Somebody just got air-ambulanced nearby. The red chopper flew low over the rooftops with a mighty whirr, closer than any other aircraft I’ve seen whilst living here. All anyone could do is watch it through their windows like some metropolitan Vietnam movie.

That, and play guitar – some chap has brought out an amplifier and microphone and is setting up for some grand performance somewhere in the open nearby. I can’t see him, only hear him play scales and murmur, the sound echoing around the sunny buildings.

There’s a surprising amount of other air traffic amidst coronavirus. I’m writing this on my rooftop again, and despite travel bans, airlines facing bankruptcy, and the fear of crowded airports, the flight path I’m under remains heavily populated. Whenever I see an airliner pass overhead, I wonder how many people are inside.

Stuck within the confines of our homes, it feels as though we’ve lost agency over our lives, like now we can only react to things. This is an illusion, however. Now is not the time to simply wait for events to affect us – it is time for us to plot our next move.

Winning this next game in Vegas

Self isolation is like Vegas… You lose money by the minute. Drinks are free-flowing. And no one knows what day it is.

– John LeFevre, former investment banker and author of Straight to Hell

Starting back in the 1950s, an American fighter pilot called John Boyd began developing a strategy that would not only change the face of warfare, but would be adopted in fields as varied as cybersecurity, litigation, sports, business and markets.

It’s called the OODA loop: first you observe the situation, judge it based on your own knowledge pool (orient), decide a strategy of dealing with it, and then act on it. Then, once you’ve acted, you loop back to the beginning and observe your situation once again. Boyd’s adoption and understanding of this method earned him the nickname “40 Second Boyd” as an instructor in the US Air Force’s top flight school where he had a standing bet that he could defeat any opposing pilot from a position of disadvantage in 40 seconds or less.

But as you can imagine, this strategy extends a lot further than dogfighting. And I think it’s especially relevant for investors during these extraordinary times we are living in. This is absolutely not the time to be making any impulsive investment or trading decisions. It is not the time to be consulting emotions whatsoever on what to do next with your capital.

Remember: nobody – I repeat, nobody – actually knows what is going to happen next in markets – they can only speculate. And of course, some speculations are better informed than others. But chasing the next move – be it to the upside or the downside depending on your view – is not a wise choice right now, unless you have incredibly strong conviction.

Considering the risk you’re taking on if the market moves against you as swiftly and brutally as it has, I really don’t think you’re doing much harm in waiting a bit, and performing a bit of market reconnaissance.

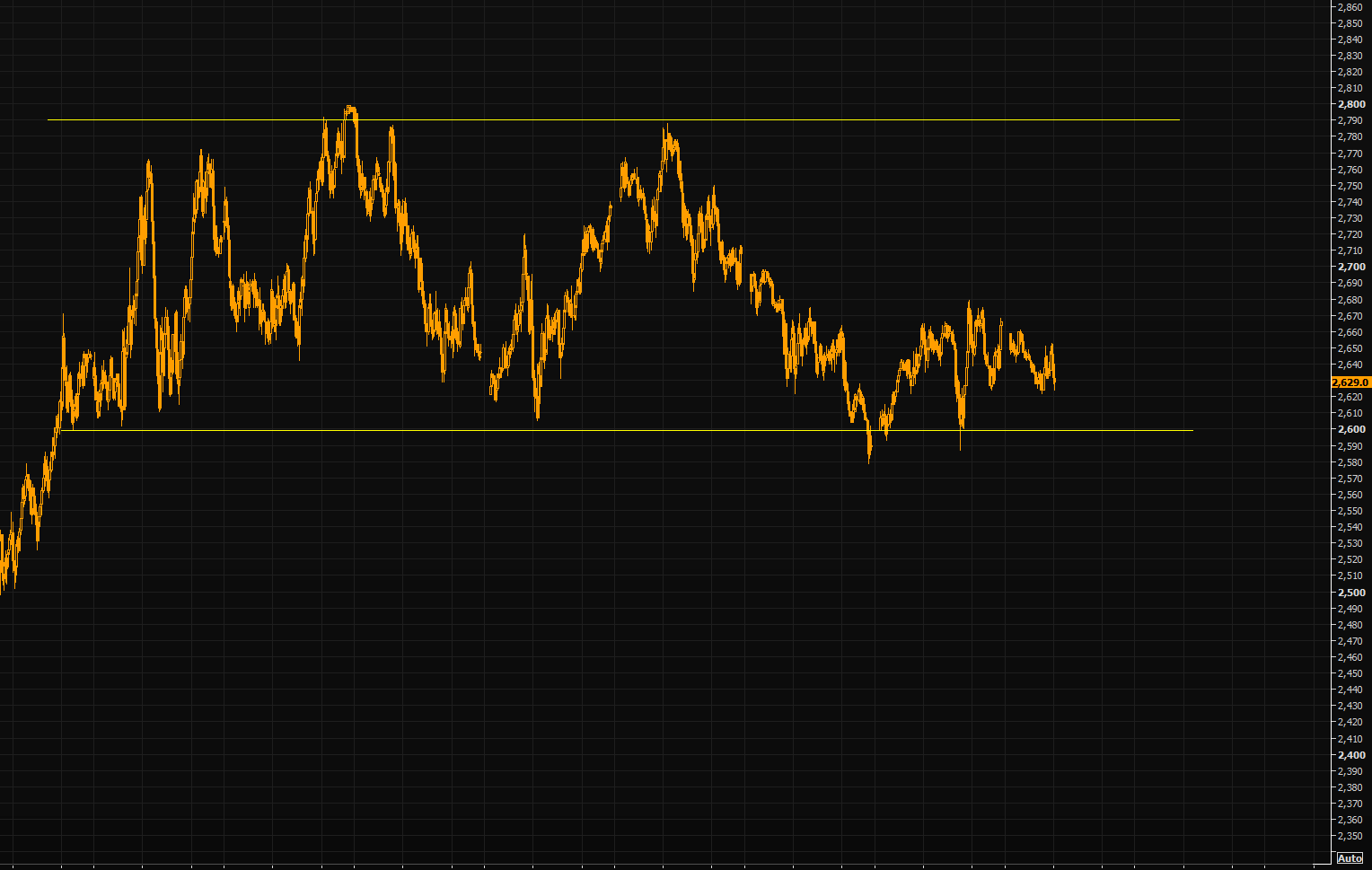

Now is the perfect time in my view to take a bit of time and thoroughly observe our market surroundings. It seems the market itself is currently doing this too in some sectors, like in the European stockmarket futures market which has traded in a narrow band since 25 March:

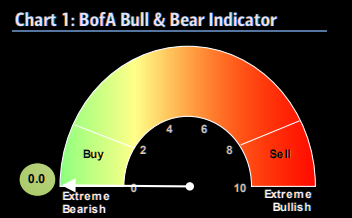

This sentiment is not echoed everywhere, however. Bank of America’s “Bull & Bear” gauge of market sentiment, intended to be used as a contrarian buy or sell signal, is now at absolute zero – as bearish as it gets:

CNN’s Fear & Greed Index, which similarly attempts to gauge market sentiment, gives a different reading however, of 21 (with zero being extreme bearish and 100 being extreme bullish).

A pandemic on the street, conflicting market signals and impulses, central banks seemingly losing control, chaos on the news, and rising international tension… it’s the investor’s fog of war. Time for OODA.

Cedar scented speculations

I’ve been mulling thing’s over while maintaining some of my own “investing infrastructure”: the humidor in which I store cigars. As readers of The Fleet Street Letter Monthly Alert will know, I’m very bullish on a certain type of cigar which has delivered sterling returns for decades and has never seen a broad-based market decline.

These are tangible assets, outside the financial system with a strong track record and a continuing strong investment case. I’m also a big fan as these tangible assets are in your own possession and as a result, they’re immune to counterparty risk.

I recently bought some more of these at auction, and am seasoning my humidor in preparation for their arrival: if cigars aren’t kept at the right humidity, around 70%, they dry out rapidly and become flavourless and pretty much unsmokable (and thus nigh-on worthless). This kind of maintenance and upkeep is the price you pay for avoiding counterparty risk, but it’s not an issue for me. Besides, seasoning a humidor is pretty therapeutic.

Humidors are just large boxes made of cedar, and you prepare them for cigar storage by staining the wood inside with distilled water – wiping it down, shutting the lid, waiting for the water to be absorbed, and then doing it all over again. You’re effectively turning the wood into a large sponge, which will keep humidity high within the box as time goes by.

Layer by layer, you keep staining the wood until its saturated. It’s incredible just how much water cedar can absorb and still feel dry on the surface. The sweet scent of cedar gets stronger with each application – its intoxicating. But after a while, the wood reaches its capacity, and applying any more water will only cause mould and destroy the humidor. It’s a bit like how individuals, households, companies, governments, and entire economies can only hold absorb so much debt before it ends up rotting them from the inside.

But back to my main two observations, I’ll expand more on these as the week goes on.

Number one: I’ve been banging on since late 2018 that we have entered a Second Cold War. The rest of the world is starting to seriously act like it. The Chinese Communist Party’s manipulation of the World Health Organisation and knowing export of the virus is stoking serious public uproar, and China’s dominance in medical supply chains (let alone everything else) is being revealed to be far above acceptable to the status quo.

I think this finally marks the end of the road for globalisation. What may come next is another form of globalisation, but it will not look like what we’ve had for the last 40 years. The reshoring of manufacturing out of the region will ultimately be inflationary, and cause serious geopolitical and domestic political disruption. Countries across the commonwealth – Australia, New Zealand, Canada and ourselves – which have tried to keep both the US and China on their side, are going to be pulled in both directions and there will be major upheaval for industries like finance which rely on both.

Number two: if Italy doesn’t leave the euro now, it never does so of its own volition. The halting of the economy puts its huge debt burden into a critical state; unable to print its own currency, the risk of default looms ever greater. Its banks, overloaded with toxic debt already, are in serious trouble when the debt that was being serviced is defaulted on due to the lockdown.

Bailouts will of course be administered and Christine Lagarde will do all she can to foster greater eurozone integration, but Germany and France will not let Italy get away scot-free and shoulder the bailout burden themselves. If ever there was a time for Italy to get back to the lira and/or default with a clean slate, it’s now.

Whether or not the political will is there, we’ll see – but there’s a freight train ploughing into the eurozone banking system right now, and such realities have a way of changing political discourse. Whatever happens to coronavirus now, it’s pushed over a domino in the Italian financial system that cannot be undone without unprecedented action. And I cannot imagine that action being positive for the value of a euro…

I’ll explore this more with Nickolai Hubble, who’s been studying the Italian banks for years, in today’s market broadcast. Once you get this note, it’ll be live –

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates