There’s always some shoot-out or other going on in that wild west of finance otherwise known as the crypto market.

Yesterday, protestors swarmed the headquarters of TRON, a major crypto project in Beijing, and police were called in to intervene. Turned out the protestors had been defrauded by imposters pretending to represent the project, a group known as the ‘Wave Field Super Community’.

Rumours that the real TRON project was itself a fraud caused the TRON token ($TRX) to plummet, and they have yet to recover fully. And just this morning, a crypto exchange in Poland abruptly ceased trading leaving users with nothing but a blunt message on a white background:

“We regret to inform you that due to the loss of liquidity, [from] 08/07/2019, Bitmarket.pl/net was forced to cease its operations. We will inform you about further steps.”

All the gunfire contrasts sharply with the sunshine. The last few days have been reminiscent of the great crypto bull run of 2017, with altcoins posting massive gains as Bitcoin slows its ascent. To hear our crypto expert Sam Volkering say it, 2019 is becoming ‘wild and wonderful’…

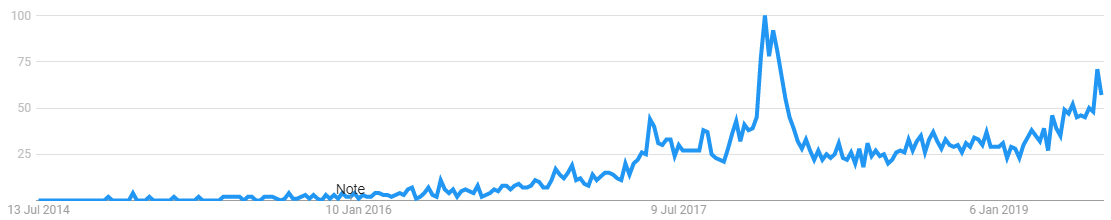

The crypto market has been reclaiming some of its 2017 glory – June 2019 saw Google searches for the word ‘Bitcoin’ hit the same level they did in October 2017, which was when things got really manic.

Interestingly, Google searches for ‘Bitcoin ATM near me’ are much more advanced, at levels not seen since November 2017, when crypto had gone parabolic:

This is likely a result of crypto exchanges adopting Anti-Money Laundering (AML) rules in order to ‘go legitimate’ and avoid prosecution by regulators. Such rules make purchasing crypto a time consuming process for new investors, who must submit proof of identity and address.

Bitcoin ATMs however, are not nearly so demanding of personal information; it looks like new investors are using them to acquire crypto more quickly. Or of course, there’s been a boom in people using them to launder money.

BTC has lost the $13,500 territory, but it’s having a fine week:

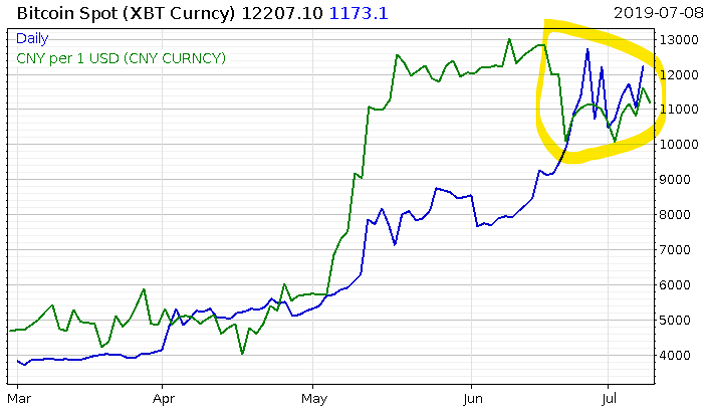

As you’ll likely know by now, my explanation for Bitcoin’s rise this year is that wealthy Chinese citizens have been using it smuggle their capital out of the country. The trade tensions between the US and China (a symptom of Cold War II) took their toll on the renminbi very strongly in May; this exacerbated fears that the Chinese Communist Party would devalue their currency to remain competitive despite US tariffs. The fall in purchasing power of the renminbi correlated strongly with a rise in BTC, and notably this relationship seems to work in reverse too.

Take a look at this chart, with Bitcoin in Blue and renminbi in green (note – a rising green line illustrates a fall in the value of the renminbi):

As you can see, the loss of purchasing power of the renminbi in May fuelled the boom in BTC. But in June, when hopes that the G20 meeting would put everything right between the two powers abounded, the renminbi strengthened (illustrated by the falling green line). The stronger renminbi allayed fears that a devaluation was coming, and the capital smuggling via BTC stopped – which is why BTC abruptly stopped rising right after.

That’s my theory anyhow. If I’m right, when everyone realises that the G20 didn’t prevent Cold War II, more Chinese capital will continue to flee the country. More sunny days for Bitcoin, to be sure. The gunfire, however, will no longer be restricted to the crypto market.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates