“What is it?”

“It’s a pie machine, you idiot. Chickens go in, pies come out.”

“Ooh, what kind of pies?”

“Apple.”

“My favourite!”

“Chicken pies, you great lummox. Imagine: in less than a fortnight, every grocers’ in the county will be stocked with box upon box of Mrs. Tweedy’s Homemade Chicken Pies.”

“Just Mrs?”

“Woman’s touch. Makes the public feel more comfortable.”– Chicken Run (2000)

My brother had a hobby of making stop-motion animation when I was a kid; I played his eager assistant. He’d move a plasticine figure on one of his tiny sets by a fraction, and I’d take the photograph, flicking the detonator-like switch looped to the camera to record the next frame. We rewatched the Wallace and Gromit series endlessly; the release of a stop-motion film at the cinema – Chicken Run – felt like a massive deal.

It feels absurd to me that the film was released two decades ago now. How time flies…

The world has changed an awful lot since an American rooster by the name of “Rocky” (voice acted by Mel Gibson) blasted into a chicken farm in rural England. But in today’s note, I’d like to reflect on one key difference that is particularly relevant to investors today.

The coronavirus is currently occupying the news in a way that only an individual by the name of Donald knows how to replicate:

Source: The Financial Times

Source: The Financial Times

To be clear: I’ve no edge when it comes to knowing how deadly the virus is, or how bad the contagion has become. All I’ve got on hand is a healthy level of scepticism on the official story coming out of China, and how efficient the containment plan is. While I’ve never had the joy of operating a digger before, something about this image just seems wrong…

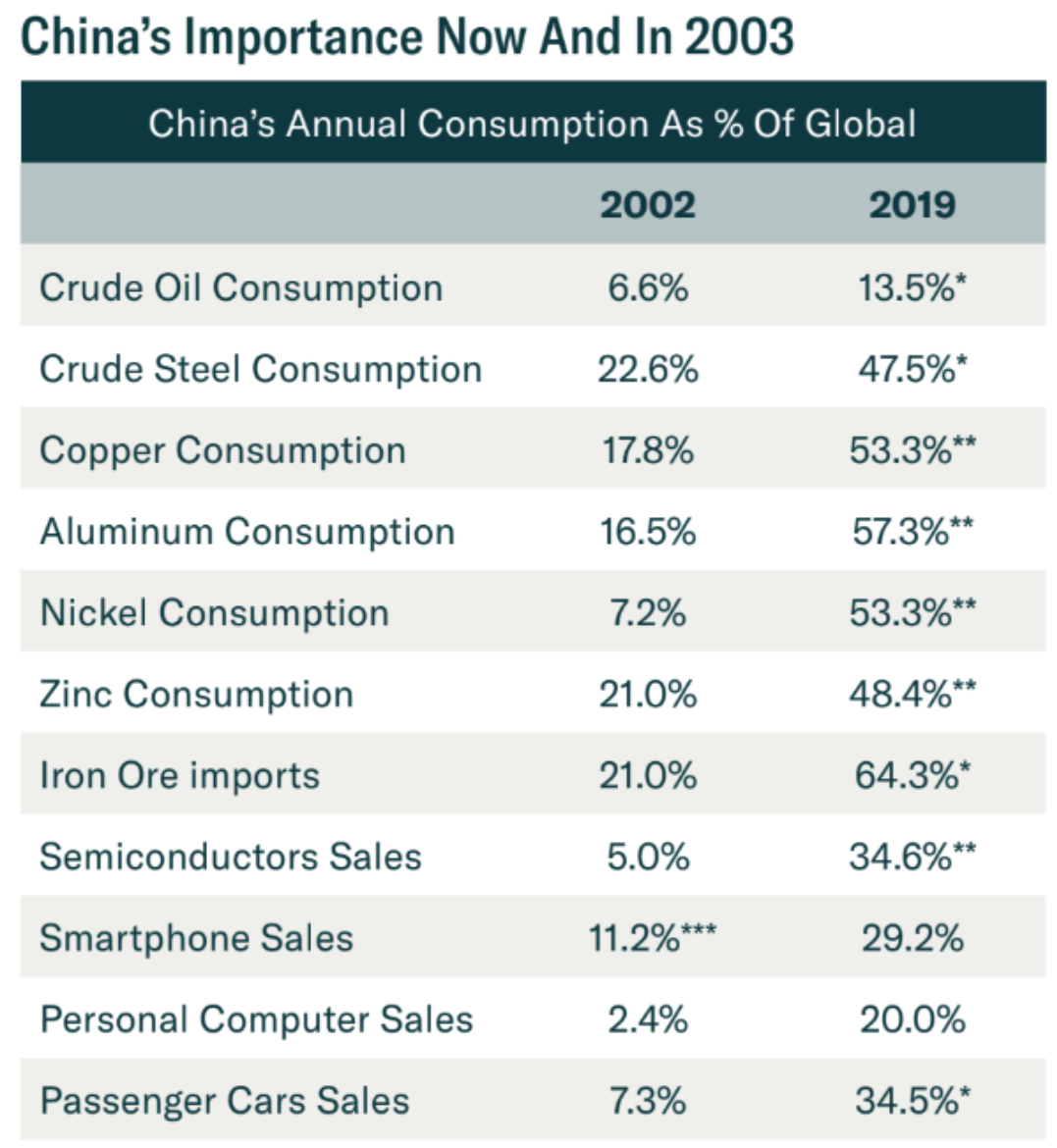

But back to the point. In much of the coverage of the stories there are plenty of comparisons between the coronavirus and SARS. While some of these comparisons are relevant, investors seeking to understand the fallout from the virus need to understand the huge changes that have taken place since 2003.

Specifically, massive changes have taken place in the structure of the global economic “pie machine” – what goes in, and what comes out.

The “chickens going in” component especially, has changed hugely where China is concerned since 2003 as the table below courtesy of The Market Ear illustrates so well:

It’s also worth bearing in mind that some of China’s commodity imports are likely not counted in those figures. The Communist Party of China (CCP) actively seeks out African militias and Central American cartels who have seized commodities, to buy them up on the cheap, including oil and iron ore.

It’s also worth bearing in mind that some of China’s commodity imports are likely not counted in those figures. The Communist Party of China (CCP) actively seeks out African militias and Central American cartels who have seized commodities, to buy them up on the cheap, including oil and iron ore.

Source: The Market Ear

The figures on the right are staggering in themselves. China consumes more copper, aluminium, nickel and iron than the rest of the world combined.

Some seem to think the coronavirus needs to be more lethal than SARS to have a more damaging impact on the global economy. But China meant significantly less to the global economy during the SARS outbreak. The coronavirus could be much more manageable, but still creates vast second-order effects that exceed that of SARS.

That copper statistic in particular is worth paying attention to, and remembering even if the coronavirus fear blows over. Investors and economists all over the world have used the copper price for decades as a health indicator for the world economy, the strength of global trade, and inflation expectations (hence its nickname “Dr Copper”).

(This is due to copper’s use in so many manufactured goods around the world – a low price for it suggests humanity wants “less stuff” for some reason or other. Or that there’s a sudden glut in supply, but you get the gist.)

But when you consider that Chinese demand for copper makes up more than half the market for it, and that demand is a result of the CCP’s economic policies, “Dr Copper” is himself effectively a communist agent, moving in line with his master’s wishes in Beijing.

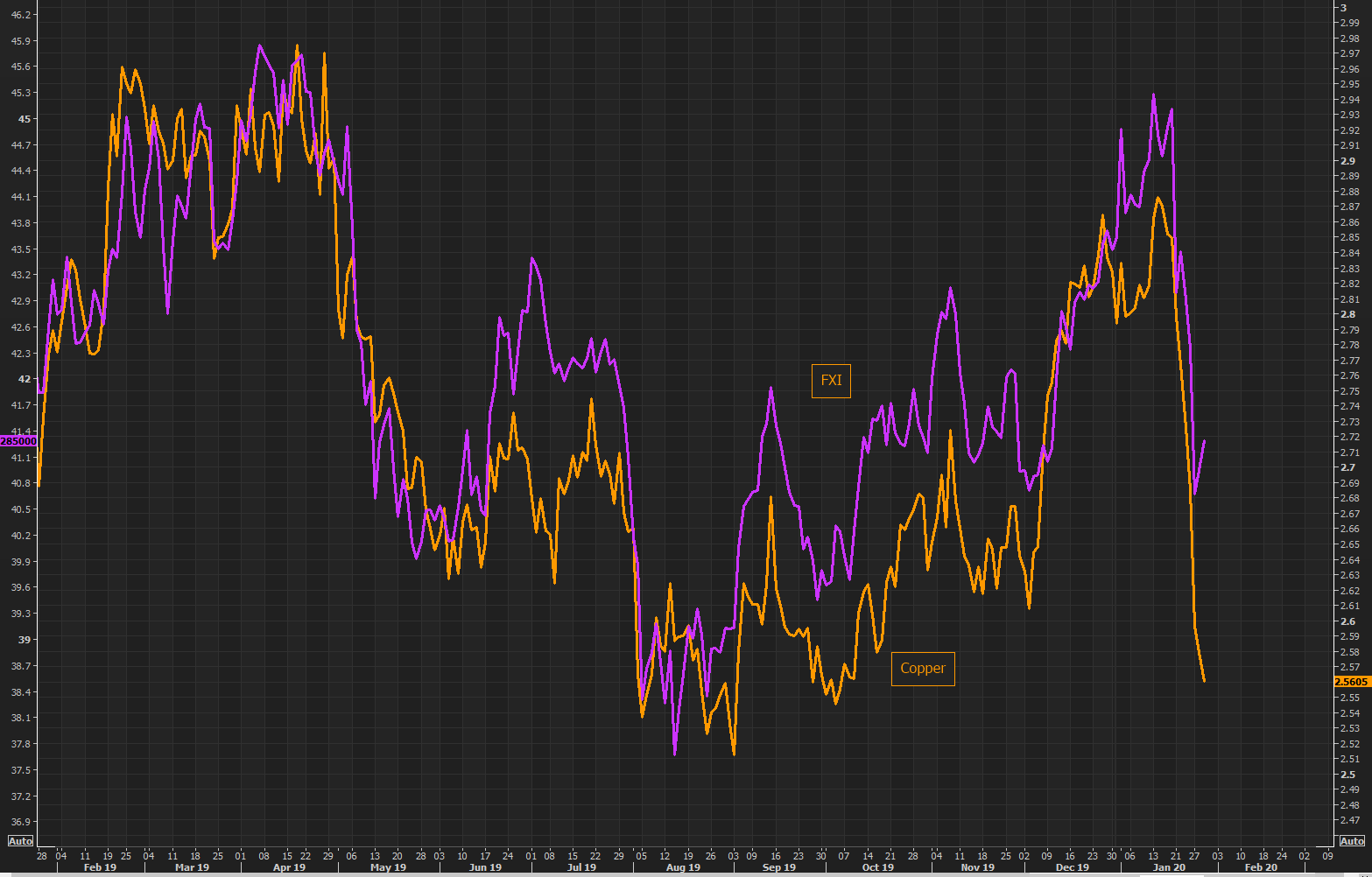

Interestingly, the market appears to have figured this out to some degree, pricing Chinese stocks in line with the copper price. That purple line is the FXI, an exchange-traded fund (ETF) which tracks 25 large-cap Chinese stocks, while the orange line is copper:

Whatever happens with the coronavirus, bear that table in mind when you consider the economic fallout – the structure of the pie machine has changed an awful lot since 2002.

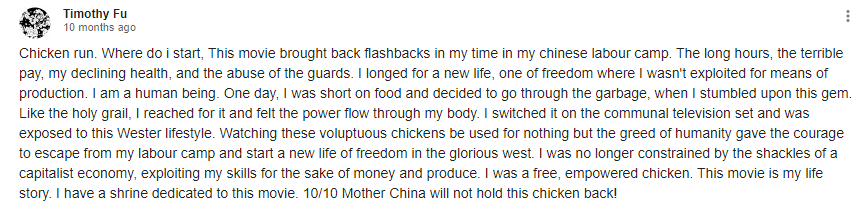

Before I leave you for this week, there’s one last thing I’d like to share with you – make of it what you will.

When I was checking what year Chicken Run was released, the first Google review popped up – and like today’s letter, it was very China-centric as well, though not in quite the same way….

Click to enlarge

Click to enlarge

Source: Google Reviews

Wishing you a good weekend,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates