If negative rates become more widespread across the globe, then the financial system needs to be rebuilt on a new set of assumptions. The problem is we do not yet know what those should be or how they would work.

– Jim Bianco on Bloomberg

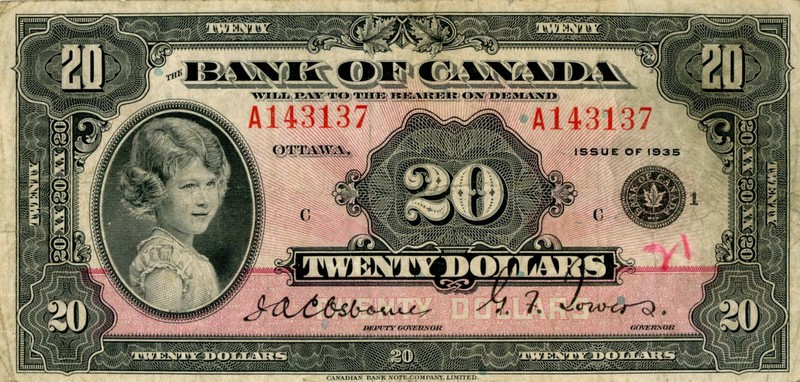

The Canadians must have a thing for the Royal Family. They put Queen Elizabeth II on their banknotes before anybody else.

Before the Bank of England, before the Royal Bank of Australia… before she was even Queen Elizabeth II, but eight-year-old Princess Elizabeth, the Canadians put her portrait on their CA$20 bill in 1935:

If the Queen is on your banknotes today, you’re in luck. You’ll likely be the last people in the developed world to be charged negative interest rates by your bank.

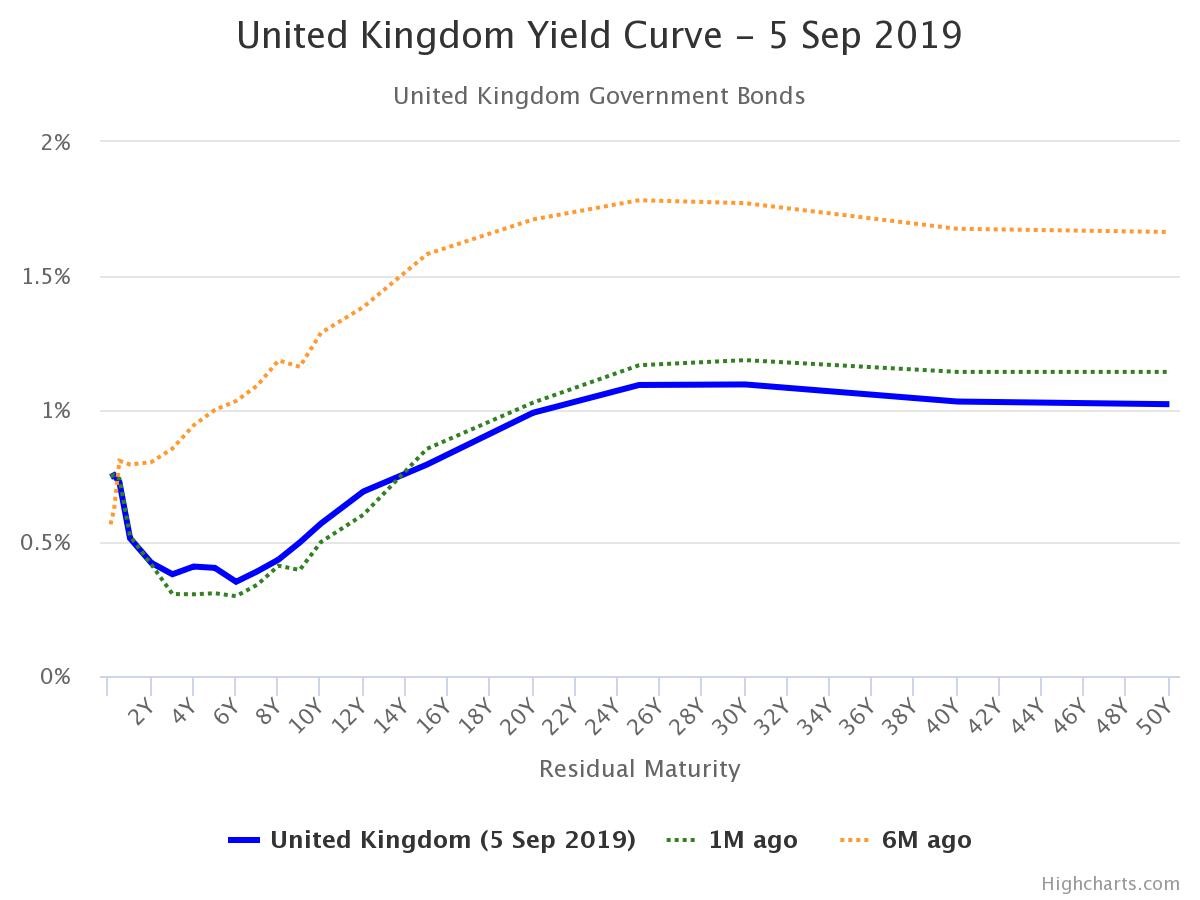

The Five Eyes share a blue line

You see, the developed nations which were formerly major hubs of the British Empire stand out today in financial markets.

Take a look at this chart and focus on the blue line. This is a yield curve, showing how much the government pays on different durations of debt. The yield paid is displayed on the left, with the duration of the loan displayed on the bottom.

Here’s us in Blighty:

Source: World Government Bonds

Source: World Government Bonds

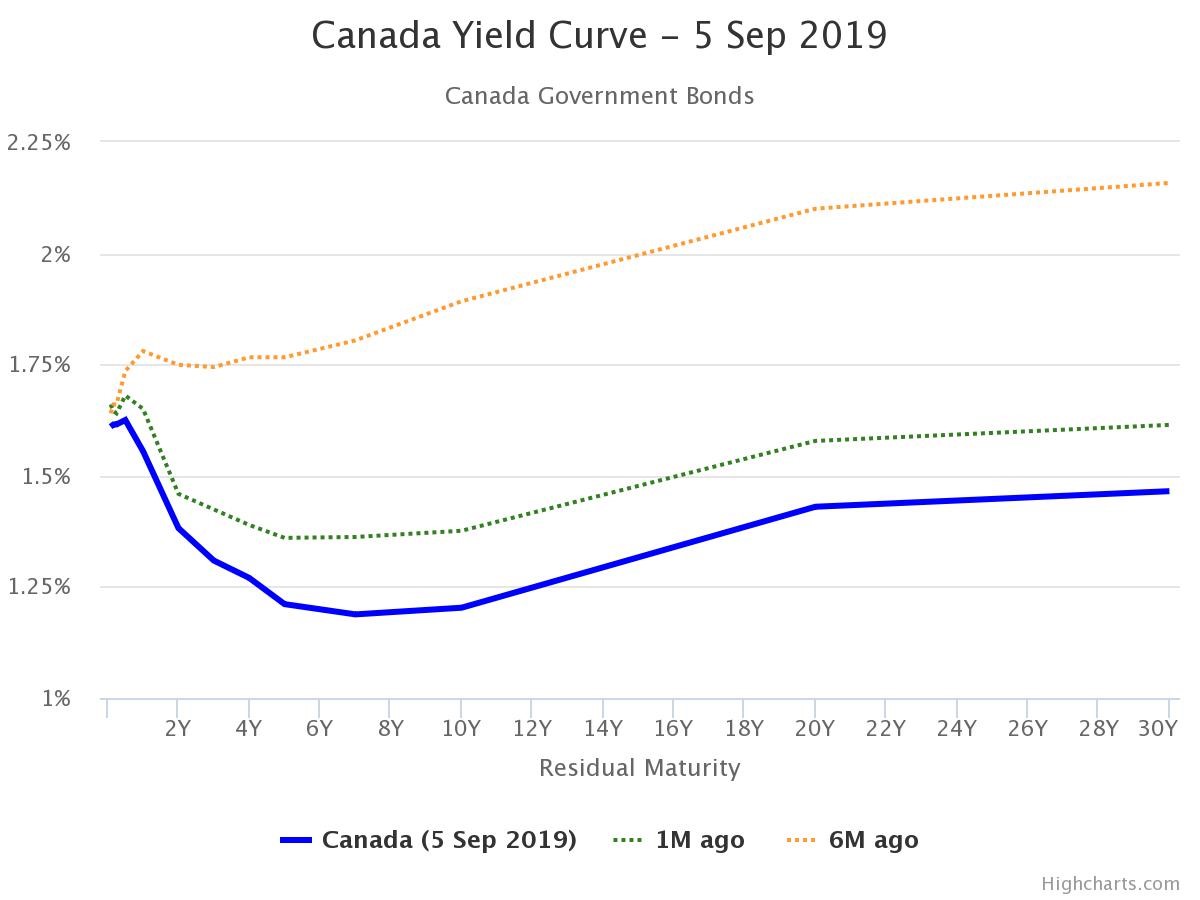

Now take a look at Royal-loving Canada:

Source: World Government Bonds

Source: World Government Bonds

Notice anything similar?

No worries if you can’t yet – these are just lines on a chart, after all.

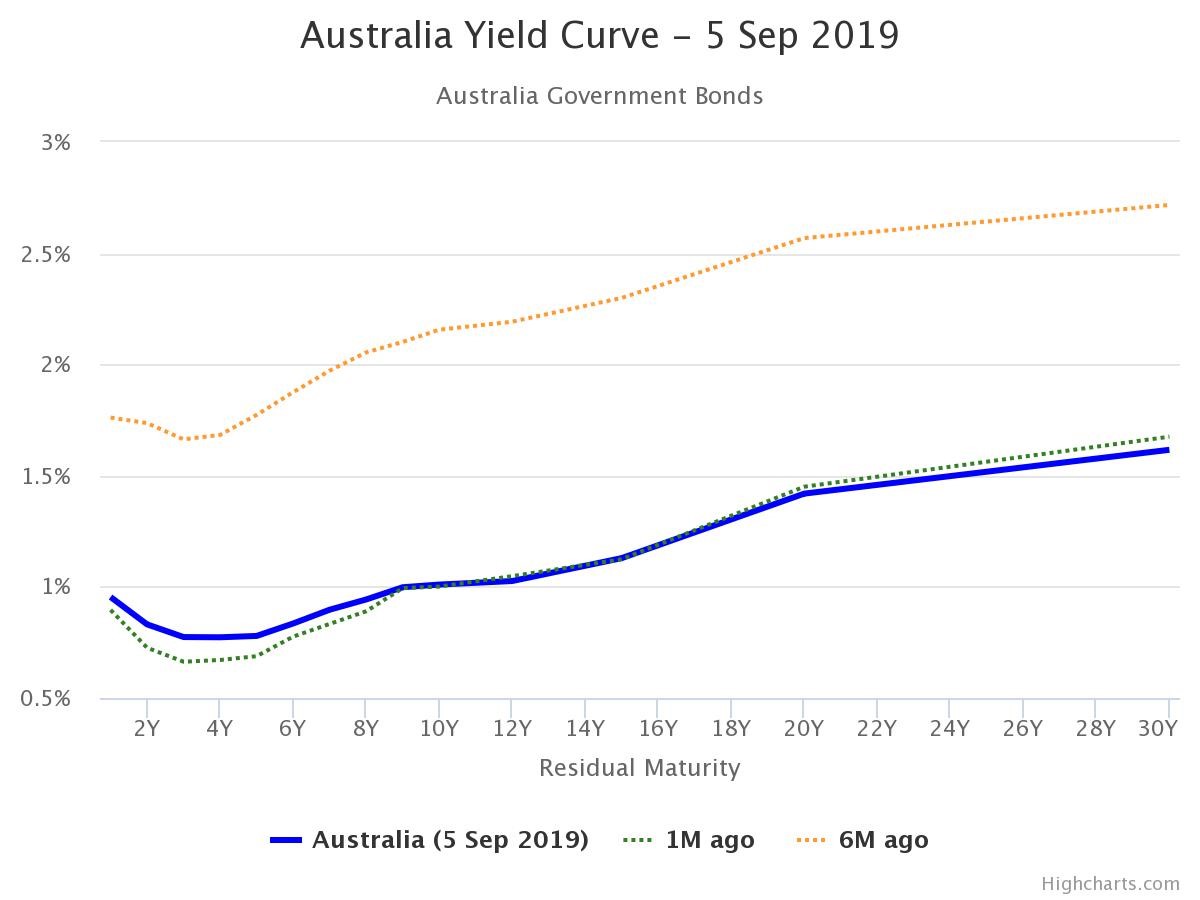

But bear with me – take a look at how the folks from Down Under are doing:

