“Investing in today’s surreal world calls for the experienced eye of the Profit Hunter.”

So read an ad for Artemis Investment Management on the side of a black cab. I noticed it as I was heading back into work after lunchtime.

… in 2017.

Boy, has surrealism taken off since then – and I’m not talking about in the art market.

This was of course before Danish banks began paying Danes to get a mortgage… before investors began shorting terrorism for interest payments… before 100-year debts began trading like penny stocks…

Source: Julian Brigden, on Twitter

Source: Julian Brigden, on Twitter

… and before Brexit stimulated the creation of television content like this:

Source: BBC

Source: BBC

Surviving surreality

Rhino horn is much sought after for use as an aphrodisiac. However, poaching has had a devastating effect on rhino populations worldwide. To combat this, Synthorn proposes a synthetic rhino horn aphrodisiac, tokenized on the Ethereum Blockchain via an ERC20 token. This would allow pre-orders, trade and speculation.

From that letter:

Have you ever fancied speculating on fake rhino horn Viagra? No? Well, you can’t say the internet never offered you the chance. If you’re in need of some light reading the full white paper is available here. It’s only five pages long, and includes great gems such as “We expect Synthorn will sell itself. Market risk, although possible, is minimal.”

Something tells me that this wasn’t exactly what Satoshi Nakamoto had in mind when they created the blockchain. I’m no specialist in the crypto arena, but I think you should avoid this one. In fact, the very existence of this digital token may well be an indication that you should avoid the cryptocurrency market together…

As it turned out, while Synthorn was a sign that the cryptomarket was getting frothy that September, the melt-up boom was yet to come, arriving in incredible style through Christmas (a scenario we may well see again this year, depending upon how aggressively the central banks step on the gas).

Avoiding the cryptomarket at that time would have been a mistake if you were a speculator with the iron constitution required to handle its volatility.

If I’ve learned anything since 2017, it’s that conditions which seem unsustainable can sustain themselves far longer than you could ever suspect. Even if market events seem surreal now, they may well grow ever further in that direction until the forces which drove them there are extinguished.

The seemingly impossible negative-yielding debt surge of 2016 is now coming back to the fore in 2019. The dynamic of investors buying bonds for capital appreciation and stocks for yield (a switching of the reasons why investors used to buy either), is absurd.

To borrow Artemis’s slogan and spin it slightly, “Investing in today’s surreal world calls for the experienced eye of the cynic.”

Cobra farming

My good friend and colleague Nickolai Hubble, ever sceptical to any form of government intervention, often opines that to make money in today’s surreal times one must become a cobra farmer.

This is a reference to a time when British India existed, and the British governor of Delhi was concerned with the level of venomous cobras in the region. In an attempt to solve the problem, bounties were offered in exchange for dead cobras to reduce their population.

While to begin with the cobra population did decrease, in short order people began responding to incentives as they always do, and began farming cobras.

Cobra farms effectively became licences to print money… until the government realised what was happening and stopped offering bounties. Looking after cobras is not something many like doing, especially if they aren’t being paid for it, and so the freshly bred cobras were released back into the wild, making the problem much worse that it was before the government intervened.

With the government intervening ever further in financial markets (“capitalism with Chinese characteristics” as I like to call it), the shrewd would do well to channel their inner cobra farmer. Market prices often reveal that many others do too.

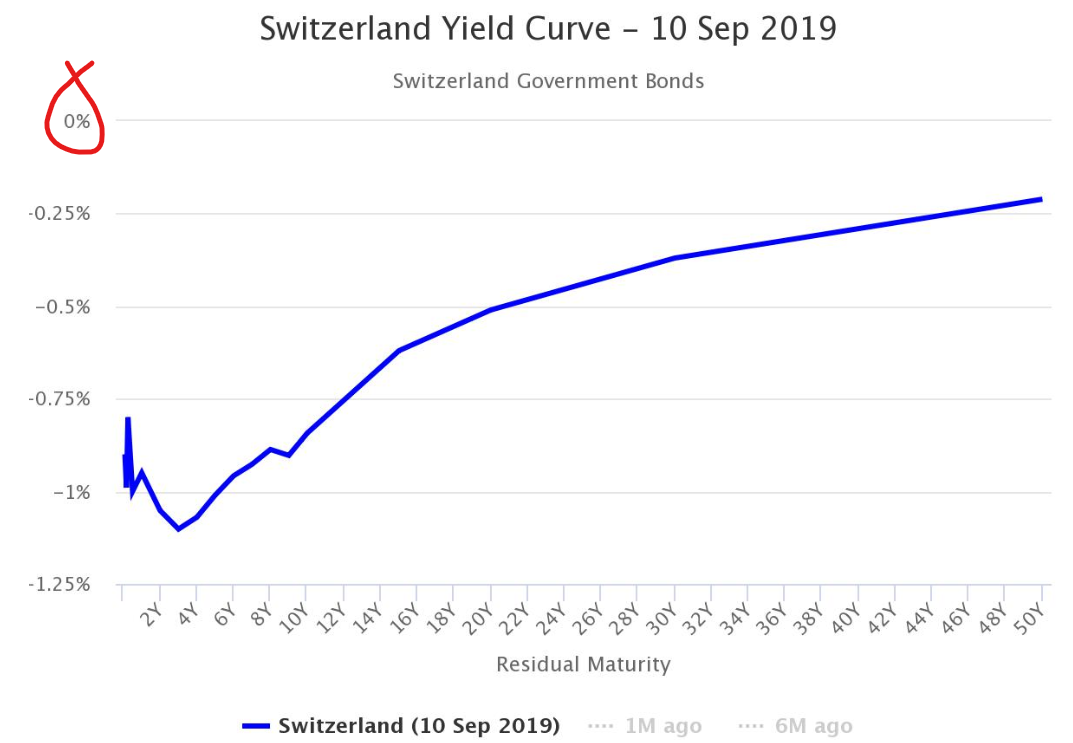

Take a look at Switzerland for example. The Swiss have one of the most ridiculous bond markets in existence: every single government bond on their yield curve pays a negative yield. From debt that matures in less than a year, to loans 50 years in the future, not a single one is close to even paying zero per cent interest if held to redemption:

Source: World Government Bonds

Source: World Government Bonds

Some of this is due to demand from investors for a safe haven bond and currency (in a way a bond is a little like a currency futures contract). It’s also been driven by many quantitative easing programmes by the Swiss to suppress interest rates by buying the bonds. However, in their efforts to devalue their currency, the Swiss National Bank went further than buying but just outright printing money to buy foreign equities.

A quick look at its top holdings reads like that of an S&P 500 tracker fund:

Some of the SNB’s top holdings – the full list is gigantic

Some of the SNB’s top holdings – the full list is gigantic

Source: holdingschannel.com

This is bullish for blue chip equities in general – a central bank printing one of the world’s safest and strongest currencies to purchase stocks abroad is hardly going to make them fall in price.

But why bother with front running their stocks… when you could just buy a share in the printing press instead?

The SNB is rare as central banks go, in that it has shares which trade publicly ($SNBN). And its money printing operations effectively turned it into a massive investment trust with an unlimited chequebook.

As the printing presses heated up, in late 2017 the cobra farmers of today got to work, and got rich:

To escape the “Cash-22”, investors cannot plead lunacy – only reach for loopholes, and start constructing their own cobra farm.

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates