“I do love the beginning of the summer hols,” said Julian. “They always seem to stretch out ahead for ages and ages.”

“They go so nice and slowly at first,” said Anne, his little sister. “Then they start to gallop.”

– Enid Blyton, Five Go Off in a Caravan

Apparently, summer only officially starts on 20 June, but this lockdown has certainly felt like it’s been stretching out for ages and ages. Hopefully we’re at the galloping stage now.

Indeed, Enid Blyton certainly appears to be influencing the news cycle. Inspired by The Famous Five and The Secret Seven, politicos are now calling themselves the “Save Summer Six” for attempting to allow pubs to reopen later in the month. From the Financial Times:

Ministers have identified June 22 as the date when they hope to reopen England’s pubs and restaurants serving customers outdoors, amid fears of mass job losses if the hospitality sector misses out on the lucrative summer season.

Chancellor Rishi Sunak is among half a dozen ministers — calling themselves the “save summer six” — seeking to accelerate the reopening of the economy. The hospitality sector was not due to open until July 4.

I’m dying to get a freshly poured pint in my hand. 22 June still feels a long way off, but I’ll take what I can get. It’ll be interesting to see if the rest of the populace is similarly keen to hit the boozer, or if I’m just an alcoholic.

My colleague Sam Volkering over at Growth Stock Network has made impressive gains for his readers from buying pub stocks at their lows when they got crunched. I wonder if all the pleasant anticipation growing in the stockmarket will continue when its reopening day and the data starts rolling in.

The market dynamic of “buy the rumour, sell the news”, where a stock rises on rumours of positive news, and then falls when the news is officially confirmed as profits are taken, comes to mind. Could we have a case of “buy the lockdown, sell the reopening”?

There’s one overlooked side of the reopening, decidedly bearish for stocks, which few have considered, but we’ll get back to that in a moment. For Enid Blyton’s influence doesn’t just end with the Save Summer Six. Indeed, the future of the EU is being fought over by the Frugal Four…

Again, from the FT:

This week’s Franco-German proposal to raise a €500bn recovery fund and hand it out through grants marks a big step forward towards the Macron vision. But the deal is not done yet. The Frugal Four of Austria, Denmark, the Netherlands and Sweden are not convinced and the final form of the fund will be subject to haggling.

As FT reporters found out, the German change of heart has to do with the recent German constitutional court ruling on the European Central Bank’s bond-buying programme, a key tool for its monetary policy response to the crisis. The decision appears to have persuaded Chancellor Angela Merkel that Europe’s governments need to take bolder united budgetary action, rather than leaving the ECB alone to do the financial fire fighting.

I discussed the latest major roadblock with Nickolai Hubble on yesterday’s market broadcast – investors will soon learn a new word if we’re right, if the lady in charge isn’t convicted in the meantime…

The Frugal Four and the Save Summer Six complement the Famous Five and the Secret Seven quite nicely. I hope Blyton’s estate is claiming some royalties.

I thoroughly enjoyed The Famous Five books when I was a kid. No doubt plenty of dullards are offended by them these days, and plenty of entities have publicly distanced themselves from them on grounds of political correctness, but that can speak volumes of positive things in the age of recreational outrage. If I’m ever blessed with children, they’ll definitely be reading them – and the originals mind, none of this “revised” (censored) edition garbage.

But I digress. The last thing that kids have been up to these days in lockdown is reading. They’ve been ploughing more and more time into their devices, just as their parents have. Hell, the parents have likely encouraged them to for the sake of their sanity.

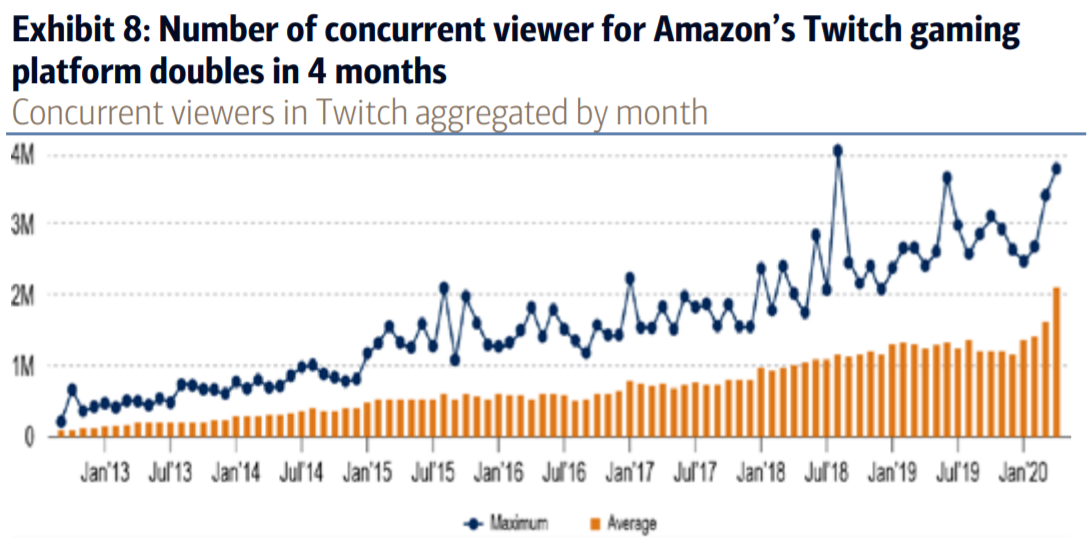

Amazon bought Twitch, the video streaming site where you can spectate as other people play video games, for nearly a billion bucks back in 2014. As the act of spectator driven e-sports has flourished, viewership on the site has grown. Under lockdown however, it has exploded:

Source: Bank of America, Twitch

Source: Bank of America, Twitch

The older kids, the young adults who have a little more money in their pockets, have been engaging in a rather different spectator sport however: playing the stockmarket.

One of the fascinating stories of recent weeks was the tale of how millennials with small brokerage accounts piled into airline stocks after Warren Buffett sold them… and it’s got to the point that Buffett now looks like the patsy.

This is a chart of the price (pink) of the $JETS passive airline ETF, and the number of Robinhood brokerage accounts (a favourite amongst youngsters) which own the stock in green. I’ve indicated in white when Buffett announced he’d sold all his airlines:

It appears that the speculative fervour of youngsters, bored and riled up by lockdown, have rescued the airlines, driving the value of $JETS up over 60% so far.

As Jim Bianco, the macro commentator, opined on Twitter recently:

The airlines are now up 65% since Buffett sold all of them a month ago and wished them well. Meanwhile the Robinhoodies tripled their holdings in the ETF “JETS” at the same time. Who is the smart money?

Who indeed?

But I wonder, if the kids are the “smart money” that’s pushing the market around… what happens when the economy reopens and they all go back to work..?

More to come,

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Market updates