Of the many brilliant Calvin and Hobbes comic strips penned by the great Bill Watterson, there is one which aptly describes our direction this week.

Six-year-old Calvin feels that technology has separated humans from nature. And so while out walking in the snow he asks his tiger companion Hobbes what life is really all about:

“You know, Hobbes, it seems the only time most people go outside is to walk to their cars. We have houses, electricity, plumbing, heat… maybe we’re so sheltered and comfortable that we’ve lost touch with the natural world and forgotten our place in it. Maybe we’ve lost our awe of nature.

“That’s why I want to ask you, as a tiger, a wild animal close to nature, what you think we’re put on earth to do. What’s our purpose in life? Why are we here?”

After a moment pondering, Hobbes responds in his cheerful, matter-of-fact manner:

Calvin promptly returns home and begins turning on the lights, and turning up the heating.

Calvin promptly returns home and begins turning on the lights, and turning up the heating.

Reality, or at least reality from a tiger’s perspective, isn’t something everybody wants to dwell on. And as we explored yesterday, escaping reality has not only been an increasingly popular pastime, but a great investment as a result.

Indeed, even when the industry is riddled with scandal, the escaping reality business has been able to escape its own reality: when the Harvey Weinstein scandal began is the same time the S&P 500 Movies and Entertainment index started a thunderous rally!

The Weinstein scandal began 5 October 2017, with a lengthy piece published by the New York Times published an article detailing decades of sexual harassment allegations

The Weinstein scandal began 5 October 2017, with a lengthy piece published by the New York Times published an article detailing decades of sexual harassment allegations

An incredible 1,640 CEOs in the US quit last year – the highest ever on record, including 2008. But if you’d paid attention to that, and actually became concerned that something might be amiss, your portfolio wouldn’t have rewarded you for it.

Nor would you have been rewarded for worrying that some 40% of all the publicly listed companies across the pond have been losing money for the last three years.

In fairness, I have ignored both of these realities: that CEOs are jumping ship, and that so many profit-seeking enterprises aren’t generating any profit. Or at least, I haven’t let them colour my perception of what is really powering the market, which brings us back to our old enemy, the central bankers, who are now all printing money at the same time to keep asset prices going up. That, and the share-buyback complex, in which companies purchase their own shares back from investors (often using debt to pay for it) are the reality of what is making stock prices go up.

The market appears to only care about these realities, and ignore all else. It’s adopted Calvin’s approach: forget that the private sector, the golden goose of any economy is devouring itself alive; go back inside, turn on the lights, turn up the heating, and buy stocks.

I began calling for a stockmarket melt-up in August last year (Fear is in fashion – 19/08/2019), and have since repeatedly predicted its arrival. It has now arrived, and with such haste that it could easily slip and have a sudden sharp fall on very little news. But after any such stumbles, I think 2020, as I detailed to subscribers to The Fleet Street Letter Monthly Alert with a list of profit opportunities if I’m right, will be a repeat of 2017 – a ridiculous increase in speculative financial asset prices, with cash spilling into some of the most absurd investment opportunities ever designed.

I am no cheerleader for the stockmarket. This is as much of an opportunity for investors, as it is a risk: the more the rich get richer, the more politically palatable seizing their inflated wealth will become.

But ignoring reality, as the market now does as a matter of routine, has consequences. And looking around at reality, in real goods like commodities, you begin to notice the odd anomaly here and there.

Let’s go for a stroll, shall we? Let’s go regain that “awe of nature” that Calvin was on about…

Corn is now so ignored that it now looks like a chart of Deutsche Bank:

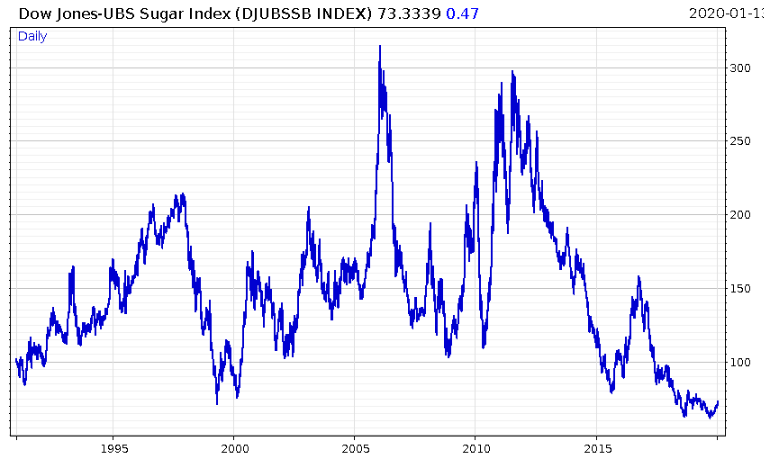

Sugar too, has been brutally caned in recent years:

And despite a little smidgen of action recently, coffee appears similarly devoured:

Indeed, pretty much everything that comes off a farm has been shunned in recent years. Here’s the Bloomberg Agriculture index:

It looks like it’s hit bottom at least – but it’s got a long way to go…

However, when you begin looking at the fruits which lie below the Earth’s surface, things get more interesting.

Something happened at the beginning of 2016. Who knows exactly what that was, and the exact chain of events that led to it. But it’s begun a trend that is still rolling with momentum today, and doesn’t appear to be running out of juice.

Though the greenies doth protest in ever shriller voices, oil is still the oxygen the global economy breathes, and it’s likely this trend I’m about to show you began with it, as it’s such a key input. Oil bottomed right at the beginning of 2016, and has continued to rally since:

But it’s not just oil. Right at the same time, uranium follows a very similar path, recovering from the hatred it received after Fukushima:

Higher oil, means higher energy prices, so the tight correlation is perhaps not quite that surprising. But it is interesting to see that the trend in both has not stopped.

And even more intriguing, it wasn’t just energy that took off right at the beginning of 2016, but copper as well, which carries on cranking upwards.

Venture further into the niches, and you’ll find even more compelling eruptions emerging within the commodities space, or what I now like to call “reality”. We’ll explore those tomorrow – as the market action, and the potential opportunities therein are extraordinary.

The three charts above appear to be an example of where oil inflation has caused a contagion of higher prices into basic input goods, as raising the basic cost of energy makes everything requiring energy (ie, reality) more expensive.

It’s this dynamic I suggested in last week’s letters that the US might exploit to create high inflation and thus regime change in its rival, the authoritarian China which cannot survive inflation the way a democracy can. (Who knows – maybe Washington has been playing the long game since 2016.)

That doesn’t mean inflation doesn’t affect democracies however. Should “reality” – the commodities space – and that trend since 2016 within it continue, there will be consequences for investors. And, even, for the escaping reality industry.

More to come…

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates