“We have been striking for over a year, and basically nothing has happened.

– Greta Thunberg

The world’s most valuable listed company was born yesterday – right as its polar opposite made the front page of Time magazine.

I’ve noted in previous letters how this year has been a bad year to get in on initial public offerings (IPOs), with the likes of Uber and Lyft tanking from the get-go. But as I wrote a couple weeks back, there was one I was bullish on. And considering it’s jumped 10% on its first day of trading, I guess I wasn’t the only one.

This company doesn’t have any of the Silicon Valley charm – quite the opposite in fact, which was one of the reasons I liked it so much – it has something much more valuable: good gulf gasoline.

Based on the value of the 1.5% of shares that are now in public hands, Saudi Aramco now has a value of £1.42 trillion. To provide some comparison, that’s more than two Amazons, almost four and a half JP Morgans, 15 BPs or 125 Deutsche Banks. The arrival of this one company has tripled Saudi Arabia’s stockmarket weight, putting it ahead of India overnight:

Source: Holger Zschaepitz, on Twitter

Source: Holger Zschaepitz, on Twitter

My case for Aramco is simple: interest rates, and yields, are set to decline. A company which supplies something the global economy cannot live without, pulling it out of the ground at a cheaper cost than anybody else at a vast profit, and pay that out in massive dividends is a diamond in the rough.

This diamond remains out of reach for UK investors, but the Saudis are putting out feelers to list Aramco in Asia as well – perhaps if the stock continues to hold strong, then we’ll see it come to London or New York.

The Cover Curse

Of course, from the perspective of some, any capital related to fossil fuels is cursed, and their voices are being greatly amplified these days. Greta Thunberg’s announcement as Time’s Person of the Year on the very same day of the Aramco IPO is damned ironic, though it may well have been deliberate.

I mentioned “The Power of Youth” Time alludes to in its headline yesterday – I expect we’ll see that “power” exhibited today when the votes are counted…

I mentioned “The Power of Youth” Time alludes to in its headline yesterday – I expect we’ll see that “power” exhibited today when the votes are counted…

Source: Time

Nobody likes being lectured to by children, and while Thunberg’s self-righteous indignation can be very irritating (stolen my dreams, how dare you etc, etc) I mostly feel sorry for her. I can’t imagine what it must be like to have Asperger’s, and have your anguish over environmental issues be encouraged and exploited by your parents for political ends.

Still, it must be pretty funny travelling the world on a mission to tell everyone else not to travel. And she’s wisely chosen not to confront the world’s largest polluter, which is run by a political regime known for doing doing very scary things to people it’s confronted by, which must help her sleep at night. But I digress.

The coronation of Thunberg on Time poses a question – are we at the beginning, or the peak of the green energy and Whoever gets that call right stands to make a lot of money, and magazine covers often indicate the opposite of their intentions.

There are plenty of examples of the “Cover Curse” over the decades. Probably the most oft quoted is this from BusinessWeek in 1979, right before a massive bull market for stocks:

More recently, the Economist in late 2016 put this on the cover right as the dollar began to decline:

More recently, some investors, including our own Charlie Morris have invoked the cover curse at the sight of Bloomberg’s claim that inflation has simply died:

In recent years, Time magazine hasn’t exactly been on the ball when it comes to predicting future trends:

Both magazines printed in the run-up to the 2016 election

Both magazines printed in the run-up to the 2016 election

Source: Time

So perhaps the coronation of Thunberg as the youngest person to get on the cover is a similarly deceptive guide to the future. My colleague Nickolai Hubble reckons this is the case, and thinks next year is going to be a bad one for the greenies.

But I take a different view. Key to what happens anywhere in markets these days are the actions of central banks, and it’s becoming increasingly clear that central banks are gearing up to print money in the name of saving the planet. This should act as a massive tailwind for – and the ones which aren’t.

One of the boldest practitioners of printing money is the Swiss central bank, who printed money to buy major US companies far from its borders in the name of weakening its currency, while at the same time gaining a share in some of the world’s most profitable companies in exchange for paper.

Such actions were always bound to invite a political agenda, and so it has, painted bright green.

From Reuters, emphasis mine:

The Swiss central bank could be required to pull its $800 billion balance sheet out of investments in fossil fuel companies in a move by one of the world’s biggest reserve banks to tackle climate change.

Swiss lawmakers are preparing a campaign that would make targeting climate change one of the policy objectives of the Swiss National Bank, alongside the traditional monetary targets of ensuring price stability and fostering economic growth.

The drive will begin this month with a motion in parliament’s lower house, two lawmakers behind the campaign told Reuters. The push is coming from the centre-left Social Democrats (SP) and the Greens, which achieved record results in October’s elections.

The SNB built up a $800 billion balance sheet during efforts to rein in the safe-haven Swiss franc, giving it an unusually large investment portfolio for a mid-sized country’s reserve bank, around a fifth the size of the balance sheets of the European ECB or the U.S. Fed.

Its investments include stakes in fossil fuel companies such as Arch Coal, Exxon Mobil Corp and Chevron.

“This is a climate emergency and we need to take action as soon as possible,” said Adele Goumaz Thorens, a Green politician who proposes this to the upper house early next year. “The SNB has invested so much money it is incredible and could really be an actor for change.”

Sandro Leuenberger from pressure group Climate Alliance Switzerland said: “The SNB is the eighth biggest institutional investor worldwide, and it gives Switzerland a huge weight internationally…. It’s the biggest lever Switzerland has and we have to use it.”

With money printers like these you could argue, who needs investment analysis? Just buy everything that’s painted green…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

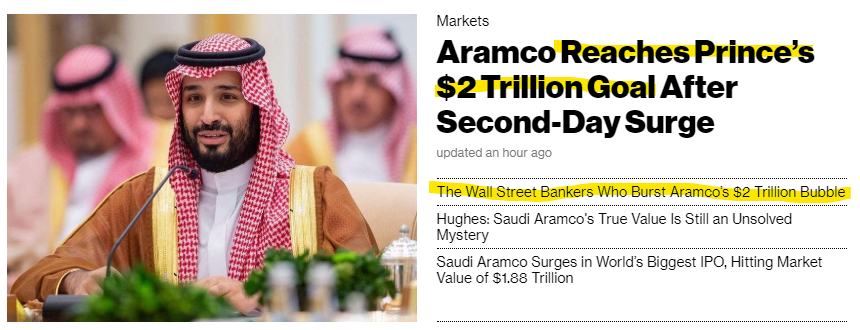

PS A quick note: as of this morning, that implied value of Saudi Aramco has risen by several more Deutsche Banks: it’s now over two trillion dollars – £1.51 trillion. While I’ve been bullish on Aramco’s IPO success, this was not something felt by the mainstream press, and its rise post-IPO has led to an amusing front page on Bloomberg this morning:

Category: Market updates