Source: World Government Bonds

Source: World Government Bonds

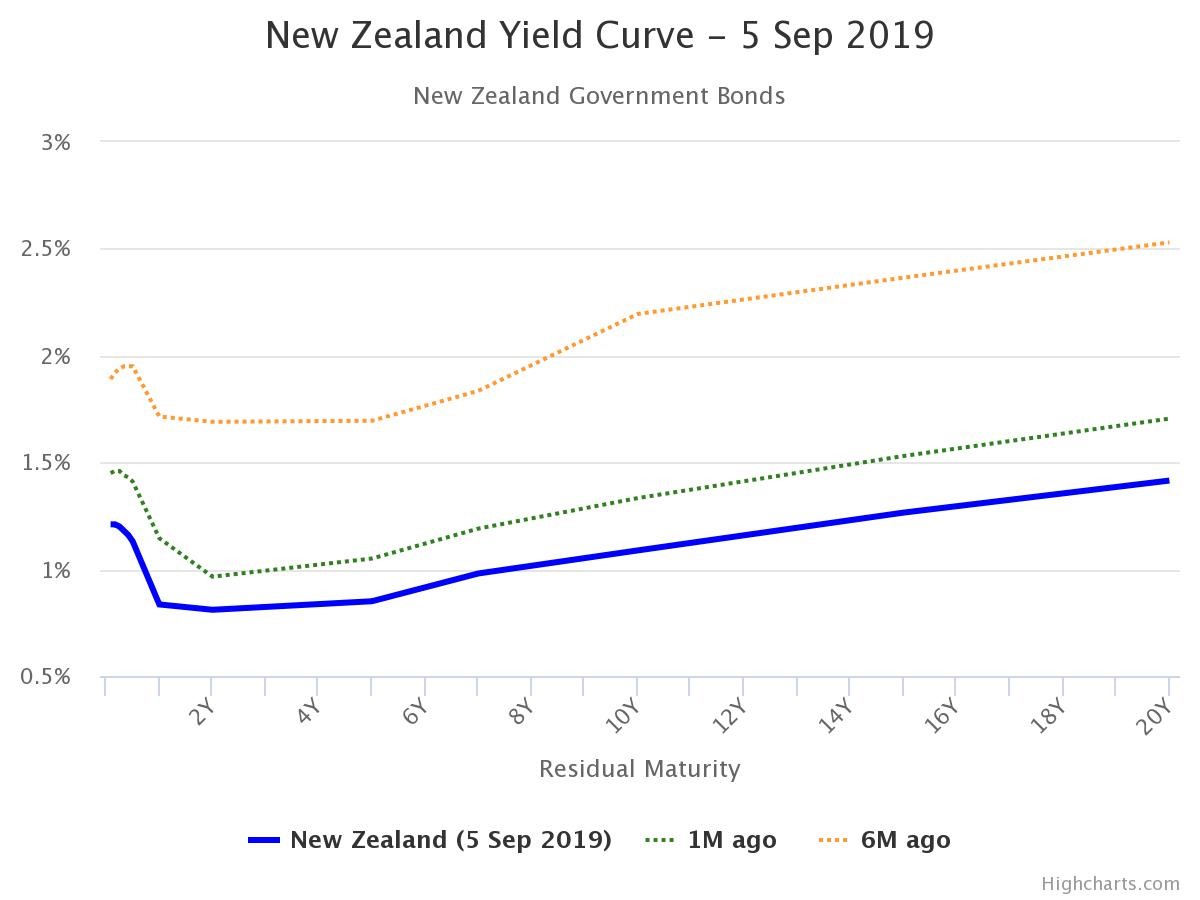

And now here’s the Kiwis, the other developed economy to bear the Queen on their currency:

Source: World Government Bonds

Source: World Government Bonds

What connects these countries, bar their use of the Queen on their currency, is that not once on any of the charts above does the blue line hit zero or lower. Not a single British, Australian, New Zealand or Canadian government bond yields zero or less.

Now you might think that’s a bad thing, in that Commonwealth governments aren’t getting to borrow money for free. But this is actually a reflection that the absurdities pervading the rest of the developed world aren’t here – yet.

The interest earned on these bonds may be peanuts compared to what they used to be, certainly.

And there’s some bad news mixed in with this as well. If you look at those charts again at the yellow and green lines, you’ll find that in most cases the yields a month and six months ago were higher, and they’re now going down.

But the longer our yield curves stay above water (zero), the further away negative rates are from trickling into our domestic financial system and being forced upon your deposit account.

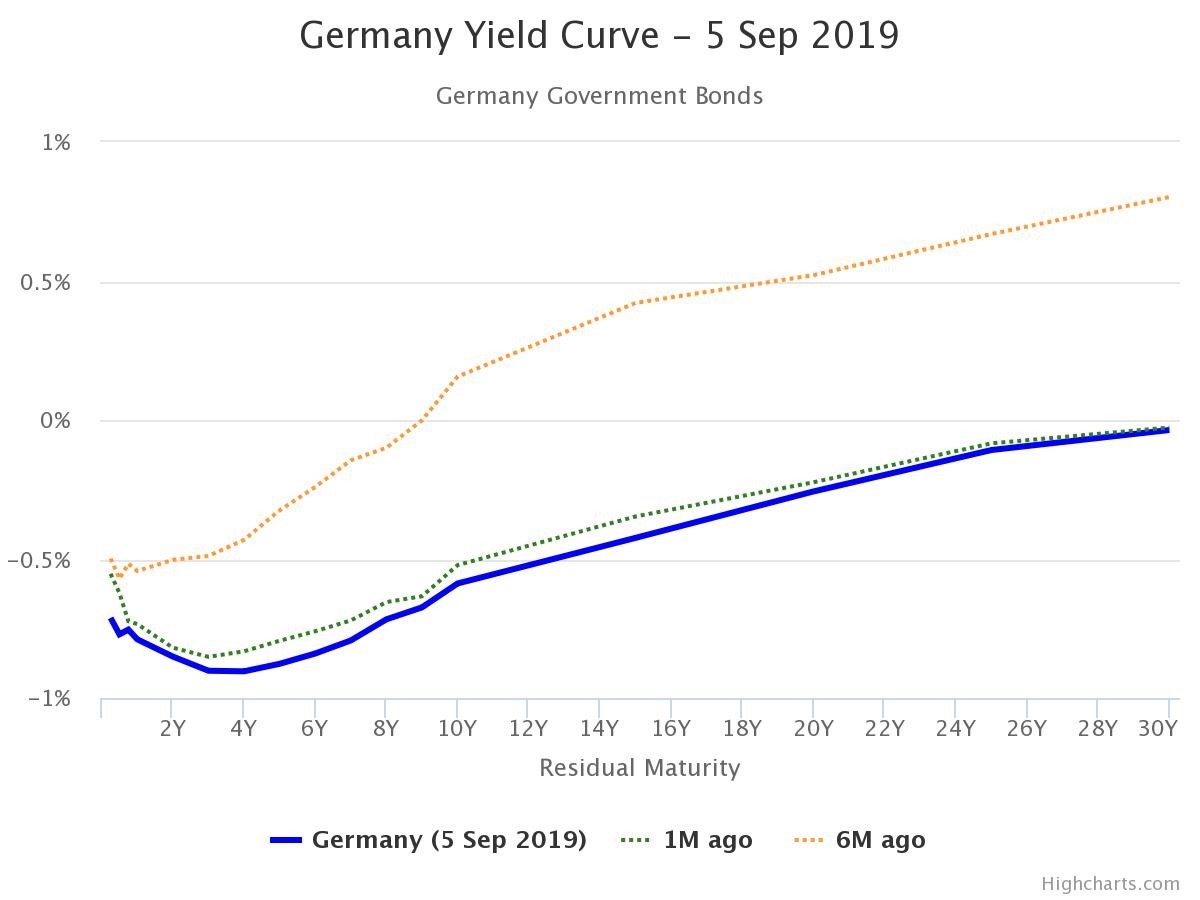

If we turn to a developed nation whose currency is not graced by our monarch, things start to look a bit negative. You look to say, Germany, and that blue line is completely submerged (just as its banks soon will be who use these bonds as collateral in their lending), in a brutal change from six months ago:

Source: World Government Bonds

Source: World Government Bonds

A similar picture comes up for Japan and Scandinavia – I wouldn’t want to be banking over there.

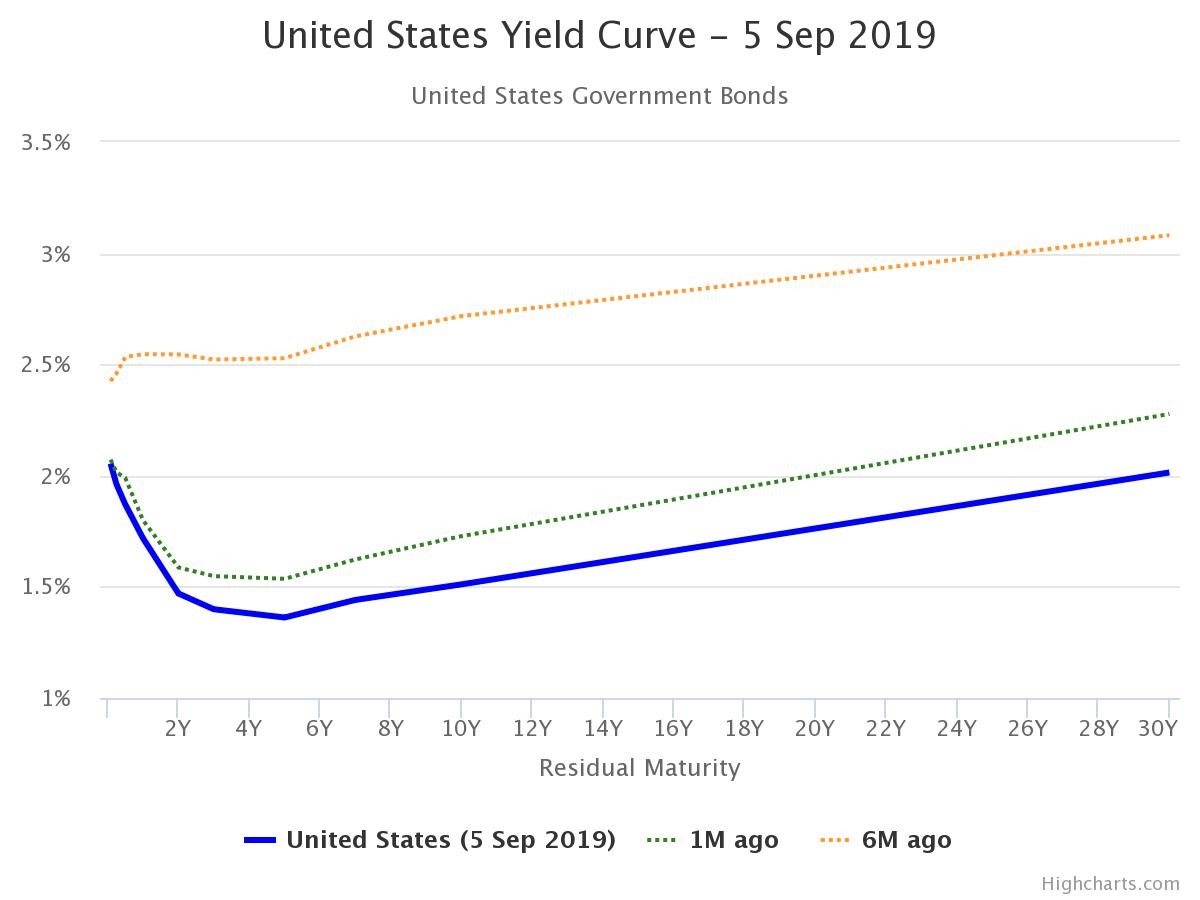

There is an elephant in the room that I’m missing out of course: our star-spangled cousins over the pond, once part of the empire but since aren’t all that keen on having monarchs on their money.

They are the only exception, the only other developed economy in the world with no negative-yielding government bonds out there.

Source: World Government Bonds

Source: World Government Bonds

So it’s not quite a “Britannia rules the waves of the bond market” scenario.

But hey. Benjamin Franklin, staring out on the face of the $100 bill may not be Queen Elizabeth… but when he was alive, he secretly preferred London to Philadelphia, which was the US’s capital at the time.

And c’mon. The yanks still struggle to differentiate St Paul’s Cathedral by the Thames from their own Capitol Building in DC:

An ad for a basketball tournament in Washington DC featuring St Paul’s Cathedral instead of the Capitol Building in 2016

An ad for a basketball tournament in Washington DC featuring St Paul’s Cathedral instead of the Capitol Building in 2016

So the Aussies, the yanks, the Kiwis, the Canadians, and us Brits are all in the same boat.

Which, as it turns out, we already are when it comes to surveillance, as part of the Five Eyes intelligence sharing alliance. We spy on them, they spy on us, and then we all share it together so nobody can blame their own government for spying on them. Happy days.

The folks on the fringe are telling me the Five Eyes connection is no coincidence… but I think I’ll leave it there for today.

I hope you have a great weekend. Now to see if there are any jokes about a Brit, a yank, an Aussie, a Kiwi, and a Canadian walking into a bar – if you know any already, feel free to send ‘em on: [email protected].

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates