If you’ve been listening to our daily market broadcasts this week, you’ll have heard Charlie Morris’s unbridled optimism in the . To close us off for this week, he penned this note for me recently on what’s going on in behind the scenes in the collapsing oil market right now, and gives a compelling argument why, if like me, you love gold… you should also love oil.

Wishing you a good weekend,

Boaz Shoshan

Editor, Capital & Conflict

PS Today on our market broadcast, Eoin Treacy phones in from LA to give us a taste of how frantic things are getting over the pond.

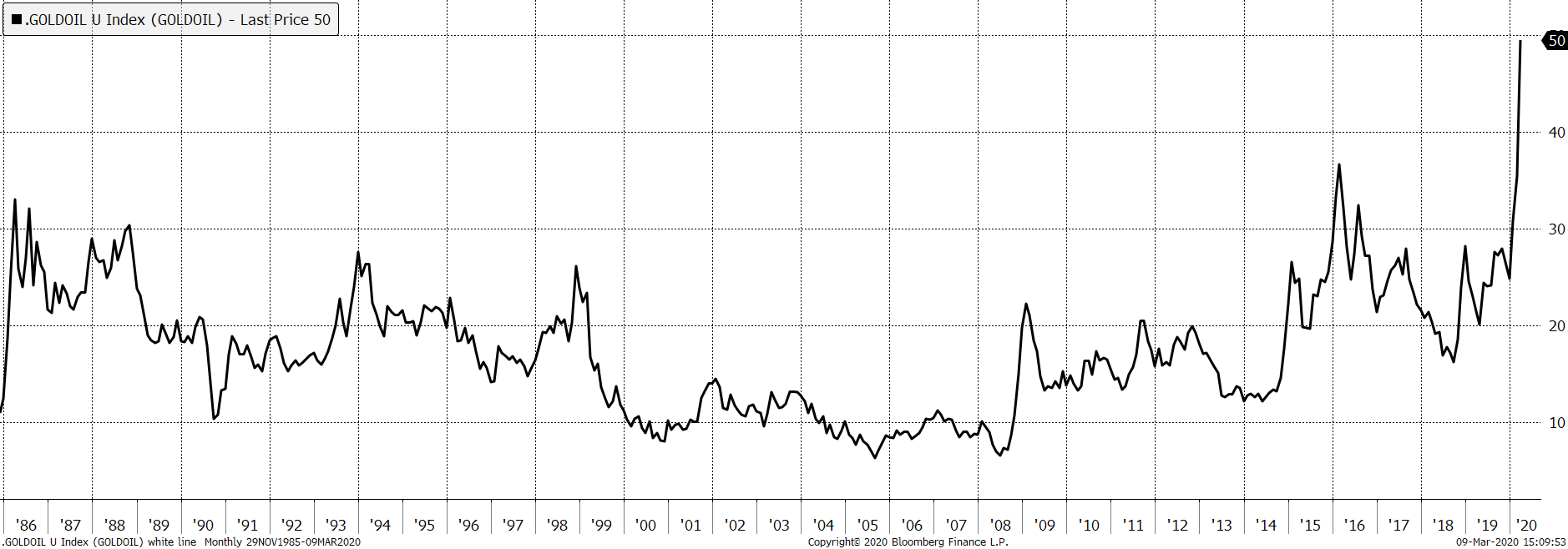

An ounce of gold now costs 50 barrels of oil. I am highlighting this because if you like gold, then at current prices, you should love oil.

Gold is now pricey oil

Source: Bloomberg – gold price divided by the WTI crude oil price since 1985

Source: Bloomberg – gold price divided by the WTI crude oil price since 1985

The low points on the chart show you when gold is cheap relative to oil, and the high points show you when oil is cheap relative to gold; as it is today. To the untrained eye, this chart might not look like much, but those wise enough to own gold when this line was rising, and oil when it was falling, are the sort of people that turn left when they get on a plane. That is of course unless they have their own plane.

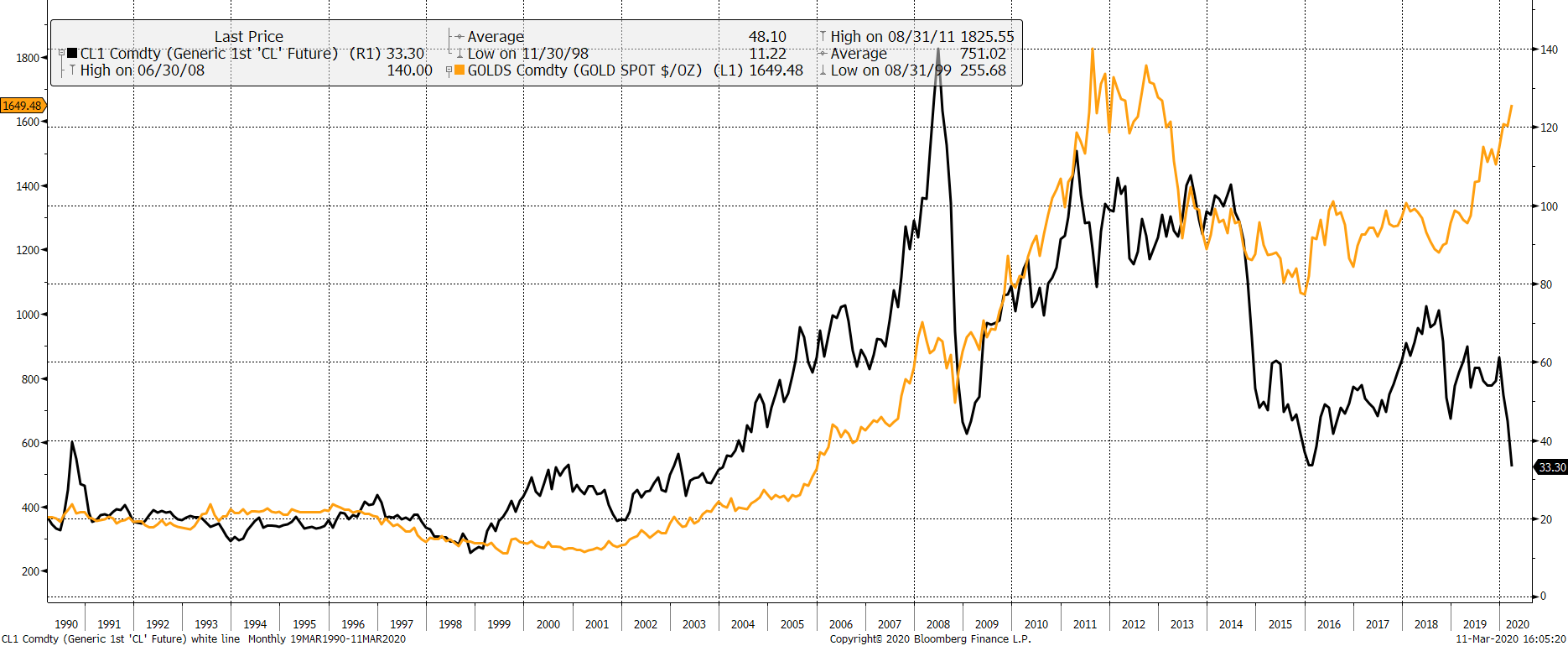

If you find the relative charts confusing, the next chart shows the prices of gold and oil independently.

Gold and oil in US dollars

Source: Bloomberg – gold price (gold) and the WTI crude oil price (black) since 1985

Source: Bloomberg – gold price (gold) and the WTI crude oil price (black) since 1985

Notice how the two commodities are correlated over the long term, but can diverge over the short term, especially recently. The convergence and divergence are highlighted on the first chart, something I call the gold-to-oil ratio (GOR).

It works just like any other chart – you simply buy low and sell high. In September 2018, GOR was 16 and is now 50. That 3x return is larger than gold, oil or even the stockmarket over the past decade (notwithstanding the recent crash).

Had you bought gold then, at a GOR of 16, at approximately $1,200 when oil was $75, your gold would today be worth $1,650 while oil is $33 – a GOR of 50. You profit in dollars is 37.5%, but your profit in oil is 3x. If you switched into oil today and GOR fell back to 16, you’d clean up.

Perhaps your oil rises back to $75 from $33, a further gain of 127%. You now have 127% and 37.5%, which compounds to 212%. You can see these huge swings occur as the economy expands and contracts. Oil rallies in the good times, while gold is the safe haven during a crisis.

Let me give you a few examples of how a successful investor might have switched between the two assets in recent years.

Gold made a high in 1986, which set it up for the famous stockmarket crash of 1987. Oil had previously been weak, which reflected a sluggish economy at the time. Yet the economy managed to avoid recession and stocks boomed.

While less ebullient, gold also rallied ahead of the crash, as it was a safe haven. Once the stockmarket crash was done, gold ran out of good news, by which I mean bad news, and it was oil’s turn to grab the headlines as the economy recovered.

Talk about overdoing it, oil rallied into the recovery only to spike on the sound of guns courtesy of the first Gulf War in 1990. That disrupted oil supplies and oil spiked to $40. That doesn’t sound much these days but recall that it was 30 years ago when $40 would buy you a good lunch at the Savoy.

At oil’s peak, GOR was 10, which rallied to 27 by late 1993 as the recession bit. Once again, as the economy turned down and the supply shock eased, investors did what they normally do – they returned to gold.

The next low for GOR came in 1995 at a modest 15. This reflected an economic recovery which would soon falter as Asian currencies broke their pegs to the dollar, and asset prices collapsed. Oil slumped to $10 as fears of deflation grew.

Gold held steady, but GOR rallied to 26. That time was really just an oil story as gold had its own problems at the time. The central banks were dumping their gold on to the market which kept a lid on prices.

Gold’s lackluster performance during the Asian crisis saw it slump into the 2000 stockmarket boom. The feeling at the time was that if it failed to rally during a crisis, what’s the point? Gordon Brown was the last to oversee a large public gold sale, and that marketed the low. He even told the market he was about to sell vast quantities of gold before he put the order on; something only done by truly braindead traders.

GOR touched 8 as gold slumped and oil recovered to $34. It didn’t last for long as a gargantuan gold bull market began starting from a low of $255 just as equities turned down. To confuse matters, China became the world’s fastest growing major economy and oil demand surged.

GOR slumped to 6.3 in 2005 and 6.6 in 2008, despite gold’s strength. Before the financial crisis, oil touched a jaw dropping $148 while gold reached $1,000. Oil won that particular race.

Then just a few months later, GOR rallied from 6.6 to 22 as oil collapsed to $37 during the credit crisis. A trillion of stimulus and wave after wave of quantitative easing saw markets recover, and GOR remained stable as it touched 20 by 2011.

At this point, China started to slow down and with that, its thirst for oil. Gold reached an all-time high at $1,900, which surprisingly did not make a huge impact on GOR until 2013 when the Federal Reserve discussed hiking rates. Gold slumped, causing GOR to sink back to 12.

The next major move came in 2014 when the Chinese slowdown gathered pace. Oil sank from over $100 to $27 while gold held relatively steady. GOR surged to its highest recorded reading at 26.

The recover in the economy, courtesy of stimulus, saw both gold and oil rally. Oil, being more volatile, rallied harder and GOR eased back to 2018. You know the rest because oil collapsed again while gold, as I write, is challenging those old highs from 2011.

The point is that financial history can be told from so many different angles. Interest rates, foreign exchange, stockmarkets and commodities all relay the same message but in different ways.

As I said earlier, the beauty of gold and oil is that they are highly correlated over the long term but have minds of their own in the short term. This makes them an ideal pair as there’s a natural and inescapable partnership.

As Warren Buffett said, “Be greedy when others are fearful.” While I can’t promise the switch is today, you can bet your bottom dollar that oil will start to beat gold once this viral storm passes. History doesn’t repeat itself but it rhymes.

All the best,

Charlie Morris

Editor, Southbank Investment Research

Category: Market updates