Owls have a reputation for being intelligent beasts. It’s hard to say where exactly this idea came from, other than their behaviour as predators, but it’s likely because Athena, the Greek goddess known for her wisdom was said to wander around with one.

A falconer told me a few years back that this is actually a huge misconception. Owls have little space in their skulls for anything other than their massive eyes: there’s little room in there for grey matter. But they sure do look clever. And appearances mean everything to central bankers.

If you follow the financial press you’ll likely be familiar with the terms “doves” and “hawks” to describe central bankers wishing to cut or raise interest rates respectively.

Dovish cuts are deemed peaceable for economies, while hawkish hikes more aggressive, (those who don’t want to cut or hike rates are occasionally labelled ”pigeons”). Christine Lagarde, the French convict/Hermes brand ambassador/president of the European Central Bank (ECB) wants to strike a new path, and make “owlish” market slang, brain-size notwithstanding.

“I’m neither a dove nor a hawk, my ambition is trying to be this owl that is associated with a little bit of wisdom” she hooted yesterday, to great adoration. But when it comes to interest rates, Lagarde has little options, so it’s no surprise she’s decided to give her existing options different labels to make them seem new.

The Eurozone is lacking growth or inflation, with interest rates already negative – the very idea of a rate hike, of increasing the costs for debtors in the massively indebted Eurozone, I.e. the idea of being “hawkish”, is ridiculous.

There are no birds of prey flying over European markets, killing off the inefficient weaklings. “Natural selection” when it comes to the efficiency of businesses has been put on hold – indefinitely. Large businesses on the continent are now being paid to borrow cash, with the risks of their ventures no longer borne by them at all, but only by those that lend them money thanks to the “owls” in charge at the ECB.

With the Eurozone producing little growth or inflation, Hawks may as well be extinct in the ECB. When it comes to interest rates, Lagarde has little choices but to decide just how deep-fried her dovishness will be, i.e. how negative can she drive interest rates without causing a heart attack for the banks which rely on positive interest rates?

Interests rates, once the main event, are really a side-show now for the Eurozone – what you need to look out for are Lagarde’s… “other” responsibilities. Those tasks are not officially listed under her job description, like printing money in the name of saving the planet… and getting the governments of central Europe to share a budget and borrow under one credit card.

She hinted at the former task yesterday:

…in our strategic review, we will take up climate change, we will take up the fight that is taken up by the European Commission and I hope other European institutions and see where and how we can participate in their endeavour.

As we’ve written in recent issues of Capital & Conflict, we reckon a green bubble is on the way –

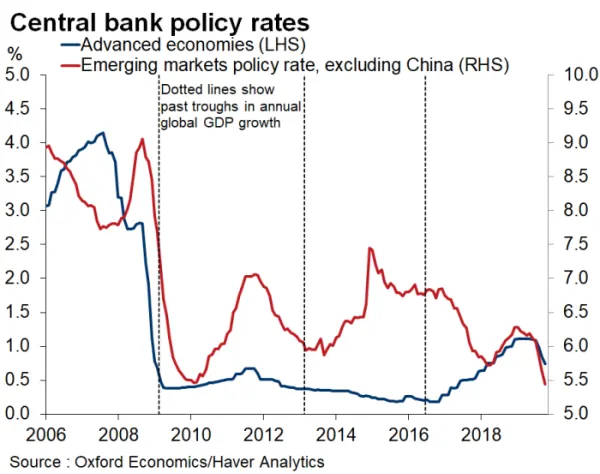

What’s more, I think all this ”deep fried” dovishness is going to turn 2020 into the year of the “melt-up”. With the ability to borrow money easier than ever + money printing by all the major central banks, I reckon financial assets may broadly increase in value, even if the economic activity behind them breaks down. After all, the ECB isn’t the only one cooking up deep fried doves for dinner – now we have the rare occasion of both emerging and developed countries cutting interest rates in sync:

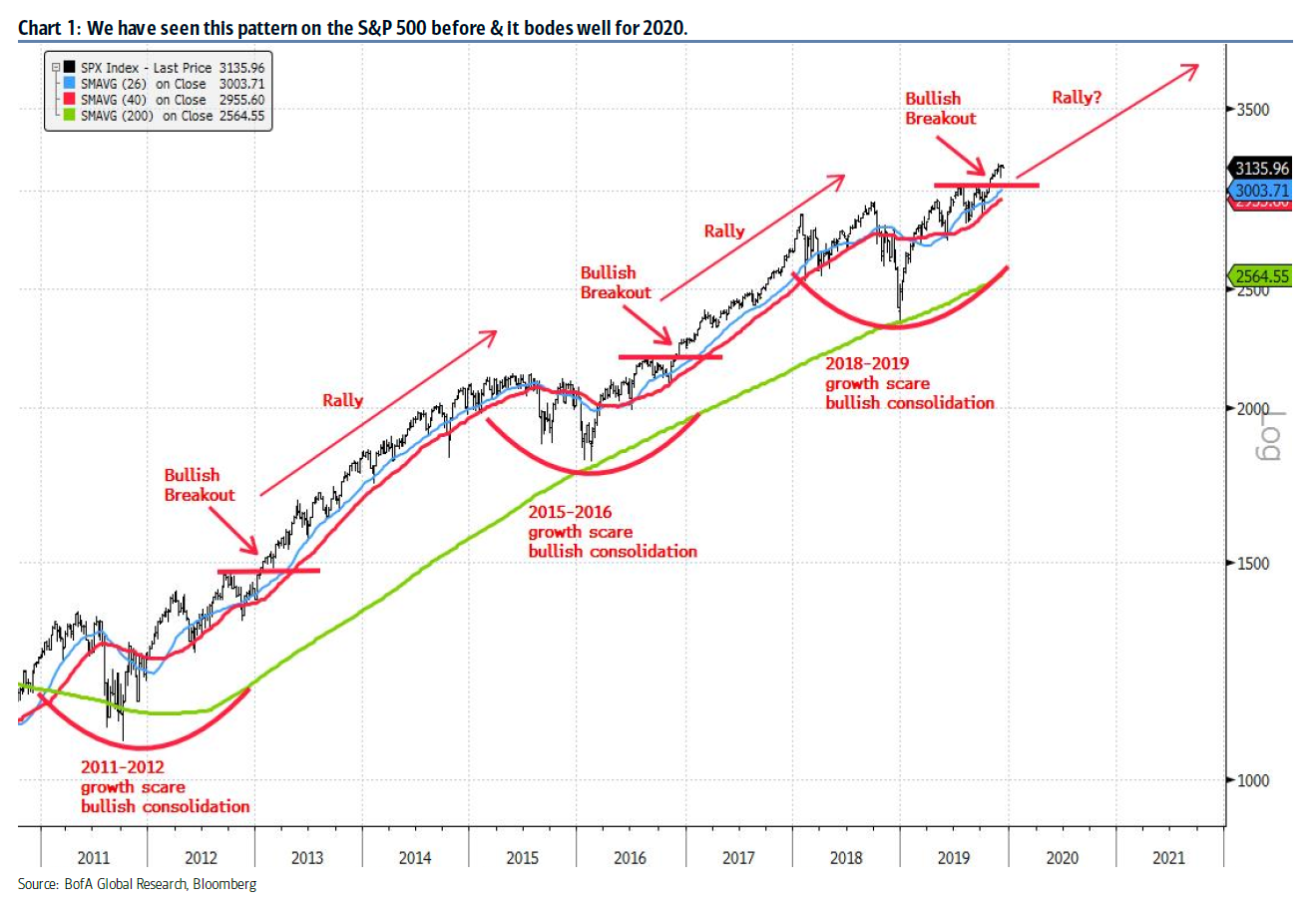

I see a melt-up as a risk, rather than a benefit to the global economy, as it will only increase wealth inequality and make the distance between the everyman and the elite ever wider. But as I’ve written in previous letters, it feels like we’ve just relived 2016, and the bull market of 2017 is just around the corner. Those at Merrill Lynch illustrate it similarly:

While Greece’s myths may have driven her chosen avatar’s reputation, in an ironic twist Lagarde made it clear in the same press conference that Greek banks would not be free of their existing lending restrictions.

Still, at least the conspiracy theory crowd will be chuffed. The owl is the symbol of the Bohemian Club, which has hosted industry and political elites in a grove California for over a century, with numerous US presidents on its membership roster. Lagarde’s announcement will no doubt be considered a pledge of allegiance to that particular “parliament” (the fitting collective noun for owls).

While I’ve an admiration for the vigilant souls living on the fringe, I’m not sure the owl in question has a brain any larger than those you’d find in the wild. Though perhaps if we end up finding owls hiding on euro banknotes, I’ll reconsider…

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates