Though the year 2019 will not go down as one in which you finally began to earn some decent interest at the bank, it will at least go down as one which produced some exceptional political theatre.

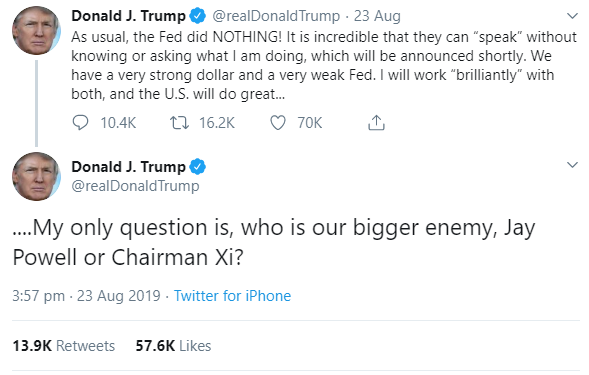

Who would’ve thought we’d see the president of the US ask if Fed chairman Jay Powell was a greater threat to Americans than Xi Xinping of the Chinese Communist Party?

But the Fed drew its own dagger yesterday. Bill Dudley, the former vice chair and president of the Federal Reserve Bank of New York (2009-2018), openly declared the Fed should begin dictating US trade policy and picking election winners.

From his article in Bloomberg:

… [Fed] Officials could state explicitly that the central bank won’t bail out an administration that keeps making bad choices on trade policy, making it abundantly clear that Trump will own the consequences of his actions.

… I understand and support Fed officials’ desire to remain apolitical. But Trump’s ongoing attacks on Powell and on the institution have made that untenable. Central bank officials face a choice: enable the Trump administration to continue down a disastrous path of trade war escalation, or send a clear signal that if the administration does so, the president, not the Fed, will bear the risks — including the risk of losing the next election.

There’s even an argument that the election itself falls within the Fed’s purview. After all, Trump’s reelection arguably presents a threat to the U.S. and global economy, to the Fed’s independence and its ability to achieve its employment and inflation objectives. If the goal of monetary policy is to achieve the best long-term economic outcome, then Fed officials should consider how their decisions will affect the political outcome in 2020.

But if Dudley, the Goldman Sachs alum who oversaw one of the greatest divides in wealth in US history, thinks this article does him and his former buddies any favours, he’s got another thing coming.

“Don’t fight the Fed” used to mean don’t doubt the Fed’s ability to restore investors’ confidence in the economy. Broadening that definition to include political influence, as though the Fed should take the role of deep-state kingmaker cartel, will blow up in Dudley’s face. His article already substantiates the suspicion that the Fed is politically biased, and will only increase the support for Trump’s antagonism.

While Dudley draws a dagger, Trump puts a gun on the table…

Before wishing Sean Connery a happy birthday, Trump thought the time was ripe to up the ante of Cold War II in dramatic fashion.

Though we did not predict the Sean Connery twist, we did allude to this particular gun being placed on the negotiating table in Capital & Conflict earlier this month.

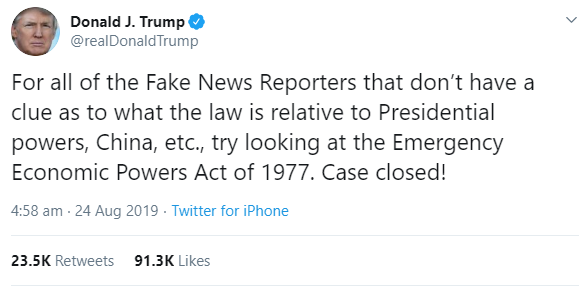

In Missile crisis incoming (6 August) we argued that investors with capital invested in Asia may soon face the same fate as those with who invested in Iran and Venezuela prior to those countries being shut off from foreign capital by the US. And the method by which the US has done this is through the provisions of the International Emergency Economic Powers Act of 1977. We expected it would be the deployment of US missiles to Asia that would cause this weapon to be drawn, but Trump wants China to take a good stare down the barrel already.

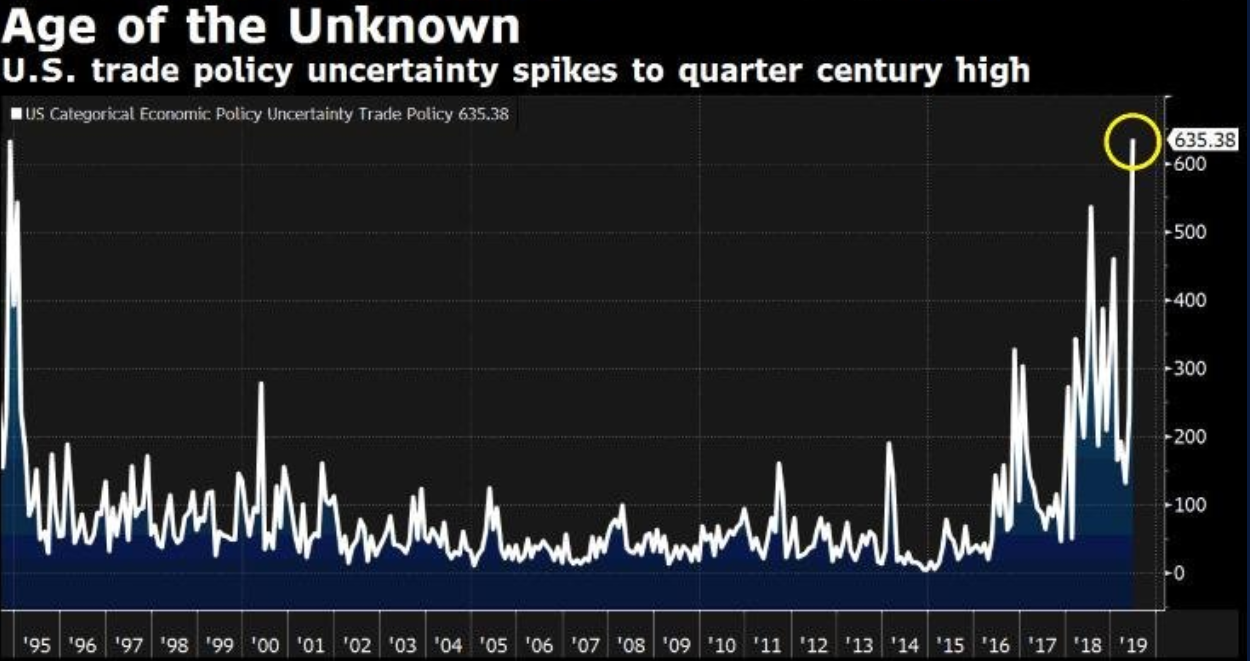

No wonder market observers haven’t been so uncertain on the outlook for US trade in 25 years:

The US Categorical Economic Policy Uncertainty index is calculated through a combination of policy uncertainty displayed by economic forecasters surveyed by the Fed and in newspaper articles, and the number of tax code provisions scheduled to expire over the next ten years which leave room for the tax code to be altered

The US Categorical Economic Policy Uncertainty index is calculated through a combination of policy uncertainty displayed by economic forecasters surveyed by the Fed and in newspaper articles, and the number of tax code provisions scheduled to expire over the next ten years which leave room for the tax code to be altered

Certainty will resume the sooner they understand that Cold War II ain’t going away – the time for investors to prepare is now.

Daggers drawn in Deutschland

All over the developed world, public institutions are turning on each other. In a recent case the German finance ministry is turning on the European Central Bank (ECB), albeit indirectly, by trying to prevent German banks from transmitting the ECB’s monetary policy.

From the FT:

Olaf Scholz, Germany’s finance minister, said last week that officials would examine the legal implications of blocking banks from levying so-called “penalty interest” on retail deposits of up to €100,000. The Federal Association of German Banks has hit back at the idea. “Legal prohibitions are alien to the system, do not help the customer any further and can ultimately lead to dangerous instability on the financial markets,” it said in a statement…

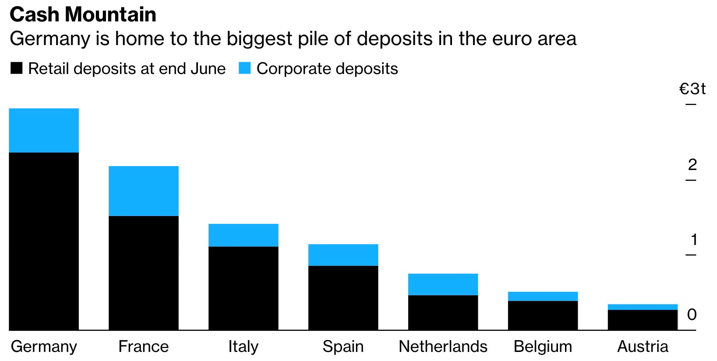

The spat highlights how the unconventional monetary policies of the ECB have stirred up controversy in Germany, a nation of savers who are outraged at the idea of being charged to deposit their spare cash. German banks are hit the hardest in Europe by negative interest rates because they hold about a third of the total excess deposits on which the ECB levies negative rates.

“What should an honest and law-abiding German citizen think when their finance minister, a high-ranking representative of the state, is investigating whether he can protect them from the actions of another state body, the central bank?” asked Stefan Schneider, chief economist for Germany at Deutsche Bank, in a note on Friday.

The German government’s resistance to the monetary policies of an institution it not only helped create but was a key founding stakeholder,

But if the ECB really wants to force cash out of deposits and into the economy, it’ll need to bleed the Germans of their famous spirit of saving, for Germany has the biggest pile of deposits in the eurozone:

Negative rates will likely be received in Germany with as much warmth as a vegan would receive upon entering a steakhouse, but that’s never stopped a eurocrat from doing “whatever it takes” to push the project forward.

With that in mind, is it at all surprising that gold just made a new all-time high in euro, surpassing the levels it reached during the sovereign debt crisis?

In short: no. And by the time this fighting between institutions is over, be it between the Whitehouse and the Fed, the German finance ministry and the ECB, the Pentagon and the Chinese Communist Party…

… when the daggers have been sheathed, these firearms holstered…

… you’re gonna see gold a lot higher than it is today.

More to come…

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates