I read a lot of comic books when I was a kid. Many of them were published in the States, and so they contained ads targeted at young Americans.

I enjoyed seeing what the ads were like over the pond – they were so different in style from the kind of ads you see here in Blighty.

Most memorable of them all that I remember, were those promoting the Montana Meth Project: a campaign group which featured particularly memorable slogans warding the kids off using methamphetamine.

These included classics like “My friends and I share everything; now we share hepatitis and HIV”, and the strangely boastful “My sister always looked up to me. Even after I made her an addict”. In the corner of every two-page spread they bought would be the logo, which bluntly preached: “Meth: not even once”.

However, the most successful of its campaigns was its “[insert extremely antisocial display of behaviour] isn’t normal. But on meth, it is” series, which had a significant impact. I can still remember seeing one for the first time in an issue of X-Force all those years ago.

“15 bucks for sex isn’t normal.” it read, “But on meth it is.”

“Hot damn,” thought my young self. “Where can I get my hands on some meth…?” I jest. The accompanying image was as grim and befitting of a preventative advert as you can imagine; come to think of it, it might actually have been why my mum decided to confiscate those comics…

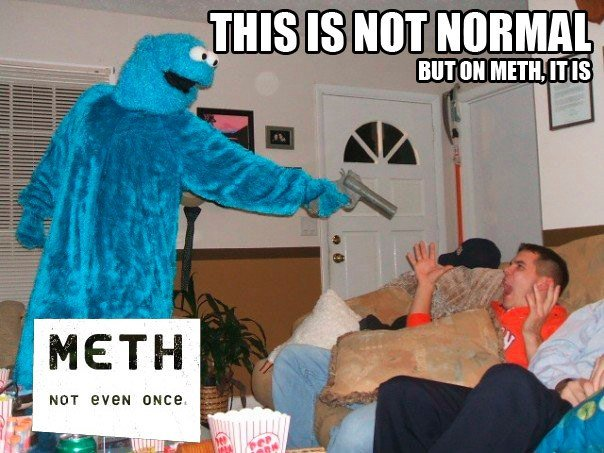

But I wasn’t the only person who found the slogans open to less serious adaptation. The blessing of such a commanding slogan was that it could be used for more… flippant purposes:

One of the tamer parodies of the ads

One of the tamer parodies of the ads

Writing an investment newsletter about anti-meth adverts isn’t normal. But on meth, it is. If you’re wondering where I’m going with today’s Capital & Conflict, don’t worry: I’m not on meth.

I was reminded of those those ads from my childhood by events unfolding well outside of the US – events I think may be a foreshadowing of what will occur all across the developed world in the future.

That, and the recently released anti-meth ads out of South Dakota, which require no parody:

Your tax dollars at work” as the the Americans would say

Your tax dollars at work” as the the Americans would say

Source: Twitter

“I’m on it” is supposed to be interpreted as “We recognise and are addressing the problem”, but the slogan, which the state of South Dakota paid nearly half a million bucks for, comes across as decidedly “Pro-Meth”.

Spending half a million bucks on an anti-meth ad that promotes meth isn’t normal. But in South Dakota it is, etc etc…

But back to the point.

Truffle trip

Having a $132,000 truffle airlifted to a war zone isn’t normal: but in Hong Kong, it is.

That truffle weighed over a kilo. I guess somebody in Hong Kong was just really hungry.

Manufacturing golden toilets in said war zone isn’t normal either. But in Hong Kong, it is.

I say “war zone”: no doubt the Hong Kong police will declare they have everything under control. But police vans shooting and speeding into crowds of protestors, while protestors show up with chainsaws and archery sets and light people on fire, all to a backdrop of universities burning, besieged… It sure don’t look like peace, love, and harmony over there. And that’s if you can believe any of the reporting on those events isn’t staged propaganda by one side or the other.

With this context, I found it fascinating to see a news item that somebody in Hong Kong had begun manufacturing gold toilets, which are bulletproof by merit of being studded with 40,000 diamonds (the going price is a million pounds each, in case you’re interested).

While Capital & Conflict readers will be familiar with my views on Cold War II, and the Chinese Communist Party’s expansion being an existential threat to the independence of Hong Kong, there’s an elephant in the room when it comes to the unrest over there: wealth inequality.

It’s common knowledge that Hong Kong has the most expensive place to buy property in the world, but the sheer scale of this isn’t so widely acknowledged.

If Bloomberg is to be believed, residential property in Hong Kong has quadrupled in price since 2016. Wage growth meanwhile, has not caught up: the ratio of house prices to disposable income is extremely high, far exceeding other major cities with roaring property markets like Sydney and London.

Hong Kong benefited from the US’s low interest rates as the Hong Kong dollar is pegged to the US dollar (Hong Kong effectively imports US monetary policy), while at the same absorbing much of Chinese government’s fiscal spending and the capital flight of China’s nouveau riche. Large swathes of land in Hong Kong are also owned by just a few players, and there are allegations that cartel behaviour is causing prices to tear ever higher.

We’ve written extensively in the past how low rates and quantitative easing (QE) has led to an ever-widening divide between the have-yachts and the have-nots. With more QE on the way, I think investing in companies that cater to the yachters is a way of letting the “little guy” actually get a cut of the money that will be doled out by the central banks, albeit third, fourth, or fifth hand.

But the societal unrest caused by this ultra-loose, ultra-dovish monetary policy must be acknowledged. I’m a firm believer that it was these policies which caused much of the so-called populism around the world, including here in Blighty. Populism isn’t normal, but on QE it is, you might say. The boys at the printing presses will not be stopping, and so I don’t see how “populism” will either

I think what’s going on in Hong Kong may be a forward indicator of what will happen in major cities throughout the developed world if the next economic downturn arrives, and central banks do not allow asset prices to go down.

Out of a job, unable to buy a home, and the rich getting only more obviously richer, the everyman may abandon hope that the system works for him at all, and turn to violence.

Societal unrest isn’t normal. Rioting isn’t normal.

But perhaps when we receive the next great injection of central bank “stimulus”– in the form of QE/negative interest rates/bailouts – we may well discover that actually… it is.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates