What asset performs well in an era of deglobalisation?

As luck would have it, beer. Or at least, beer made in certain areas.

A few months back, a South Korean court ruled that Japanese companies must pay compensation to Korean labourers who worked under the Japanese during their occupation of Korea during 1910-1945.

The Japanese government responded by placing heavily disruptive export restrictions on South Korea, and the dispute only escalated from there. In the past, the US diplomatic service could ride in and crush the dispute, but the US is no longer interested in preserving a globalised world.

As Peter Zeihan, a geopolitical commentator, wrote of the incident:

American security policy in the post-World War II era is based upon a single, simple premise: we will pay you to be on our side. Everyone gets access to the U.S. market, the U.S. Navy will make the global ocean safe for everyone’s commerce, everyone gets an iron-clad guarantee to their physical security as well as the shelter of the U.S. nuclear umbrella, so long as you stand should to shoulder with the United States against the Soviet Union…

The American-led global Order didn’t so much end grievances among the allies as freeze them in place. It would do no good, for example, for France and Germany to go to war (again) if they were supposed to be jointly resisting the Soviets. Making the Order work didn’t just require aircraft carriers and army divisions, but also the American diplomatic corps riding herd on oftentimes quarrelsome partners.

Under “normal” circumstances, the United States would have ordered the South Koreans and Japanese to cut this crap out the day after it started. But the Americans are getting out of the global management business and so the bilateral snit has been allowed to boil up into and beyond a full international incident.

Buy beer, wear diamonds

In light of the growing rift between the two nations, Japanese beer has abruptly lost favour amongst South Koreans.

In August last year, they imported $7.57 million dollars’ worth of it. But this August, that figure has taken a brutal 97% haircut, down to $223,000.

That doesn’t mean they’ve quit booze of course. They may have spurned the Japanese stuff, but that doesn’t mean they’re on the wagon.

And so while it’s been a bad time for Japanese breweries, the local breweries have been having a great time.

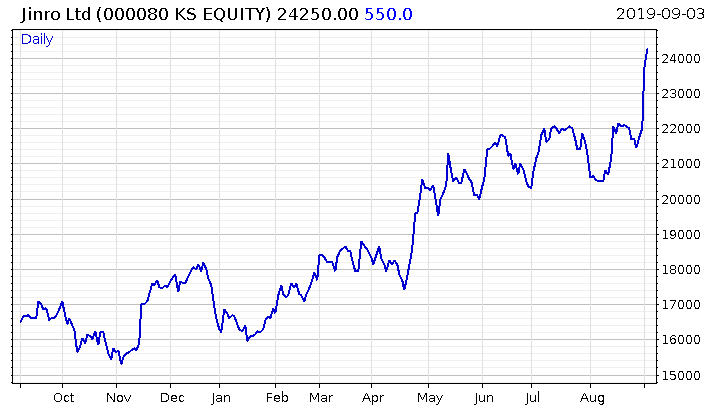

Take South Korean brewer HiteJinro for example, which has had an excellent year thus far:

For king, country… and capital growth

We wrote late last year in this letter (A goose in the crossfire – 13 December) that as globalisation goes into reverse and Cold War II ramps up, we’ll see many stocks boom or bust not due to the fundamentals of their business, but purely due to their location or the perceived nationality of their brand.

At the time, luxury jacket brand Canada Goose ($GOOS) had just lost almost a fifth of its value over the course of four days after the Canadians arrested a Huawei executive. Simply being associated with Canada was enough for the Chinese to boycott the company in favour of the Chinese equivalent, which boomed.

HiteJinro is merely the latest example of the fracturing state of global affairs finally bleeding into financial markets. We’re only going to witness more of such idiosyncrasies; financial markets are set to become a bazaar for patriots now that what Steve Bannon would call “economic nationalism” is taking off.

Public intellectuals wedded to the globalised world continue to bemoan its destruction, citing the higher costs that tariffs and currency devaluations will bring to businesses and the wider economy.

But we are returning to a world of mercantilism, where states overtly compete against one another for resources and wealth, regardless of the friction, animosity, and economic damage this will create. Those hoping for a return to the nineties and noughties need to get with the programme or just get out of the way, for there’s no way in hell we’re going back there.

Investors would be wise to scour their portfolios for companies which could quickly become collateral damage in a trade or security dispute. The shrewd stands to make a buck from this “New World Disorder” by buying assets that thrive on discord – my colleague Nickolai Hubble outlined several Japanese companies which fit that bill in a recent issue of Zero Hour Alert.

Charlie Morris over at The Fleet Street Letter meanwhile, thinks the damage the pound has taken with all the Brexit drama is nearly at an end – and that “Buying British” will soon be a golden trade. With breweries in high demand from investors here as well as SoKo, he may well be on to something:

The greatest periods for UK equities, relative to the world, have occurred when the pound has rallied from depressed levels. That happened in 1976, 1985, 1992 and 2001. In my opinion, that will happen again once Brexit is behind us.

UK equities relative to the world

Source: Bloomberg – UK equities relative to the world since 1971 capital return

… This switch into UK domestics will be fun. Li Ka-shing, Hong Kong’s richest man, has just bought Greene King, having recognised the value on offer. There’ll be many more people like him coming over here once the fear diminishes. Best not to wait too long and beat them to it…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates