Back in 2008, only one EU member managed to keep its economy growing. The one that doesn’t have the euro, and doesn’t want it any more.

The logic is simple. Your own currency gives you your own exchange rate. If that exchange rate can reflect your own economic prospects, instead of Europe’s as a whole, then the currency can help you rebalance your economy.

With your own exchange rate, you avoid the ups and downs of the severe business cycles that occur inside the eurozone.

Europhiles claim fiscal policy must be integrated across the eurozone to deal with the problems the euro creates. After all, if something isn’t working, just do more of it.

But here’s what even the economists miss. What I explain will lead to the next financial crisis.

Having the wrong exchange rate thanks to euro membership doesn’t just stop an economy from recovering quickly like Poland did thanks to the zloty. It actually causes the boom and bust cycle in the first place.

That’s what makes the euro so poisonous. The euro is why housing bubbles boomed and busted in the GIIPS (Greece, Ireland, Italy, Portugal and Spain) in 2008. And why there’s a housing bubble growing in Germany now. My mum complains she literally cannot find a single flat she would like to live in to escape another Austrian winter next year.

I’ve been pointing out the inherent flaws of the euro for a year now. But using the wrong example, it turns out.

Australia didn’t have a recession in 2008 either. The Aussie dollar’s tumble made sure of that. It turns out the Poles are a much better example. Closer to home for the euro.

While Polish GDP growth has boomed, the rest of Europe is struggling. Badly.

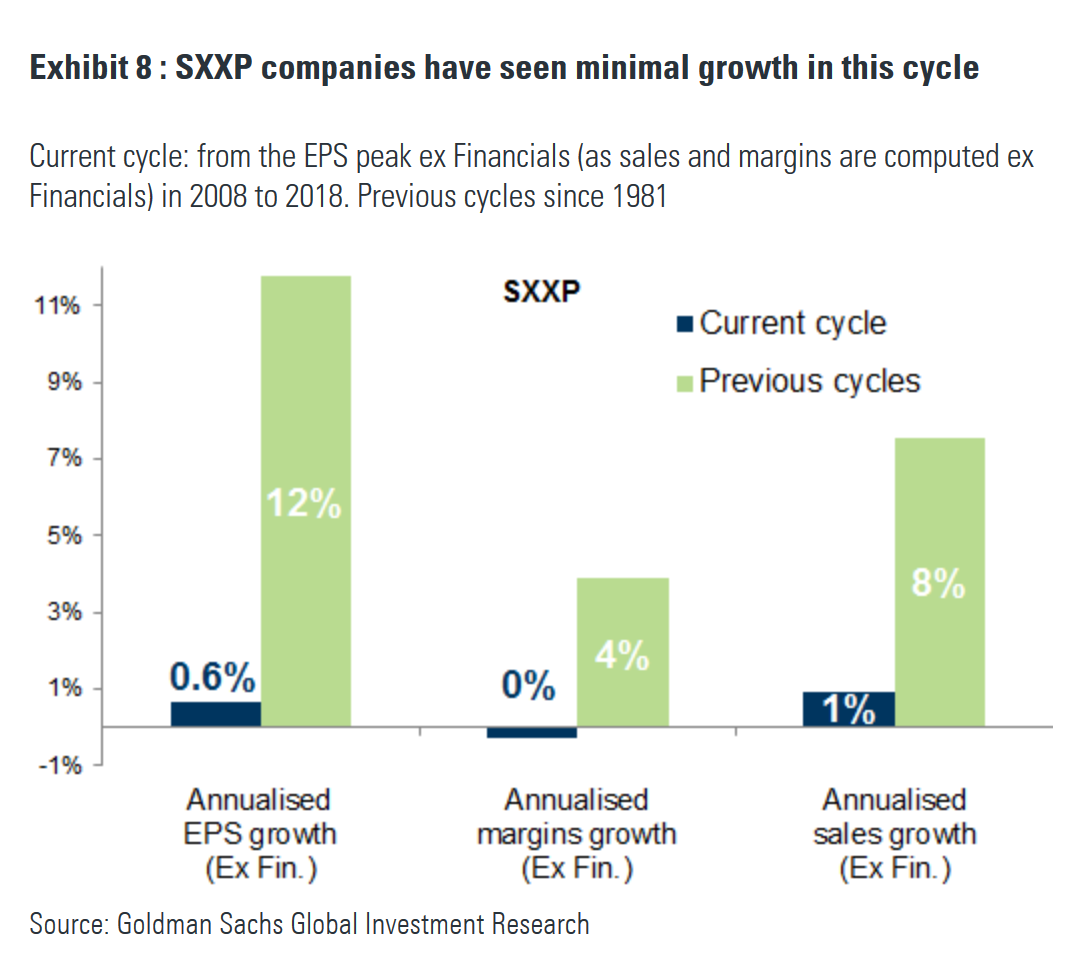

As an investor, you’ll want to know about this little chart in particular. It shows how European non-financial firms have not recovered from 2008 in terms of profits. Especially compared to historical recoveries. Source: The Market Ear

Source: The Market Ear

The charts don’t include financial firms. But keep in mind that European financials are in even more dire straits than the rest. The ones that haven’t failed already…

The Market Ear follows up with more charts showing European revenue growth has been half of GDP growth. And euro area GDP growth has been a third of the usual recovery rate since 1980.

The result, in terms of stock prices, is not surprising:

[European stocks] underperformed the US by 76% (in local currency terms) since March 2009 (51% including dividends), and the EPS [profits] differential explains 100% of this underperformance.

While S&P 500 EPS stands 86% above its pre-crisis peak, SXXP EPS is just 3% above. This has been a function of cyclical and structural growth differences between the two markets.

In other words, Europe’s poor economy and poor corporate profits are dragging it down. That’s precisely what you’d expect from sharing a common currency. The lack of a decent recovery because markets can’t adjust as they need to.

Another example of all this comes from the Financial Times:

Sweden, an open economy reliant on exports, has been squeezed, forcing its central bank, the Riksbank, to pause plans to raise its key interest rate above zero. Energy-dependent Norway, meanwhile, flush with a rising oil price, has its Norges Bank signalling it will lift its borrowing costs next month.

As a result, the two currencies have diverged. The Swedish krona is the world’s worst-performing big currency this year, losing 8 per cent against the dollar and almost 6 per cent against the euro, Bloomberg data show.The Norwegian krone has risen 1.4 per cent against the euro, while slipping about 1 per cent against the dollar.

Now imagine if the two countries were tied together with a shared currency and monetary policy in the Krozone. They’d lose the stabilising influence of their exchange rates and be doomed to a boom and bust economy. Divergence over time, not convergence.

The Polish politicians are aware of all this, reports Bloomberg. So they don’t want to join the euro:

“We’ll lose out one way or another” if Poland adopts the euro, ruling-party leader Jaroslaw Kaczynski told a rally last month. “We say no to the euro and no to European prices — we want European wages and we’re backed by a majority of Poles.”

Even the Polish central bank governor agrees. But Poland’s EU Industry Commissioner Elzbieta Bienkowska says otherwise:

staying out of the euro would mean Poland has no voice on important policy discussions. That could leave the country “side tracked” for generations, she said.

Doesn’t that sound familiar?

Perhaps that’s a new way to frame the Brexit debate. Do you want each nation to run their own affairs, or meddle in each other’s? Do you want complete control over what happens in your nation, or a tiny amount of control over what happens in others’? Which of the two leads to the best possible results?

But that’s playing the wrong game altogether, in my view. Especially for investors.

Who is meddling in whose affairs makes a marginal difference. My point is that any meddling is a bad idea, no matter who does it. And the results of meddling are huge for investors, as Europe’s stock and economic slump shows.

There’s a particular reason why political interference is so bad for investors.

Those running the show don’t know what they’re doing. They inherently and consistently make a mess of things. The question is, what are you going to do about it when it comes to investing your capital?

I tried to watch the new Brexit documentary Behind Closed Doors yesterday. It made me realise how clueless those in power really are. Not that it’s a surprise.

With the benefit of hindsight, it becomes obvious that political leaders consistently get things wrong. And yet, we still look to them for our future. Just because it’s a new face each time around.

I mean, stagflation was considered impossible until politicians caused it.

Germany’s central bank, die Bundesbank, has recently worked out it is clueless too. Low interest rates are supposed to spur spending, borrowing and investing. It turns out that’s just not what actually happens.

Instead, Germans are “bunkering” their cash in bank accounts, more than ever, due to low rates.

What did economists get so wrong?

Well, as interest rates fall, the opportunity cost spread falls to. The amount of interest you earn compared to just keeping your money in a checking account falls. You’re not giving up as much by being financially lazy.

But you do have to save more to reach the same sort of financial position over time. The power of compounding is dramatically less powerful at lower interest rates. And so, the Germans are saving more instead of spending.

In a way, I find it amusing. Remember all those kids who were shown by experts how small savings would multiply at the bank thanks to interest rates and compounding? They are now disappointed grown-ups with 0% interest rates.

That’s what you get for believing in the government. Financial literacy campaigners should keep that one in mind…

Also keep in mind that the reaction in other parts of Europe is the opposite to Germany’s. Over in Sweden, a world record 100% of Swedes are invested in mutual funds, one way or another. I suspect the number is higher than 100% in Australia, where even working holiday visa holders are forced to invest…

But Australia’s private pension investment industry was one of the worst performing in the world in 2008… Britain has since sought to copy it with auto enrolment.

My point here isn’t a pick and mix of failures. It’s to point out the nature of those failures.

We’re not talking about something that didn’t work as expected – a margin of error. We’re talking about a deep level of cluelessness. The regularity with which impossible and ruled-out political events happen.

Are you prepared to expect more such events given they’re dished out rather often?

In the private sector, deep rooted cluelessness leads to financially dangerous mistakes. Like bank failures. Like 2008.

The only thing propping up the financial world economy since then is governments and central bankers.

But the authorities don’t know what they’re doing either. Not at all. And their solutions tend to make things worse, not better.

Incidentally, the authorities don’t just muck things up in bad ways. Sometimes they create investment opportunities.

My friend Eoin Treacy recently flew in from Los Angles to explain one of those opportunities to our readers. It’s all about a fortnightly event that the US government has imposed on financial markets. One that predictably moves the markets in a very particular way.

That means profit potential for you, if you know about it. If Eoin’s testimonials are anything to go by, big profit potential.

This is just the sort of thing that investors need in a politicised stockmarket. Political profits.

Until next time,

Nick Hubble

Editor, Southbank Investment Research

Category: Market updates