“It’s never a good time to be poor, but now is a really bad time to be rich.”

Steve Diggle, a hedge fund manager said that in a Real Vision interview back in 2014.

On the face of it, this statement appears ludicrously incorrect.

A quick look at the figures, and it would appear that the 2010s are a damned marvellous time to be rich.

In 2017, 82% of all wealth generated globally was earned by the richest 1% of the population.

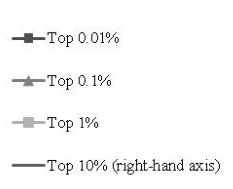

Here in the UK, the top 0.01% of income earners make triple what they did in in 1995. Of all income paid in the UK, they take home 2.5% of it. In fact, everyone in the top 10% of income earners has been having a whale of a time, only earning more in the pre-2008 run up:

Click to enlarge. Source: Institute for Social and Economic Research

Click to enlarge. Source: Institute for Social and Economic Research

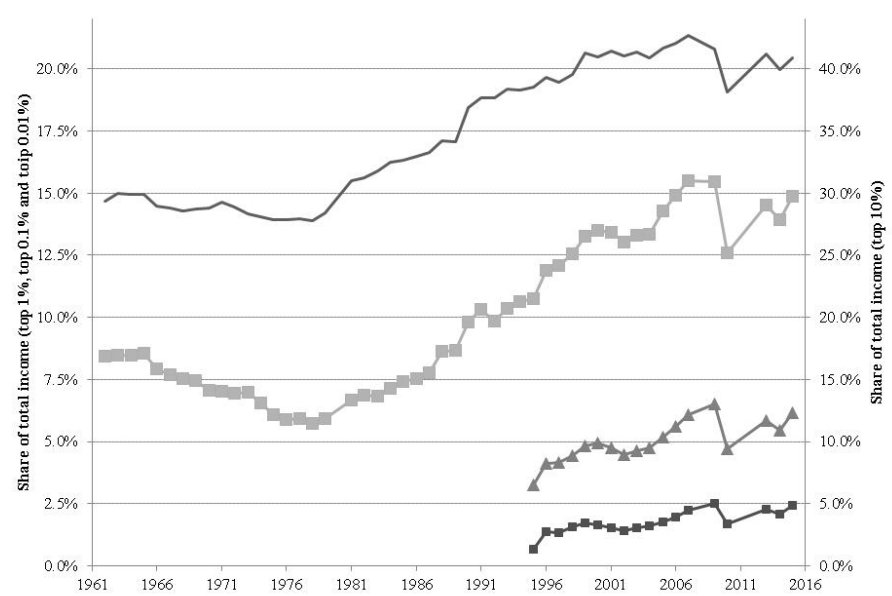

And what’s better, for all that that extra income… they’re needing to work for less and less of it!

For the top 0.01% of income earners in the UK, 40% of that income is “unearned”, coming from financial instruments (stocks, bonds, etc) rather than employment, a figure that has been rocketing higher since 2010:

The share of income for top income earners which comes from earnings rather than investments

The share of income for top income earners which comes from earnings rather than investments

Click to enlarge. Source: Institute for Social and Economic Research

It gets even better in the States.

Today in the US, the top 0.01% are now taking home a larger slice of the pie than they were at the height of the Roaring Twenties. During the age of “Robber Barons”, the likes of John D Rockefeller cornered 4.8% of all income in the US, earning great notoriety for their grand wealth and political influence.

Today, that 0.01% elite is now populated by the Barons of Silicon Valley who currently take home an incredible 5.1% of all income in the US.

With the wealthy in the US getting a tax cut, and Boris Johnson promising some of his own here in Blighty, it would appear that Steve Diggle is still in the wrong, and that the present era is a terrific time to be rich.

But actually, I reckon he’s right…

The Robbers will be robbed… but they won’t be the only ones

A society with elder ‘power elites’ and young visionaries feels very different from a society with elder visionaries and young ‘power elites’. The first is an Awakening, the second a Crisis.

– John Howe, co-author of The Fourth Turning

The reign of the Robber Barons came to an end when their notoriety caught up with them. Having built a reputation of kings answerable to no one (Rockefeller, pictured right in Puck Magazine), they became political targets. Antitrust action broke their monopolies apart.

We are beginning to see the notoriety of the Silicon Barons reach a similar degree. The threat of antitrust against tech giants is actually a bullish scenario for their stocks, but that’s for another time.

What really threatens the rich, and not just those in Silicon Valley, is the rise of the voting millennial. We saw a foreshadowing of their power over the election in 2017, where if polls are to be believed, two thirds came out in support of Labour.

Lacking the property that would make them value property rights, and full to the gills with student debt, the participation trophy generation have yet to really clear their throat at the ballot box.

But with a new general election on the cards, we’re set to hear the voice of the cohort much more clearly, as quite simply, many more of them are now eligible to vote. And at nearly 30% of the electorate, they cannot be ignored by any political party – anybody wanting to win will need to pander to them.

What will they want? Well, this advert targeted at them offers a decent glimpse at their situation:

But it ain’t a pair of boots they’ll be demanding at the ballot box– it’s a bailout. And they don’t grow on trees.

More to come,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates