The pound’s bull market continues. It had another good week last week.

However, on Monday it made a breakthrough that went, as far as I know, unreported.

It’s a breakthrough that, in my opinion, has set it on the path to $2.

A major breakthrough for the pound

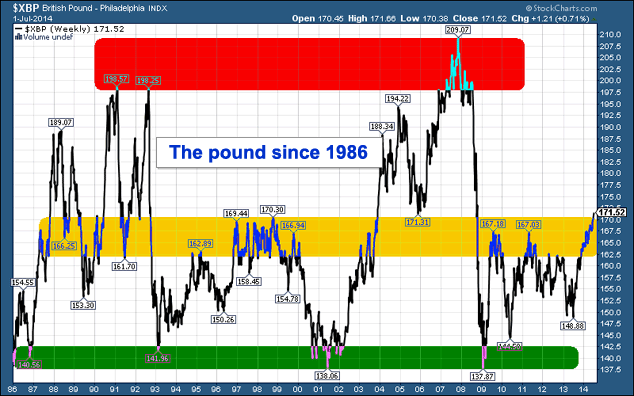

We’ll start with my favourite sterling chart. It shows the price action of the pound sterling against the US dollar since 1986.

For all the volatility of the foreign exchange (forex) markets, it’s actually a pretty consistent pattern in the long term.

Broadly speaking, the pound is a ‘buy’ when it’s in the green zone – around $1.40 – and it’s a ‘sell’ when it’s in the red zone – around $2.

What concerns us today is that pivotal yellow area in the middle of the range, between $1.60 and $1.70.

During periods of sterling weakness, such as the 1990s and the early part of this decade, it has been a barrier of resistance. But during periods of strength, such as the late 1980s and early 1990s and the 2010s, it has provided support during sell-offs.

And here’s the thing: on Monday, sterling broke above $1.70 for the first time in five years.

$1.70 is a price I’ve been harping on about for some time now. My line of thinking has been that, if sterling can break above it, it is headed to two dollars – or, to be more specific, $1.98 – the start of the red zone.

There is very little resistance – very little to stop it, in other words – between $1.70 and $1.90.

It might take a year or more, but it is now a realistic target, in my view. Any such suggestion even a year ago when the pound was trading below $1.50 would have seemed ludicrous. But a quick look at the habitual price patterns of ‘cable’ (the pound v the dollar) shows that when it goes, it goes.

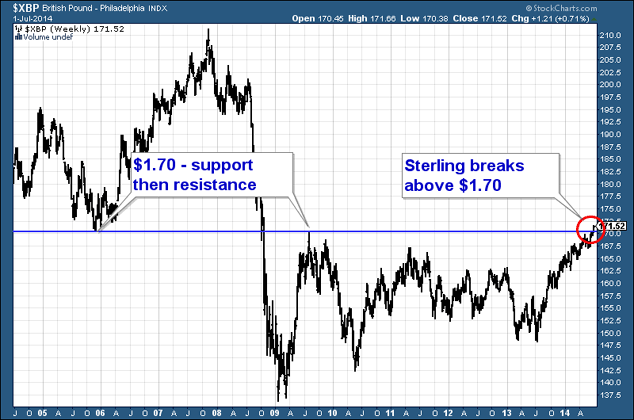

Looking now at this ten-year chart below, I have drawn a horizontal blue line at the $1.70 price level. You can see how pivotal it is. It was support in the 2000s, and it was where the bounce following the 2008 sterling crash ran out of steam.

What I like most about the sterling chart now is that there is a nice clean trade set up here. Be long – and have your stop-loss just below the blue line. Perhaps just below $1.67.

How politics could affect the pound in the coming year

Of course, there are two sides to this story. Sterling’s strength is as much, if not more, about US dollar weakness.

When stock markets are strong, sterling tends to be strong as well – it represents an economy based, for the most part, on financial assets. The dollar, meanwhile, tends to be weak. But as soon as stock markets sell off, the dollar becomes the go-to asset.

Sterling’s break above $1.70 could be telling us that stock markets are headed even higher. As for the dollar’s weakness, it seems the forex markets still don’t really believe all this talk of tapering.

But there are two political events in the UK in the year ahead that might have an effect on the price of the pound.

First, of course, there’s the Scottish independence vote. I think the pound wins either way. A ‘yes’ vote would cause volatility, of course. But, ultimately, I think it would lead to increased pound strength because of the relief it will bring to spending obligations. The more likely ‘no’ vote will not change anything – it will just be more of the same – the same fundamentals that have forged this upward trend will remain.

Then, second, there’s next year’s general election. The outcome of that, if you follow the polls, is anyone’s guess. Mine is that Brand Dave will be more appealing than Brand Ed to wavering voters – and so Brand Dave will come through somehow.

I guess the pound will continue to like that. It has so far: it was $1.40 when Cameron became PM. But who knows? Perhaps we will end up with a Labour-Ukip coalition. I doubt forex markets would look favourably on that.

This all assumes a Scottish ‘no’ vote of course. A ‘yes’ vote would probably mean England having the Tories for the foreseeable future. Markets like political stability, and they’ll appreciate the pound if the government is relieved of Scottish spending obligations.

So that’s all very interesting and very speculative. But ultimately it’s all about the price action – and the trend is higher. For the time being, sterling doesn’t seem worried about electoral outcomes, and it marches ever higher.

But beware – it’s all about financial assets and the stock market. As long as they remain strong, the pound will remain strong too. And if they turn down (and despite higher prices I’m still reading a lot of bearish sentiment), so will sterling.

But for us Brits, America’s becoming a cheap country to visit again. Hooray. I think I know where I’m going to spend some holidays later in the year.

As for all those Americans who own des-res pads in Kensington, some of them might be very tempted to sell. In fact, pound strength will not only deter foreign buyers, it will tempt existing foreign owners to become sellers. So perhaps London property might start to become more affordable to the natives again too.

Category: Market updates