“Who do you think buys the stones I bring out? Dreamy American girls who want a storybook wedding and a big shiny rock just like the ones they see in the advertisements in your politically correct magazines. So, please, don’t come here and make judgements on me, alright. I provide a service, the world wants what we have, and they want it cheap. We’re in business together you and me. Get over yourself, darling.”

– Blood Diamond, 2006

This week, we’ve been taking a look into the commodities space, a long forgotten land, left behind by investors determined to leave reality and seek returns in companies which lose money and destroy capital.

In this space where tangible assets are retrieved from the earth, strange things have been occurring – perhaps even signalling a market regime change in the making…

Dreamy American girls stop dreaming, and get over themselves

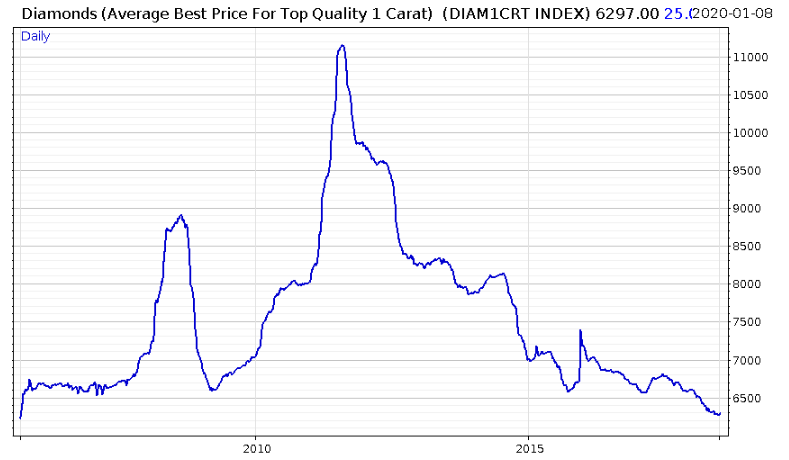

It may well have just been a coincidence, but diamonds had a terrific year following the release of Blood Diamond back in the noughties. It’s that spike you can see there on the bottom left:

But that was 14 years ago. And as you can see, the desire of dreamy American girls for “big shiny rocks” – as advertised in politically correct magazines – is now considerably lower than it was.

And they’re not the only ones – investors as a whole appear thoroughly fed up with companies that specialise in digging up said shiny rocks:

But it’s not just the shiny rocks that are being scorned.

Interestingly, their ugly older brother with a nasty smoking habit has been trading in loosely the same way:

Coal in blue, diamonds in green

Coal in blue, diamonds in green

While diamonds have reacted with something of a lag, and with less or more intensity, they share the same broad direction, and in recent years that has been a grinding route downwards. Despite their massive differences in application, coal and diamonds have shared the same fate, though I’ve yet to hear diamonds be blamed for climate change.

But why? It can’t be those dreamy American girls. I can’t imagine coal being advertised as a wedding accessory, let alone in politically correct magazines (though I don’t read them, so I could be wrong).

So why are the prices of these carbon siblings so cold to the touch? The answer may lie in the furnace of inflation, which has been left seemingly untended since the financial crisis.

The lacklustre growth from the developed world following 2008 has done little to force consumer price inflation up (if you believe the official statistics from governments, at least). Consumption is being strangled by a combination of debt burdens, and the large cohort of retirees with less purchasing power. And the low labour costs in emerging markets remain a “disinflatory” force keeping goods and services costs down.

As we explored yesterday, a bump in commodity prices was delivered in 2016, likely caused by a rise in the oil price. You can see it temporarily boosting the carbon pair on the right in the chart above, before trending down once again.

I’m relatively bullish on coal purely as a contrarian, as it’s hated by self-righteous journos, celebrities, and the mainstream financial industry alike. But more on that tomorrow – for there are some commodities which haven’t stopped rising since 2016, and are poised to have a terrific 2020.

Metallic momentum

Metals began rising all around the same time in 2016, and remain on the up. We looked at the strong performances of copper and uranium yesterday, but it’s a broad trend that’s pulled almost anything metallic up.

Nickel, used mostly in batteries, is a great example, continuing to tear up the way:

Things like zinc, mostly used for galvanising iron or steel, has established higher territory:

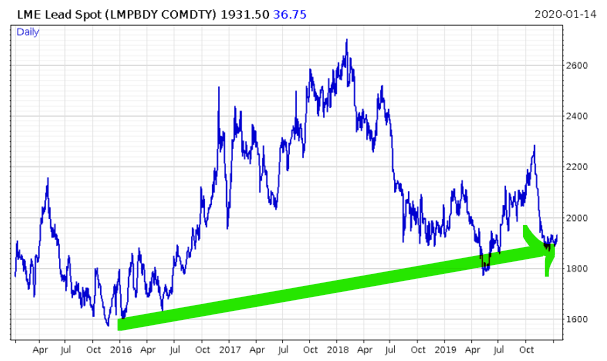

As dull as lead may be, the market level for it too has risen since the momentous year of 2016:

Note how the bearish 2018, and the deflation shock of 2019 rocked demand for both metals.

But as we roll into 2020, the bears are at bay. Central banks all across the world are printing money now at the same time to keep deflation away.

As you’ll know if you’ve been reading Capital & Conflict for a while, I see a repeat of 2017 on the cards, which means rising prices for the metals above. As they are all basic inputs to the modern world, higher prices for them mean a more highly priced modern world – greater inflation.

But for investors seeking the big bucks, these metals are really small fry. Tomorrow, we’ll venture further into the woods, and show you where the real incendiary metals lie – and how a metallic melt-up may be swiftly approaching…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates