for the bounce might be $1.63 – if the polls are really favourable to the union, $1.65. These numbers are based on simple lines of support and resistance.

Here, for your information, is a chart of cable over the last two years. Note the perfect W bottom (or double bottom) at $1.49 that it made last year and the huge rally out of it to $1.71, before the capitulation of the last few days.

But who knows, if things get really chaotic, we might find ourselves back in the green zone of my first chart at $1.40.

If we get there, there’ll be a great deal of noise – you can bet your bottom dollar – political turmoil, imminent defaults and rising rates even. It’ll be Rothschild’s ‘blood on the streets’ time. But we’ll be back in the green zone – so you’ll know what to do, won’t you?

Category: Market updates