The governments of the world are in debt to the tune of £46 trillion. When you include unfunded liabilities like state pensions and welfare, the figure is much higher.

And with politicos unlikely to break the habit of spending other people’s money, it’s unlikely that figure is going to be going down anytime soon. So, as you would expect, they’re going to find a way to fudge it.

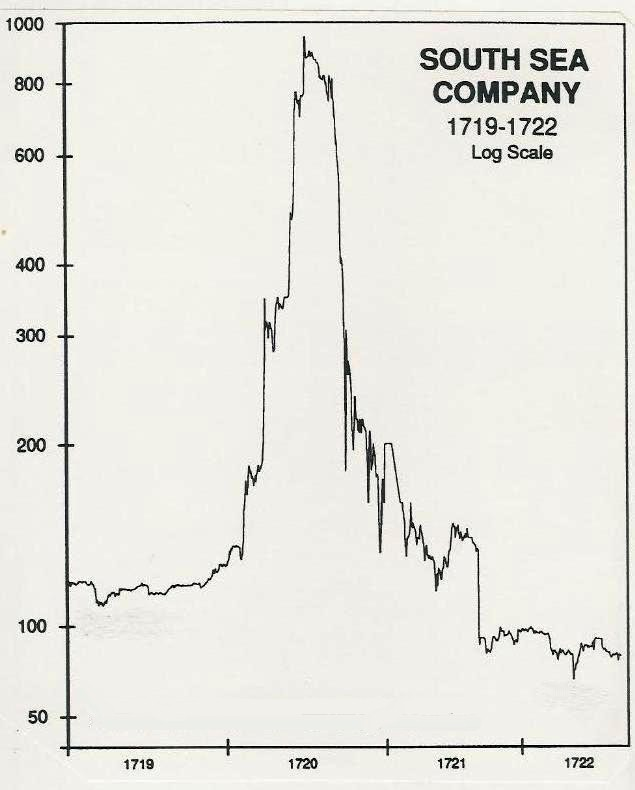

In yesterday’s letter, we explored how the British and French governments of the early 1700s reduced their debt burdens through a cunning work of market alchemy, in which they transmuted their debt into stocks that investors were gasping to buy: the South Sea and Mississippi companies.

By giving those companies monopolies over certain trade that held great promise, investors were scrambling over each other to buy them. Through a nimble new piece of financial innovation, governments allowed punters to buy those shares at a discount, if they bought government debt first. They could then convert that debt into shares in the companies at a cheaper price, an action which destroyed the debt.

Of course, that “discount” didn’t look all that good about a year later:

When the South Sea bubble collapsed, (which in turn led to the collapse of the Mississippi bubble), investors from all classes of British and French society were ruined – but their respective government’s balance sheets were looking a lot tidier. Effectively, after cooking up a grand speculative bubble, governments took their debts and wrapped it around the necks of investors giddy with greed.

Looking around at the world today, it’s possible that the same strategy could be employed again. Creating a big enough bubble to absorb the lion’s share of £46 trillion will take some doing however. What kind of monopoly on trade could be perceived to carry such potential? It’s hard to find one on earth…

The great moon monopoly

The moon may not be made of cheese, but it sure as hell has a lot of loot hiding amidst its vast white expanse. Loot which is looking mighty attractive these days.

The dust on the moon’s surface is saturated with a very special type of gas: helium-3. Though “helium” may sound familiar, what’s injected into balloons is helium-4; helium-3 is very hard to find here on earth and has some very special applications. From The Diplomat:

Helium-3 is a helium isotope that is light and non-radioactive. Nuclear fusion reactors using helium-3 could provide a highly efficient form of nuclear power with virtually no waste and negligible radiation. In the words of Matthew Genge, lecturer at the Faculty of Engineering at the Imperial College in London, “nuclear fusion using helium-3 would be cleaner, as it does not produce any spare neutrons. It should produce vastly more energy than fission reactions without the problem of excessive amounts of radioactive waste.”…

It has been calculated that there are about 1,100,000 metric tons of helium-3 on the lunar surface down to a depth of a few meters, and that about 40 tons of helium-3 – enough to fill the cargo bays of two space shuttles –could power the U.S. for a year at the current rate of energy consumption. Given the estimated potential energy of a ton of helium-3 (the equivalent of about 50 million barrels of crude oil), helium-3 fuelled fusion could significantly decrease the world’s dependence on fossil fuels, and increase mankind’s productivity by orders of magnitude.

The moon is also full of rare earth metals, which China has an almost total monopoly over. These are vitally important to everything from phones and computers to GPS and missile guidance systems, which is why the US has recently begun looking for sources of rare earths outside of its greatest rival.

The issue with rare earths isn’t that they’re rare however – there are deposits all over the place, including here in the UK – it’s that extracting them is incredibly damaging for the environment (in its deliberate attempt to gain a monopoly over supply, the Chinese government has allowed rare earth extraction facilities to run riot with the surrounding environment).

But on the moon, there’s a lot less animals, humans, and foliage to damage – making it a pretty great place to extract rare earths from…

Project Moondoggle

The 1967 United Nations Outer Space Treaty forbids any nation claiming ownership of the moon. But what if it was a global effort to harvest its resources, perhaps led by the International Monetary Fund (IMF)?

Let’s imagine the story. One company – “Standard Lunar” let’s say – is created by the IMF with international support granted the sole rights to extract lunar resources. All of the governments who want in on the project expend significant resources hyping the prospects for Standard Lunar and the vast profits they expect it to make, getting billionaires, sovereign wealth funds and more to provide vocal support for the plan and provide capital. The more “progressive” central banks say they will purchase shares and do their part for humanity.

Imaginative accounting is employed by the likes of McKinsey, Deloitte, and SoftBank amongst many others who all widely agree and endorse a grand valuation of the enterprise in over $100 trillion. The company will not only be in the resource extraction business they say, but also be able to lease vast swathes of land and develop real estate for tourism; it will build mankind a moon colony, a permanent staging post for further space exploration, a step forward that will never be retraced as mankind claims its destiny amongst the stars.

Grand PR campaigns are created across the world to get the populous excited for the project, promising that this wealth creation event will be open to all who are willing to invest. But of course, there’s a catch – there won’t be an IPO. Shares will only be created through the conversion of government debt.

Shares can trade freely afterward of course (ticker: $LOON), but those who do not want to purchase the shares for a significant premium as they inevitably will once the deliberately constructed frenzy is less loose, can simply convert government debt to equity at a fixed rate, inevitably lower than the price of shares being goosed up by the market.

To reduce the liquidity of the shares and thus make their value jump higher when large buyers come to the market, shares are only made available in physical form. Citizens all around the world are encouraged to proudly display their ownership of the shares, which arrive in special frames and are printed in a classic and ornate style evoking previous grand eras:

Trillions of dollars of government debt is converted into Standard Lunar stock, supposedly at a “discount”. The company achieves a greater market cap than the GDP of most countries.

$LOON is constantly ranked as the best performing for the day/week/month, trading higher and higher as investors battle for larger stakes in what is supposedly the greatest opportunity of the century. Government debt in turn is bid to ridiculous prices by speculators impatient to convert it into stock.

The share is listed on the stock exchanges of all major countries, and many emerging markets too. Governments begin reducing the discount investors can achieve by buying government debt first, such is the great, giddy, gluttonous demand for it.

Fortunes are made overnight through little effort by princes and paupers alike who continually buy as much stock as they can and expect the price to just keep going up – for it always does.

Government debt is being destroyed at a manic rate – billions of dollars a day – as ever more of it is converted into fresh Standard Lunar stock.

Government deficits around the world are drastically reduced. The populace of every major nation in the world is significantly invested in it. The political class breathes a sigh of relief… and the stock of Standard Lunar is allowed to collapse.

Credit for this idea goes to Nickolai Hubble, who came upon the idea having read up on the Mississippi bubble – I’ve just taken the liberty to add a few details.

Lunacy? Sure. But possible? Well, as you can probably tell from the above, I can see it happening. A return to the moon is an inevitability of this second Cold War between the US and China – I’d encourage anyone doubting that to check out NASA’s Artemis programme – and China has already expressed an intention of hoovering up that Helium-3.

What better way of maintaining international stability than an International Space Station programme on steroids with as many other countries involved as possible – and all the world buying its stock..?

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates