Today I want to take a closer look at the pound.

The general election is just a day away. With no clear winner in sight, forex markets have started to get the jitters, as my colleague John Stepek noted yesterday.

Yet compared to 2010, the pound is so far behaving rather well.

But tomorrow’s result could change that…

The pound’s movements aren’t all about what happens this week

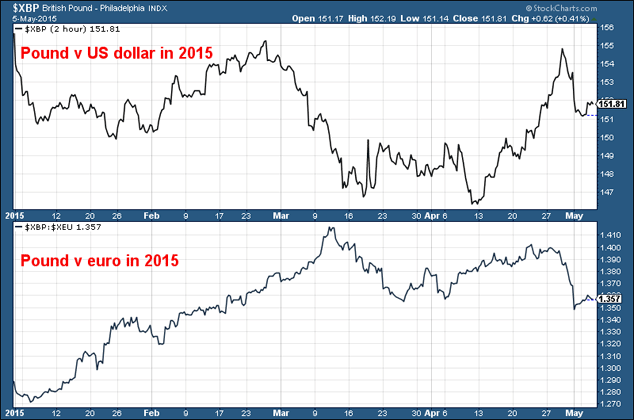

Here’s a simple chart showing what’s happened to the pound this year.

Above we have ‘cable’ (the pound against the US dollar); below, the pound against the euro.

We tend to be rather self-centred (it gets worse this close to elections), and attribute forex activity to what we as a country are doing.

We tend to be rather self-centred (it gets worse this close to elections), and attribute forex activity to what we as a country are doing.

However, both the euro and the dollar are much bigger currencies, representing much bigger economies than the pound. Their strength or weakness is often determined by factors that have little or nothing to do with the actions of the UK economy or its policy-makers.

The short story is that the pound is down 4c against the dollar this year, and up about 7c against the euro. The dollar has been strong, the euro weak, and the pound somewhere in the middle.

Sterling’s direction – like the outcome of this election – is not clear. Yet the forex markets have been rather calmer about the pound than they were in the lead up to the last election.

So far.

A trip back to May 2010

Cast your minds back to May 2010.

Labour had been in power for almost half a generation. But Gordon Brown was loathed.

Even so, the Tories weren’t trusted.

The polls – as they do now – showed no clear winner. Nobody was quite sure what would happen in the event of a hung parliament. Uncertainty was everywhere.

And – reflecting all that uncertainty – in the two weeks leading up to the big day, the pound fell from $1.55 to $1.47. (This time around it has rallied by a similar amount).

In the week that followed the announcement on 12 May of the Cameron-Clegg coalition, the pound fell further, dropping as low as $1.43. The forex markets did not like the idea of a coalition.

Yet that $1.43 has not been seen since – despite the extraordinarily strong dollar – which suggests that, broadly speaking (blimey, there’s a lot I can find fault with) this coalition has worked.

The closest we’ve come to the low was $1.46. That was just three weeks ago, when there was a burst of US dollar strength and Labour seemed to be edging the Tories in the polls.

I wouldn’t say the pound has been strong under this coalition government. But, whether against the euro or the US dollar, it has – until the uncertainty of the past month – crept gradually higher. (It was about €1.12 on May 2010 as opposed to €1.35 now).

The simplistic mantra is that you’ll see a stronger pound under the Tories than you will under a Labour. It’s not strictly true, of course.

When Tony Blair came to power, cable stood at about $1.59, and when he stood down it was $2. The part of Labour that the forex markets really didn’t like was Gordon Brown.

In the first few months after he became PM, sterling went as high as $2.10 and €1.50 (it seems incredible, now, that a pound was so high). But the US dollar was very weak then, nearing the end of a multi-year bear market, and we were at the end of a huge financial boom to which the UK (and thus the pound) was extremely levered.

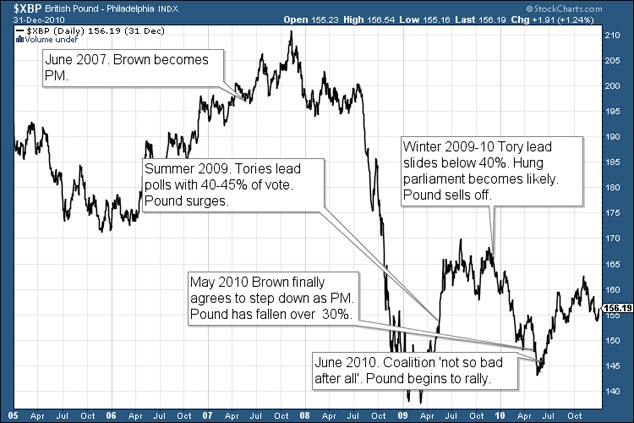

When the financial crisis got going, sterling plunged, and the only time it rallied was when the Tories were well ahead in the polls.

It seems incredible now in this age of inevitable hung parliaments, but in the summer of 2009 the Tories had well over 40% of the vote. It was only when that lead slid below 40% that the pound started sliding again.

Here’s that little history of cable in graphic form:

A Miliband government could be very bad for the pound

I have to say, I see Miliband’s Labour – in terms of perception, popularity and policy – as closer to Gordon Brown’s than Tony Blair’s. And I think sterling will react badly to a Miliband win.

It’s too early to say what a Miliband win would lead to. Perhaps he’ll prove to be a great economic leader overseeing a prosperous period of no deficit, reduced debt and tremendous economic growth.

But the initial reaction of sterling, I am sure, will not be positive.

On the other hand, I think it will breathe a sigh of relief at the prospect of a renewed Cameron-Clegg coalition.

By my reckoning, to head a majority coalition, the Tories will need to win some 285-90 seats, with the LibDems taking 25-30 and the DUP 8. That would take them past the 323 mark.

Labour will need about 265 to go with the SNP’s 52 and Plaid Cymru’s 4.

I know Miliband has firmly ruled out a coalition with the SNP (and one presumes he’s done this for a reason). But some kind of deal – even if it’s just an anti-Tory one – looks inevitable.

The Lib Dems could be kingmaker once again. They are probably closer in policy to Labour than they are to the Tories, but I can’t help thinking Clegg (for all sorts of reasons) would prefer to deal with Cameron than Miliband. Better the devil you know and all that.

So my view is that, by hook or by crook, Cameron will still be in charge after the election. And, after an initial wobble, sterling will rally as a result.

In short, I’m predicting a Cameron-somehow win and a sterling rally towards $1.60 by the time the year’s out, after a nasty post-election wobble.

Miliband in Number 10, and we go sub-$1.45.

Clearly, that’s a pretty significant difference. John and Merryn will be reviewing the outcome for MoneyWeek readers on Friday morning – if you’re not among them yet, find out more about our post-election action plan here.

Category: Market updates