King of Thieves, released in 2018, is a film about the Hatton Garden heist that took place three years prior.

It had a lot going for it when it was released, with an all-star cast led by Michael Caine.

However, the cast is pretty much all it has going for it: it is a dumpster-fire of a film to be avoided at all costs – especially for Valentine’s Day viewing.

That said, it does yield one gem (ironically) during its opening sequence – a line voiced by Caine:

The problem with gold is the effect it has on people. It drives them crazy.

I’m afraid the film is all downhill from there. But that quote is true – there is something about it that drives folks nuts.

Perhaps that’s why conspiracies about the gold market being rigged are so commonplace, and sometimes believable.

On the other hand, maybe that’s why so many people conspire to rig the gold price…

Conspiracy confirmed?

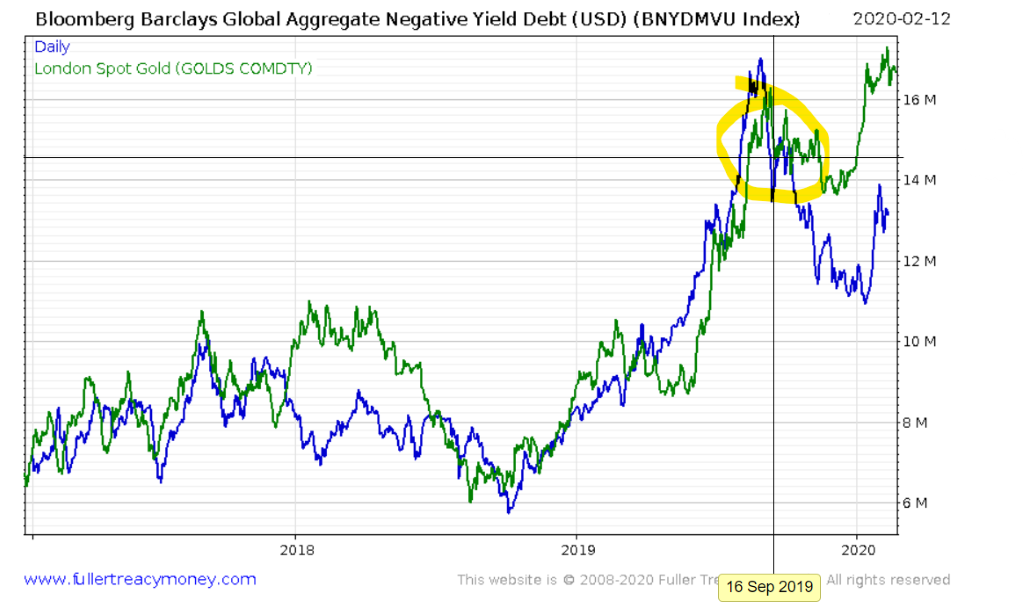

If you’ve been reading these letters for a while, you may recall the correlation we highlighted between the gold price and the outstanding amount of debt in the world that pays negative interest (Smell the napalm? – 17 July 2019).

As you can see, until late last year, the pair stuck relatively tightly together.

That’s the outstanding debt stock in blue, and the gold price in green:

However, on 16 September, gold stopped following the negative debt pile. Though the world’s stock of “crazy bonds” – debts that pay less than 0% interest to the lender – was going down, the gold price didn’t go down with it. Instead, it went sideways, and took off on its own in January.

So – what happened on 16 September? Why did gold break free from its bind, and keep going higher? Well, that was the Monday after the drone attacks on Saudi Aramco sent oil soaring. But considering the oil market swiftly shrugged off the 15% jump higher, it’s interesting why the two lines converge again. Perhaps the gold price never was strongly correlated to the negative debt pile, and their moves together were just a coincidence.

But Luke Gromen, a gold expert I interviewed a while back, has recently come out with a much more interesting thesis, albeit very “un-PC” from the mainstream financial industry.

Market commentary at the time was heavily focused on the Aramco attack – while other events slipped under the radar of many investors.

16 September happens to be the day that JP Morgan was criminally indicted for rigging precious metals prices – with multiple individuals being charged with “conspiracy to conduct the affairs of an enterprise involved in interstate or foreign commerce through a pattern of racketeering activity”. There have been guilty pleas for manipulation committed since 2007.

From a Bloomberg article released back day, amidst a deluge of articles on the Aramco attack and the oil price:

When JPMorgan Chase & Co. took over Bear Stearns more than a decade ago, it got two traders with a new trick.

Their strategy: Use multiple fake orders to manipulate the prices of precious metals futures. The maneuver, adopted by the traders’ new colleagues at JPMorgan, became part of a spoofing and rigging campaign so expansive that federal authorities have now likened it to a criminal enterprise operating inside the U.S.’s biggest bank.

In a criminal indictment unsealed on Monday, U.S. prosecutors accused three JPMorgan traders of rigging futures trades in precious metals for nearly a decade, making millions of dollars for the bank at the expense of counterparties that included the bank’s own clients.

The charges were the latest turn in a years-long investigation that has previously yielded guilty pleas from traders at several banks, including two from JPMorgan. Prosecutors said more than a dozen JPMorgan employees ultimately helped make manipulative “spoof” trades for the bank, in part by using the strategy their new colleagues brought in May 2008…

Easiest way to get a Wall Street bank to stop doing something? Start publicly prosecuting its competitors for doing it. The indictment on 16 September, Gromen argues, caused other manipulators to stop pushing gold down and the gold price to break free. Perhaps the entire correlation between gold and negative-yielding debt was an illusion…

But how deep does the rabbit hole go? The feds prosecuting the riggers allege the dozens of trades they’re using in the indictment are just the tip of an iceberg thousands of trades large made over the years.

Just how much of an effect they had on the price is another factor, however – these may just have been small tactical trades, for scalping small profits rather than the widespread suppression many gold bugs believe in. The gold price will likely give us our answer – if it starts going bananas in the near future, the latter becomes more credible.

When you start embracing the idea that vast portions of the market are being secretly manipulated (and not openly, like interest rates), it’s a gateway drug to mistrusting everything. Which, ironically, is why you own gold in the first place…

On Monday, we’ll explore another “conspiracy theory” that’s become conspiracy fact… and how a technique brought in by the feds to keep the gold price down in the 1970s… was used to clobber the bitcoin price in 2017.

In the meantime – happy Valentine’s Day!

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates