So the Chinese Communist Party ram £130 billion worth of stimulus into its financial system in a day…

It makes it illegal for major shareholders in companies to sell any stock for six months…

It straight up bans people from shorting the market…

And still the Chinese stockmarket gets whacked 10% in just a few hours.

It’s a good reminder that as much as state planners try to gather the tide of money into their hands, it’s a force that is ultimately out of their control.

Though it may appear the central banks and the treasury departments, and the financial regulators hold all the cards and pull all the levers, a line from the 1981 classic Rollover still rings true: “Money – capital – has a life of its own. It’s a force of nature. Like gravity, like the oceans… it flows where it wants to flow.”

The longer the price suppression… the larger the market distortion… the harder the eventual hangover will be.

You’d be forgiven for forgetting that these days, as the hangover just hasn’t arrived, the wild spectacles at the end of the party just keep dragging on, becoming ever more extreme. It’s taken a pandemic in Asian markets for some investors to grab their coat – only to be blocked at the door by the host, grinning with yet another cauldron of punch.

Noise of the commotion in the East doesn’t even appear to have reached the party in the US. The share price of Tesla ($TSLA), which reported it had burned some $800 million in 2019 last week, has rallied 14% since the announcement, rising almost $100 in share price at the time of writing:

Tesla since mid-December. Earnings announcement indicated by crosshairs.

Tesla since mid-December. Earnings announcement indicated by crosshairs.

Source: Yahoo finance

The level of speculative cash sloshing into risky assets was broadcast all over the world over the weekend during a break in Super Bowl LIV, where a startup called Quibi had spent millions on a notoriously expensive advertising spot – when it hasn’t even released a product yet.

This has happened before: at the peak of the dotcom bubble.

In Super Bowl XXXIV back in 2000, no less than 11 startups purchased the notoriously expensive ad space. The very next year, eight of those 11 companies had either gone bankrupt or been sold at a deep discount to their value at the time of the game. Pets.com, the most notorious of the dotcoms, was one of these, which went broke no more than ten months after its ad was aired during the game.

Admittedly, the excess was much more extreme in that case – far more startups were burning their cash on the ads – but it’s representative of where we are in the investment cycle. Bull markets don’t start from here. The party attendees have not just arrived with a full stomach and a fresh liver – they’re already hammered, and are reaching that stage of the evening where alcohol tolerance has begun to matter.

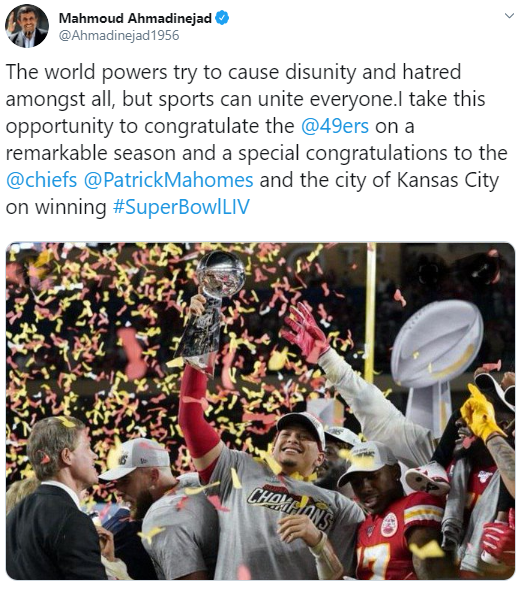

I say the Quibi ad was broadcast “over the world” and not just in the US, for as nationalistic American football might appear, you’ll find the event has an incredibly diverse and multicultural following:

What a time to be alive

What a time to be alive

Source: Mahmoud Ahmadinejad, on Twitter

Donald Trump’s use of “Make America Great Again” will go down in history as one of the most deeply subversive and persuasive slogans of modern Western politics. The Don has a way of getting what he wants, including goosing the stockmarket by spamming his Twitter feed with information (true, or not) about the economy or prospective trade relations with China.

But his reflection is cast ever clearer upon markets, when you consider that under his presidency, for the first time in history there were four US companies worth a trillion dollars, with a familiar acronym.

Microsoft

Apple

Amazon

Google has slipped a little below $1 trillion since January, but if the punch keeps flowing, $MAGA is the name of the game…

… until it isn’t.

I’ve told you on multiple occasions my melt-up thesis, and I stand by it – as absurd as valuations may be now, they can still become more absurd. Individual disbelief has no bearing on the situation – the old cliché that markets can stay irrational longer than you can stay solvent certainly applies.

But at some point, the party will end somehow. $MAGA will crack. And you should have a strategy in mind now, right as we’re enjoying the crazy phase, for how you’re going to deal with that.

And the solution really isn’t all that simple. When rotten banks in Europe keep their heads above water despite the terrible debts dragging them down, when investors are paying the French government to borrow their money while protestors are literally setting it on fire, when companies are rewarded the more capital they destroy… you’re left wondering what could actually be strong enough to cause a massive shift in price.

This is compounded when you consider that bad news isn’t necessarily “bad” for asset prices any more. Bad news can now be good news for stockmarkets, because bad news = more free money from the central banks = rising stocks prices = good news. You end up questioning if you can really trust any fundamentals, or indeed be certain of anything in the future except more government intervention.

All from me for today. Tomorrow, we’ll get to the bottom of yesterday’s riddle…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates