June Carter: Well, go on down to Jackson; go ahead and wreck your health.

Go play your hand you big-talkin’ man, make a big fool of yourself,

You’re goin’ to Jackson; go comb your hair!

Johnny Cash: Honey, I’m gonna snowball Jackson…

June Carter: See if I care.

“Jackson”, first sung by the famous duo in 1967, is about a married couple who each claim to fit in better than the other when they arrive in a town called Jackson, after the “fire” has left their relationship.

It was originally written by a man called Billy Edd Wheeler back in 1963. He didn’t actually have a particular town called Jackson in mind when he wrote it – he just liked the way the word “Jackson” sounded.

Whatever Wheeler was thinking up when he drafted the lyrics, it’s unlikely the Jackson he envisioned resembled anything like Jackson Hole. And yet, as the central bankers board their flights to that idyllic valley in Wyoming once more for its annual Economic Policy Symposium, the song seems apt.

The end of an era

The days of central banks heading down to Jackson to rig global markets together amid the beautiful American landscape has ended. You could say that the fire has left the relationship.

The image of an era: Janet Yellen (former Federal Reserve chair), and Mario Draghi (reigning European Central Bank president) chat for the camera in 2016. Haruhiko Kuroda (Bank of Japan) stands by, amused by something out of shot (perhaps an onlooker suggested he stand on the railing).

The image of an era: Janet Yellen (former Federal Reserve chair), and Mario Draghi (reigning European Central Bank president) chat for the camera in 2016. Haruhiko Kuroda (Bank of Japan) stands by, amused by something out of shot (perhaps an onlooker suggested he stand on the railing).

The central bankers are no longer united, in fact their relationships have become competitive, as devaluation of their respective currencies becomes the name of the game.

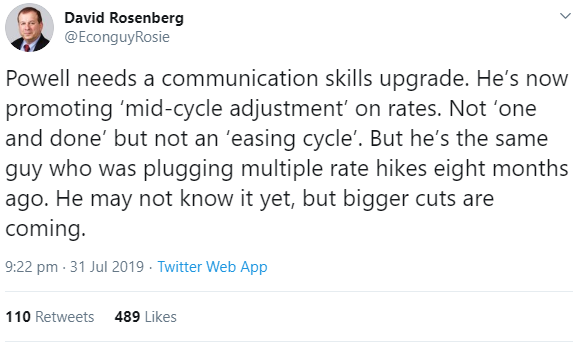

The “big-talkin’” that made men like Mario Draghi famous no longer has its intended effect. His promises of more stimulus can no longer make markets “stoop and bow” as they previously did. Market participants begin to wonder what phrases like “whatever it takes” will really mean if implemented. Jerome Powell’s claim that his rate cut was merely a “mid-cycle adjustment” and not the beginning of rate-cutting season is ridiculed.

Tweet by an angry David Rosenberg, chief economist of Gluskin Sheff

Tweet by an angry David Rosenberg, chief economist of Gluskin Sheff

As our own Charlie Morris remarked in a note to readers of The Fleet Street Letter at the beginning of this month:

The break has now come, and it has been fast and furious. Let me sum up the latest storm, and what needs to be done.

Last Wednesday, the Federal Reserve cut rates by 0.25%, which wasn’t enough. We can be sure that 0.25% wasn’t enough, because the dollar rallied hard. I’ll come back to this point.

Donald Trump then slammed heavy tariffs on to Chinese imports, and the Chinese devalued their currency, by 2.3%. That doesn’t sound much but a similar cut in 2015 caused equity markets to sharply correct by 10%. The Chinese also diverted soybean imports from the US, while releasing horrendous videos of their crowd-control tactics, ready to be deployed in Hong Kong.

The German 30-year bond now has a negative yield for the first time in history (the ten-year has been in and out of negative territory since 2015). It is accompanied by most eurozone countries (ex Italy, Greece, etc), Switzerland and Japan.

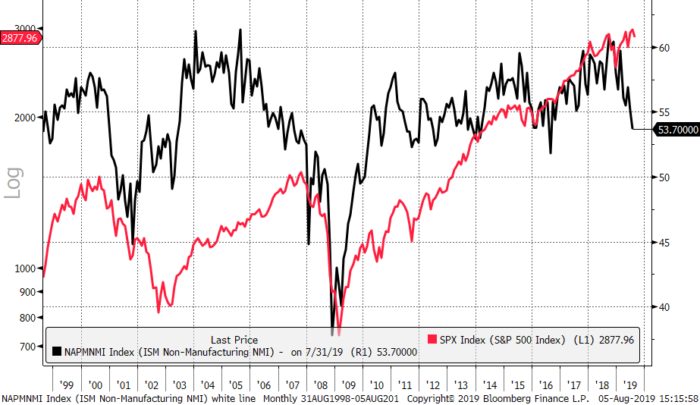

But right now, the storm seems to be everywhere. The latest indicator to wreak havoc is the ISM Non-Manufacturing Index (a US indicator of economic health). It has a history of dragging down the stockmarket and has been disappointing since this time last year.

The ISM NMI has turned down

Source: Bloomberg – ISM NMI (black) and the US stockmarket since 1999

Source: Bloomberg – ISM NMI (black) and the US stockmarket since 1999

The Fed falls short

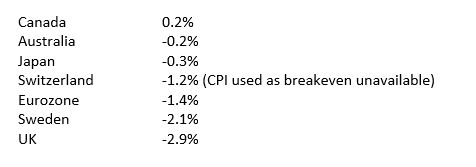

Having cut rates by 25 bps at the month end, the dollar surged on the news. The feeling is that while the major currencies are racing towards zero, the dollar isn’t doing its bit. US real rates at 0.1% look like tight money when you consider the competition.

Real rates (ten-year bond yield less ten-year breakeven)

A 0.5% cut by the Fed would have brought US real rates down to zero, thus closing the gap with the rest of the world. The positive real yield in the US will become a magnet for global capital, and that explains the recent dollar breakout.

China has now devalued in response, and that is sending a deflationary shock wave around the world. A 0.5% cut wouldn’t have changed much but might have prolonged the agony for a little while longer. I have written much on the renminbi devaluation thesis.

Markets believe the Fed will capitulate

The surge in the US long bond (remember that trade I was flirting with earlier this year) is essentially a signal that the US is just like the rest of us in the long and drawn-out aftermath of a banking crisis a decade ago. The dollar surge was short-lived. It only lasted a couple of days after the rate cut and then reversed; projecting gold higher in the process.

The reason is that US interest rate expectations have subsequently collapsed. The market now sees them not only going lower, but much lower. The euro rallied on Monday alongside a range of low interest rate (ZIRP) currencies. That’s because the rate gap is closing, and currencies are a relative game. It no longer matters if currencies are good or bad, just which are less worse…

“Go ahead, and wreck your health…”

The Jackson Hole Economic Policy Symposium kicks off on Thursday, and lasts two days – it’s quite fittingly been themed “Challenges for Monetary Policy”. This is where we’ll get a peek at what comes next for central bank policy.

It’ll likely be to go ahead and wreck the health of their balance sheets: what little there is in positive interest rates will be cut, and asset purchases will once more resume. As the voices of Johnny and June put it over 50 years ago:

I’m goin’ to Jackson, and that’s a fact.

Yeah, I’m goin’ to Jackson, ain’t never comin’ back…

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates